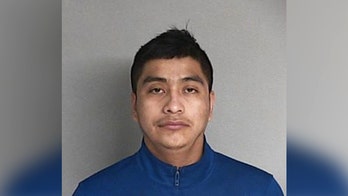

Nov. 29, 2010: Energy Secretary Steven Chu gives a speech at the National Press Club in Washington. (AP2010)

Energy Secretary Steven Chu plans to say that the buck stopped with him over the half-billion dollar loan made to California solar company Solyndra, using a hearing on Capitol Hill to take responsibility for the failed investment while continuing to defend his actions as not politically motivated.

Chu, in testimony prepared for delivery Thursday to a House committee, claimed he was looking out for the taxpayer when reviewing the Solyndra finances.

"As the Secretary of Energy, the final decisions on Solyndra were mine, and I made them with the best interest of the taxpayer in mind," Chu said in testimony prepared for the House Energy and Commerce Committee. "I want to be clear: over the course of Solyndra's loan guarantee, I did not make any decision based on political considerations."

Chu is the highest-ranking official to testify on the scandal, and Republicans on the committee are eager to grill him on his involvement and on why he overrode concerns from his own subordinates about Solyndra's financial situation.

Chu, in his prepared testimony, said his decision to approve the $528 million Solyndra loan was based on the analysis of experienced professionals and on the strength of the information they had available to them at the time.

"The Solyndra transaction went through more than two years of rigorous technical, financial and legal due diligence, spanning two administrations, before a loan guarantee was issued," he said.

"Based on thorough internal and external analysis of both the market and the technology, and extensive review of information provided by Solyndra and others, the (Energy) Department concluded that Solyndra was poised to compete in the marketplace and had a good prospect of repaying the government's loan."

He claimed the investigation into the matter should back up his claims that the department believed the loan was viable.

"As you know, the Department has consistently cooperated with the Committee's investigation, providing more than 186,000 pages of documents, appearing at hearings, and briefing or being interviewed by Committee staff eight times," he said. "As this extensive record has made clear, the loan guarantee to Solyndra was subject to proper, rigorous scrutiny and healthy debate during every phase of the process."

Chu also took responsibility for a later decision to approve a restructuring of Solyndra's debt that allowed two private investors to move ahead of taxpayers for repayment in case of default

Chu undoubtedly will face hostile questioning Thursday from House Republicans who are investigating the $528 million federal loan received by solar panel maker Solyndra before it went belly up, laying off its 1,100 workers.

In a joint statement, Reps. Fred Upton of Michigan and Cliff Stearns of Florida said they intend to find out how decisions were made to guarantee and lend more than $500 million to Solyndra. Upton chairs the energy panel while Stearns heads a subcommittee on investigations.

"We want to find out why the administration restructured the loan after Solyndra had reached a technical default, and how they explain putting private investors in line ahead of taxpayers. And we need to understand how all the warnings, from inside and outside the Department of Energy, were ignored and this risky bet was allowed to happen," Stearns and Upton said.

The Energy Department faced a difficult decision in late 2010 and early this year, he said: Force Solyndra into immediate bankruptcy or restructure the loan guarantee to allow the company to accept emergency financing that would be paid back first if the company was still unable to recover.

"Immediate bankruptcy meant a 100 percent certainty of default, with an unfinished plant as collateral. Restructuring improved the chance of recovering taxpayer money by giving the company a fighting chance at success," Chu said.

Although both options involved significant uncertainty, Chu said he made the judgment that restructuring was the better option to recover the maximum amount of the government's loan. The decision also meant continued employment for the company's approximately 1,100 workers, he said.

Chu said it was worth noting that U.S. taxpayers remain first in line for repayment of the initial loan and noted that private groups invested nearly $1 billion in the company.

Solyndra faced another crisis in August, Chu said. This time, after consulting with outside analysts, he decided that the U.S. should not provide additional support to Solyndra. Days later, the company filed for bankruptcy.

While disappointed, Chu said the U.S. should continue to support clean energy.

"When it comes to the clean energy race, America faces a simple choice: compete or accept defeat. I believe we can and must compete," he said.

Solyndra was the first renewable-energy company to receive a loan guarantee under the 2009 stimulus law, and the Obama administration frequently touted the company as a model for its clean energy program. Chu attended a 2009 groundbreaking when the loan was announced, and President Barack Obama visited the company's Fremont, Calif., headquarters last year.

Since then, the company's implosion and revelations that the administration hurried a review of the loan in time for the September 2009 groundbreaking has become an embarrassment for Chu and Obama and a rallying cry for GOP critics of the administration's green energy program.

The Associated Press contributed to this report.