Projected economic impact of Biden's student loan bailout

Texas Public Policy Foundation Executive Director Robert Henneke on the student loan bailout plan and a poll showing 74% of Americans have a negative view of the economy.

New York Times opinion writer Peter Coy tore into President Biden’s student loan handout plan, claiming it will incentivize people to "borrow unwisely" and further "increase the cost to taxpayers."

Coy argued that the way Biden’s handout sets up student loan repayment is "so attractive," it will be "’a financial no-brainer to take out the maximum student loan,’" quoting Brookings Institute senior fellow Adam Looney.

Additionally, Coy claimed that the Democratic Party’s handout will "indirectly subsidize the schools and majors" that are not as lucrative, while giving little aid to those schools and majors that lead to high-paying jobs.

LAWMAKERS BLAST ARMY SOLDIER FOOD STAMP SUGGESTION AMID BIDEN’S STUDENT LOAN HANDOUT: 'OUTRAGEOUS'

New York Times opinion writer Peter Coy published a searing criticism of President Biden's student loan handout plan on Monday. (Ron Sachs/CNP/Bloomberg)

The author’s Monday piece, titled "Biden’s Student Loan Plan Has Issues," opened with the central problem of the handout plan, "The more merciful the government is to debtors, the worse the incentives it creates. People will be more likely to borrow unwisely if they expect the government to forgive their unpayable loans."

Coy said, "This is an old problem for governments, of course, but it’s stark in Biden’s student loan relief plan, especially the income-driven repayment plank, which has gotten less attention than the forgiveness of up to $20,000 in federally held loans."

Through this repayment plan, "Borrowers won’t have to pay more than 5 percent of their discretionary income on undergraduate loans (down from 10 percent now). Plus, less of their income will be defined as discretionary."

Coy claimed, "No one earning under 225% of the federal poverty level — equivalent to about $15 an hour for a single borrower — will have to pay anything at all on their student loans." Additionally, he mentioned more: "The plan would cover borrowers’ unpaid monthly interest so that "no borrower’s loan balance will grow as long as they make their monthly payments."

The author claimed this repayment scheme will have "unintended consequences." He cited Looney’s article for Brookings, which stated the handout "represents a radical change in student lending." Coy noted the fellow’s estimate that "students might pay back only 50 cents of every $1 they owe" on average.

Quoting Looney on the danger here, Coy said, "The terms are so attractive that ‘it will be a financial no-brainer to take out the maximum student loan,’ he wrote. That will increase the cost to taxpayers, he argued."

The author quoted The Penn Wharton Budget Model estimates on the financial damage of such a plan, stating, "the changes in income-driven repayment will cost $70 billion over 10 years and could cost an additional $450 billion over that time if the Department of Education automatically enrolls borrowers for whom it has sufficient information."

HEGSETH SLAMS 'SHAMEFUL' ADVICE TO SOLDIERS ON SEEKING FOOD STAMPS TO DEAL WITH INFLATION

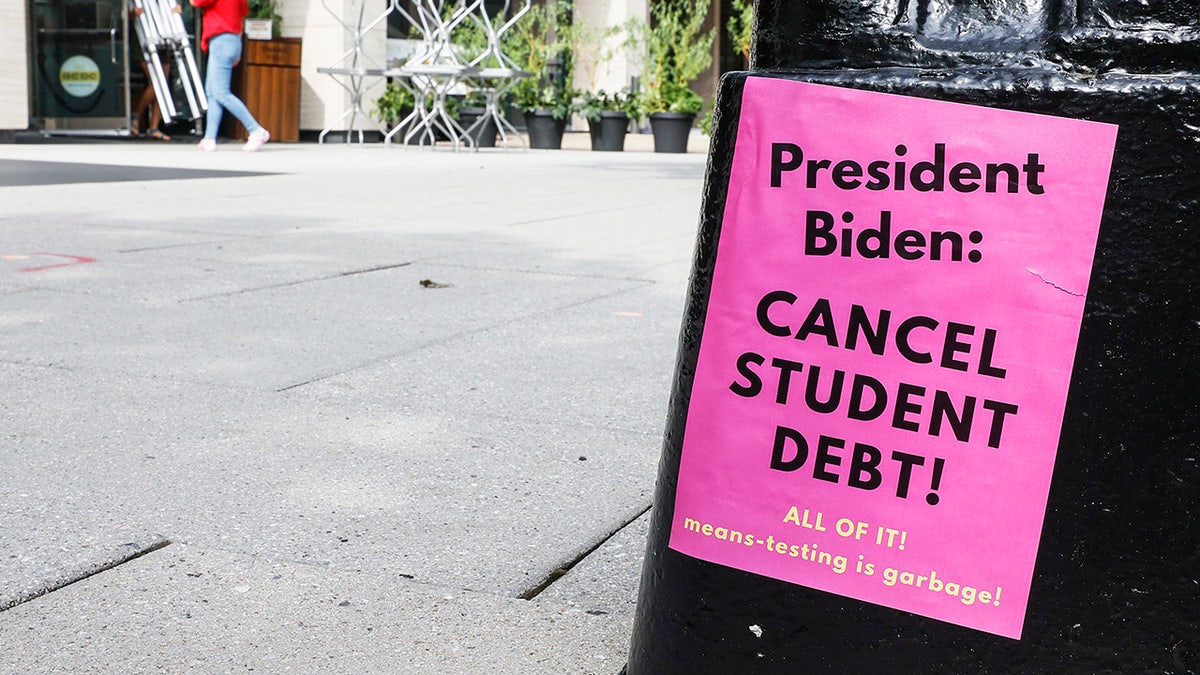

A sign asking President Biden to cancel student debt is posted on Pennsylvania Avenue near the White House staff entrance on July 27, 2022. (Jemal Countess/Getty Images for We, The 45 Million)

Coy continued, saying, "Worse is that Biden’s plan will indirectly subsidize the schools and majors that do the worst job of preparing their students for remunerative careers."

He added, "If you major in mechanical engineering and get a job in the field, you will probably make too much money to qualify for a break under income-driven repayment. If you major in cosmetology, you will probably qualify for a break."

Coy brought up another issue with the plan, namely that the Biden administration will make it easier for "predatory schools" to take advantage of the loan program. He wrote, "By making it possible for many more students to stop paying without being considered in default, Biden’s plan guts a rule that prohibits institutions from participating in federal grant and loan programs if too many of their students default on their loans."

He added, "Combined with auto-enrollment of some borrowers, ‘this eliminates the last remaining policy with any teeth that keeps predatory schools out of the loan program,’ Looney said."

Demonstrators rally in front of the White House to celebrate President Biden canceling student debt and to begin the fight to cancel any remaining debt on Aug. 25, 2022. (Paul Morigi/Getty Images for We the 45m)

CLICK HERE TO GET THE FOX NEWS APP

The author also claimed, "One flaw in Biden’s plan is that many people will not expect to repay their loans in full and will behave accordingly. The other flaw is that too many of the programs that absorb all their loan money aren’t worth it."

Though he mentioned the White House’s reassurance this will work out. "On the first point, the Department of Education says that Biden’s plan, with its generous terms, prioritizes helping hard-pressed current borrowers. On the second point, the department says it is working hard to weed out bad programs."