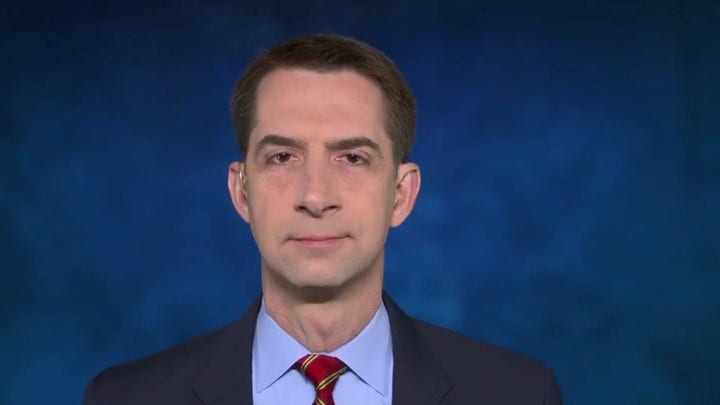

Sen Cotton on backlash over restricting trading during GameStop saga

Sen. Tom Cotton, R-Ark., discusses the ongoing backlash to restrictions against investors and the possibility of Washington overreaction.

Sen. Tom Cotton, R-Ark., said Friday that the Senate will need to conduct an investigation and hold hearings into the Robinhood investment application and other outlets to ensure that trades are being conducted on an "equal and fair basis."

During an interview on "America Reports", Cotton asserted that the solo investors responsible for billions of dollars in losses to major Wall Street hedge funds aren't doing anything different than what major insitutional investors "do to each other all the time" utilizng "short squeeze" calls.

Cotton aknowledged that while the situation needed to be examined, hearings would be conducted to ensure the "stock markets reflect the underlying market realities" and that it was not to condemn any one "actor in the marketplace."

DAVE PORTNOY SLAMS ROBINHOOD APP AMID GAMESTOP TURMOIL: 'I THINK PEOPLE HAVE TO GO TO JAIL'

SEN. TOM COTTON: "I do believe we will need to have hearings, in particular have hearings on Robinhood and some other outlets shutting down trading for small solo investors yesterday into these stocks, while major institutional investors continue to trade. These solo investors have really done nothing to some of these major institutional investors that they don't do to each other all the time by so-called short squeeze, buying stocks that the institutional investors are short on. No surprise, no real news there ...

CLICK HERE TO GET THE FOX NEWS APP

But the trades have to be conducted on an equal and fair basis and several investors who are making money, sometimes a lot of money, at the expense of these institutional investors shouldn't be shut out on the market and shut out on their trades. More fundamentally, we want to make sure that our stock markets reflect the underlying market realities, that there are ways for companies with a good idea to go out and raise money to try to produce that good idea, to serve the American people in the marketplace ...

We should get to the bottom of what happened over the last week. That doesn't necessarily mean that there's a government response to what happened. But, we do need to examine it and especially the closure of trading platforms for some of these solo investors this week. I don't want to jump to conclusions about the matter. I want to ensure we get to the bottom of what happened and that we have a well-functioning, fair, marketplace that is allowing anyone who wants to trade, to trade in stocks, and that is helping companies raise the money they need to grow and provide jobs and to provide goods and services in the marketplace. That's a point of the hearing. It's not to jump to conclusions. It's not to condemn any one actor in the marketplace."