HOLD FOR RELEASE July 26 at 12:01 a.m.; Charts show median net income and wealth ratios for Blacks, Whites and Hispanics

The median income for Latinos in the U.S. is around $38,000. This means half of us live on more than $38,000 per year and half of us live below. This median is less than $10,000 less (and closer to $15,000 less) than the median income in the U.S. overall – which is about $52,000.

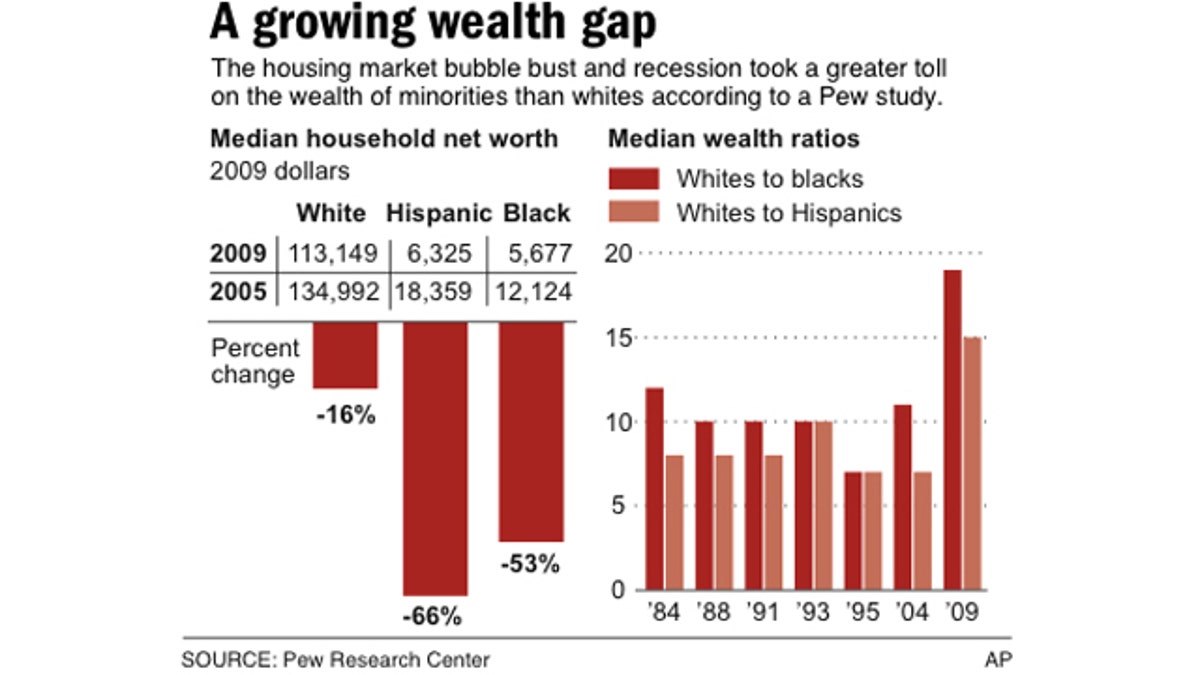

But more importantly, the wealth of Latino households is abysmal. The median wealth of Latino households is less than $7,000. That means when you subtract everything that is owed (in a median Latino household) from everything it owns, you end up with less than $7,000, and for many households, much, much less.

And over the past couple of decades, while the income gap has stayed roughly the same, the wealth gap has grown. The median wealth of white households is about 18 times that of Hispanic households.

What does this mean to us?

Well, on the one hand, if you make over $38,000 per year, you can count yourself in the top half of Latino income earners.

On the other hand, it means that many of us are making way too little.

Why is this important?

It’s up to us to change these numbers. Only you can decide if building your wealth matters to you. Much as I might like to, I can’t do it for you.

And this can be as simple as deciding to save more, invest more, strive to make more.

I can offer you negotiation strategies, give you suggestions on which fields will pay you better for the skill set you have, and offer tips on how to save, where to put your investments, and what percentage of your income you should save for retirement.

And this is all information that you should look for and have.

But I can’t go out and make more money for you, nor can I force you to put money away, or learn about the miracle of compound interest.

Only you can decide if this is a worthwhile endeavor. How much do you care about making more money, keeping more of what you make, and investing in what is truly important to you? Because to the extent it’s important – to you – it makes a long-lasting difference (and not just to you).

To the extent you make more, you can keep more, save more, give more. Your individual effort brings up our community as a whole.

I’m not saying that we should put money above all else. Rather, I’m saying that making increasing your wealth a goal of yours is not greedy, not unethical, and not self-serving.

It benefits all of us.

And while I understand some of us are in circumstances that are nearly impossible to change, many of us are not.

Simply making a commitment to learning how to save more, invest more, and have more, and keeping this in your focus, will change your situation.

Other longer term strategies include increasing your level of education, or getting a specific certification, both of which can raise your income greatly.

Getting any amount of education will increase your ability to earn. People who have a bachelor’s degree have a median income of about $50,000 more per year than those who haven’t finished high school.

And many employers will pay for you to increase your skill set – and then pay you for that increased skill set they’ve encouraged you to gather. Even if you are in the top half of income earners, does it mean you should rest on your laurels? No!

The extent to which we have –and know how to direct– our wealth in the near future will have an enormous impact on the U.S. as a whole.

Many of you have probably heard that by 2050 –if not before– Latinos will make up a full third of the U.S. population.

Do you want that population to be wealthy, and feeding the economy, or to be still struggling to catch up? It’s up to you!