Fox News Flash top headlines for May 7

Fox News Flash top headlines are here. Check out what's clicking on Foxnews.com.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

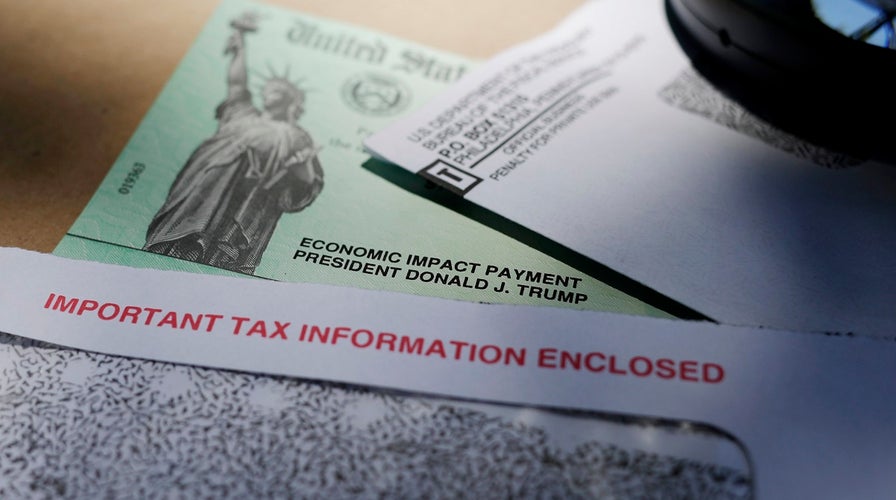

The Treasury Department is asking the relatives of deceased and incarcerated family members who mistakingly received economic stimulus payments intended to help Americans weather the coronavirus pandemic to return the funds to the federal government.

The IRS updated two notices Wednesday, issuing clarifications that nonresident aliens, deceased persons and incarcerated individuals are not eligible for economic relief.

"Deceased and incarcerated individuals do not qualify to receive Economic Impact Payments. See FAQ #41 to learn how to return an inadvertent payment," a Treasury Department tweet said.

Congress approved a $2.2 trillion relief package in March that provided Americans with one-time payments of up to $1,200 per adult and $500 per child as many Americans face financial hardships brought on by the coronavirus pandemic. Most of the funds hit bank accounts in April, while others were sent paper checks.

A number of deceased people and foreign workers have received payments, which were distributed based on a person's 2018 or 2019 tax returns. The California Department of Corrections and Rehabilitation told Fox News that at least one inmate also received stimulus funds.

"The inmate is a veteran, receives a pension, and files a tax return, which is why we believe he received the payment," agency spokeswoman Dana Simas said.

Simas said directions were given to each institution in the California prison system to return relief payments mailed to inmates. It was unclear whether there will be any punitive repercussions if the funds are not returned.

An IRS spokesman declined to comment to Fox News on how widespread the mishaps are.

CLICK HERE TO GET THE FOX NEWS APP

Return instructions vary based on the type of payment issued.

For direct deposits, the agency is asking that people submit a money order or personal check to the specified IRS location. Checks should be made payable to “U.S. Treasury” and "2020EIP" should be written on them, as well as the taxpayer identification number (Social Security number or individual taxpayer identification number) of the recipient of the check. An explanation of why the money is being returned should also be included.

Fox Business' Brittany De Lea contributed to this report.