Harvey Weinstein's company received more than $400,000 in New York state tax credits -- with one report claiming the company received at least $5 million in subsidies for two productions in recent years.

The 2014 film "St. Vincent," starring Bill Murray, and an undisclosed production from Weinstein Co. subsidiary Coed Films resulted in $5 million in tax credits since 2011, according to Crain's New York Business, which reviewed recent public filings.

The revelation was roundly criticized Friday by government watchdog groups, such as Reclaim New York, which blasted the state for providing such credits to powerful Hollywood companies at the expense of taxpayers.

"New York state continues to dole out the most lucrative film and T.V. tax credit which forces taxpayers to pay millions of dollars a year to Hollywood production," said Douglas Kellogg, communications director for Reclaim New York, a non-partisan group that monitors government spending.

"They all seem to be politically connected," said Kellogg. "We can't say there's a quid pro quo for sure but it certainly becomes conspicuous that we have a tax credit that is the most expensive in the entire country."

"This program is a waste," he said. "You have officials spending millions of dollars over a few years on Hollywood productions that tend to give donations to politicians rather than giving tax relief to real New Yorkers and home grown businesses."

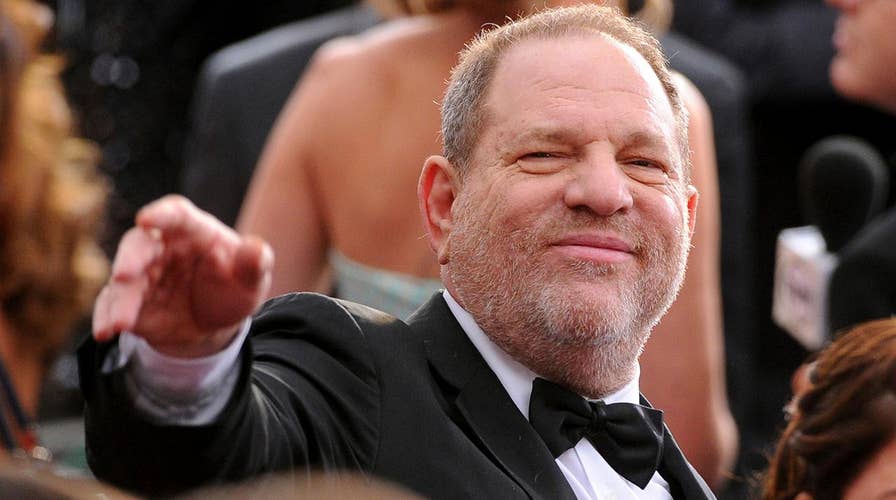

Weinstein was fired Oct. 8 from the independent film company he co-founded following a New York Times expose that detailed decades of sexual abuse accusations made against Weinstein by actresses and former employees.

The allegations against the film mogul range from sexual harrassment to rape. Weinstein, through representative Sallie Hofmeister, has denied all allegations of non-consensual sex in a statement.

"Mr. Weinstein obviously can't speak to anonymous allegations, but he unequivocally denies allegations of non-consensual sex," Hofmeister wrote in a statement to the Associated Press.

New York's film tax credit program offers subsidies to production companies for fees incurred while filming in the state. The program costs New York state $420 million each year -- far exceeding every other state in the country. From 1997 to 2015, New York spent $2.6 billion on tax breaks for the film industry.

Assemblywoman Linda Rosenthal, D-Manhattan, also criticized the amount of taxpayer money paid to Weinstein's former company -- but for a different reason. Rosenthal said film and T.V. production companies should not be elligible for tax credits unless they fully disclose sexual abuse complaints and settlements.

"Taxpayer dollars should not be used to subsidize sexual harassment or assault," said Rosenthal, who is sponsoring legislation to condition the receipt of tax credits on company policies and records on sexual harassment.

"For years, sexual harassment has been an open secret, with companies both large and small going to great lengths, often spending millions of dollars to protect their reputation by covering up abuse," Rosenthal said in a statement. "We have zero tolerance for sexual harassment here in New York, and we will let our tax credits do the talking for us."