Playboy to drop nudes to focus on attracting younger readers

Jonathan Hunt reports from New York

Big changes for old media brands made a lot of noise last week. But are these the sounds of growing pains or death rattles?

The timing of major developments at the Village Voice, Playboy, Time and Conde Nast leave no doubt that for old-world news organizations, the need for millennial, new-media currency has become more urgent. The news business may be plagued with uncertainty as consumption habits change by the minute and monetization proves slippery, but there’s real opportunity there, as underscored by the mad rush into the space by the likes of Apple, whose latest OS update included the curatorial Apple News; and Reddit, which stepped into the fray with news site Upvoted.

With all that in the mix, the most storied brands in the business find themselves embattled on all sides. Some companies have begun to crack the code — like the New York Times, which recently trumpeted the milestone of hitting 1 million digital subscribers — but in general, it’s a puzzle that has no one solution to sustain all news outlets.

| “In the 21st century media landscape, an outlet that can organize an engaged community of interest has real staying power.” |

| John Wihbey, Northeastern U. |

The sale of the Voice, the additions of Pitchfork to Conde Nast and Hello Giggles to Time, and the changes at Playboy represent very different strategies — and none of them is assured of success.

The Benevolent Billionaire

The purchase of the Village Voice, by Pennsylvania newspaper owner Peter Barbey, seems the most familiar story of the three. Jeff Bezos and the Washington Post; John Henry and the Boston Globe; Glen Taylor and the Minneapolis Star Tribune: a Hail Mary purchase by a one-percenter has become downright common among struggling newspapers.

In many ways, magnates make the best matches for these companies. The road to viability will be littered with failed experiments before anyone figures out what works. “That’s a lot of expense at the front end, without much potential for recoupment, so deep pockets are a necessity,” noted Rick Edmonds, a media business analyst at the Poynter Institute. The Voice hopes to use its owner’s millions to return to relevance as a national alternative-news brand, beginning by bolstering arts coverage.

Barbey, Bezos and his fellow patrons all cite civic value as a major reason to keep these news organizations alive. But whether civic value can be converted into ongoing profits remains to be seen.

The Reinvention

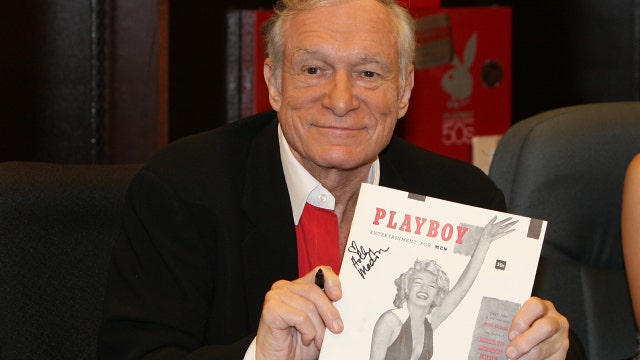

When the beleaguered Playboy magazine announced it would no longer showcase the nude female form (merely the scantily clad female form), it represented a capitulation to the new world order in a couple of ways.

First, it marked an acceptance of the fact that there’s no money in skin anymore, at least not in Playboy’s old-fashioned version of it. “There’s a saying that if you can’t be No. 1 or No. 2 in your field, get out of it,” said media analyst and “Newsonomics” author Ken Doctor. “That’s what Playboy’s doing.”

| Publishing Snapshot | |

| While niche publications continue to flourish, monetizing the content remains a huge challenge | |

| 97% | Increase in Conde Nast’s mobile users, 6/14-6/15 |

| 258% | Increase in Playboy.com unique visitors during the year it brought content inhouse and made it “safe for work” |

Besides, the explicit material kept Playboy content out of up-and-coming digital distribution platforms like Facebook Instant Articles, Google’s AMP and Snapchat’s Discover.

Licensing makes up a huge chunk of the company’s revenue (with 40 percent of its business coming from China), but in stepping away from nudity, Playboy is distancing itself from what made its

bunny logo so valuable. And so far, no one quite knows what to expect from a Playboy that you really do read for the articles.

The Demo Grab

Get past the complaints about cool kids selling out to corporate America, and hipster music site Pitchfork’s sale to Conde Nast has clear advantages for both parties. For Pitchfork, the deal will help ensure the survival of a grassroots, independent startup that probably couldn’t have lasted forever on its own. And for Conde Nast, its new buy — the digital successor to old-guard music mags like Rolling Stone and Spin — represents a clear play for the millennial generation, which is on the verge of growing into its spending power (expected to top $200 billion by 2017). Likewise, Time’s acquisition of Zooey Deschanel’s Hello Giggles site will give it valuable access to millennial women.

It’s also becoming clear that there’s value in operating as a digital hub for a particular vertical, such as music fans. “In the 21st century media landscape, an outlet that can organize an engaged community of interest has real staying power,” said John Wihbey, a journalism professor at Northeastern U.

Factor in NBCU’s investment in BuzzFeed and Axel Springer’s purchase of Business Insider, and the last couple of months seem to have served as a validation of the value of digital news. Now, the challenge will be finding a road to profit in a world where brand-specific websites and apps are increasingly usurped by major news platforms run by giants like Apple and Facebook.

“Over time, this could compel the publishers to evolve more into ‘studios’ that focus overwhelmingly on creating IP and look to distribute their content across the most lucrative and attractive third-party platforms, vs. building up their own branded destinations,” said Christopher Vollmer of consultant group Strategy&.

In any event, there seems to be gold in the digital content hills — now the Voice, Playboy, Time and Conde Nast just have to figure out how to pan for it.

Four4Four: Ronda Rousey stars in sexy swimsuit shoot - but why?