Jann Wenner, co-founder and publisher of Rolling Stone magazine, speaks during the 29th annual Rock and Roll Hall of Fame Induction Ceremony at the Barclays Center in Brooklyn, New York April 10, 2014. (Reuters)

Rolling Stone magazine founder Jann Wenner is looking to sell his controlling stake in the company – but finding a buyer might turn out to be difficult in the modern media landscape.

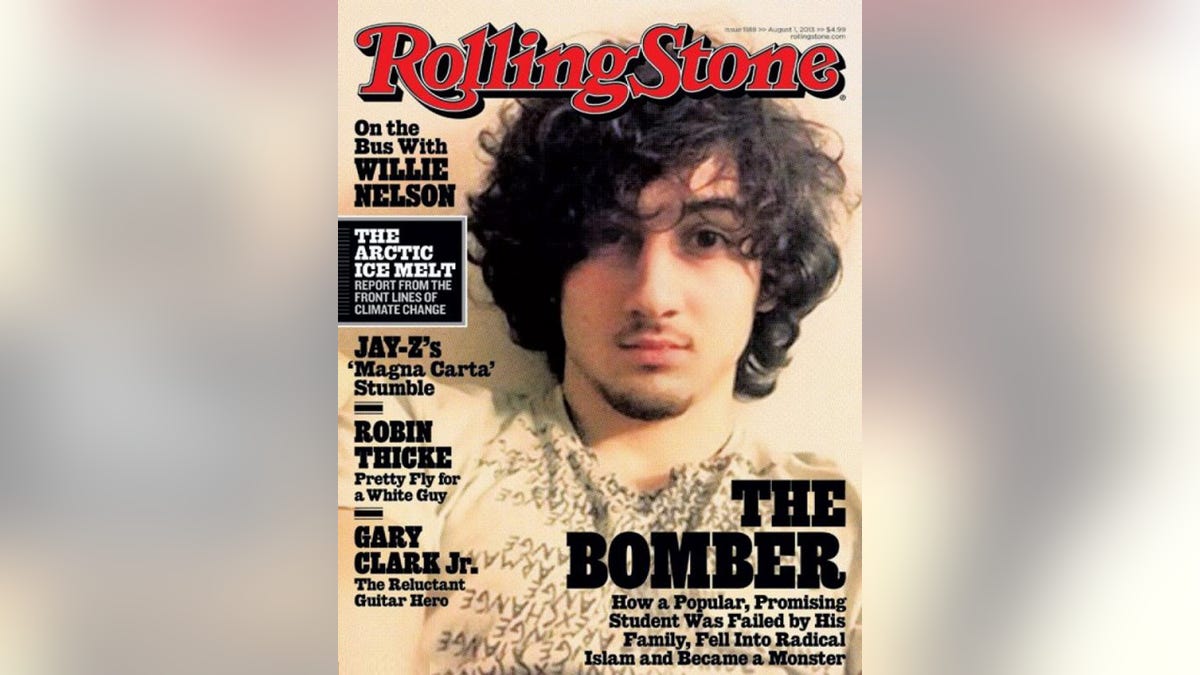

The iconic magazine has become increasingly controversial in recent memory, including glamorizing Boston Marathon bomber Dzhokhar Tsarnaev with a cover photo and publishing a since-discredited story about a gang rape at the University of Virginia. The discredited rape story damaged the magazine’s journalistic reputation and resulted in three lawsuits – one of which was thrown out but is under appeal, while the others were settled for over $4 million.

"There's no doubt that Rolling Stone [has] tarnished its journalistic credibility -- that impossible to put-a-price-on value -- badly by the UVA story, and its mishandling of it over time," digital media guru and "Newsonomics" author Ken Doctor told Fox News.

(Courtesy of Rolling Stone)

Doctor added there's a "two-fold disadvantage in selling now."

"Number one, it makes it harder to rebuild the brand and the business, diminishing price given new investment necessary and secondly, in the Trump era, there's an avoidance of controversy growing among advertisers," Doctor advised.

Media Research Center vice president Dan Gainor told Fox News that someone will buy Rolling Stone "as a vanity property, expecting to lose a lot of money" because it remains a recognizable name with older readers.

"Buyers purchase the good name of a publication. When that name has been soiled with shoddy reporting and shockingly poor editorial judgment, it makes people wonder if it's worth the trouble," Gainor said. "Wenner should either have solder earlier or managed his business better to prevent the UVA scandal from further souring the magazine’s reputation."

In addition to the scandal surrounding the discredited story, there is also the reality that all print publications are having a hard time converting to the Internet where ad dollars are scarce and competition is enormous. Doctor said that Rolling Stone "hasn't made much of a transition to digital subscriptions" and "counts only a little more than 20,000" digital subscriptions.

The Singapore-based BandLab Technologies purchased 49 percent of the Rolling Stone last year, but Wenner’s controlling stake is available. Magazine giants Hearst, Time Inc. and Condé Nast aren’t interested in purchasing it, the New York Post reported, citing “insiders” and “sources.” American Media recently purchased Us Weekly from Wenner but is “unlikely” to strike a deal for Rolling Stone, according to the Post.

With the typical magazine brands seemingly out of contention, a Silicon Valley brand could emerge as a possible suitor. Doctor called the magazine industry "flat as a pancake" and said traditional buyers are extremely limited but a wealthy tech giant could be a nice fit.

"Think of what Jeff Bezos did with the Washington Post, which was back on its heels. For the right price, the right set of deep pockets may find the opportunity too good to pass up," he said.

According to a press release announcing Wenner’s intention to sell, the company reaches over 60 million people per month. The brand’s digital traffic has grown 50 percent in the past three years, while social media has increased over 100 percent during the same time period.

Doctor said it would be difficult to peg a specific price for Rolling Stone without knowing its earnings before interest, tax, depreciation and amortization, but he noted that most print publications have been reduced by roughly 90 percent over the last 15 years.

“Today, in selling its 51 percent share, I'd anticipate that Wenner Media would get $25-50 million. That would be based on relatively meager profits, and the trophy/brand value inherent in a brand that offers the potential of being rebuilt. Jann Wenner has emphasized that he's looking for a buyer with deep pockets, to rebuild his business,” Doctor said. “Further, any buyer knows the brand needs reinvestment to make a future, so the price of admission -- buying the 51 percent -- is just a buyer's first step.”

Wenner started the magazine back in 1967 when he was only 21-years-old. He “could have gotten hundreds of millions over the years for the prize that was Rolling Stone,” if he sold earlier according to Doctor.

“For him, though, it was more than a business; it was a life's mission and very much a part of his own identity… It's not like many other businesses, with the passion -- and the ego -- often outsized to the actual business and profit potential,” Doctor said.

Methuselah Advisors has been retained as Wenner Media's financial advisor.

Rolling Stone did not immediately respond to Fox News’ request for comment.