Washington – President Obama and congressional Democrats signaled they plan to push Republicans for more tax hikes in the months ahead, after getting them to agree to an 11th-hour deal that let taxes rise on top earners.

After drawn-out negotiations, Congress was able to cobble together a fiscal plan and pass it in both chambers Tuesday night. No one walked away getting everything they wanted but that didn’t stop Obama from declaring victory and playing the passage as a ringing endorsement from the American public to push Republicans even harder on taxes in the coming months.

“The agreement leaves substantial scope for reducing tax expenditures for high-income households” during any future debates over tax reform and entitlement programs, the Obama administration said in a "fact sheet" released following Tuesday morning's Senate vote.

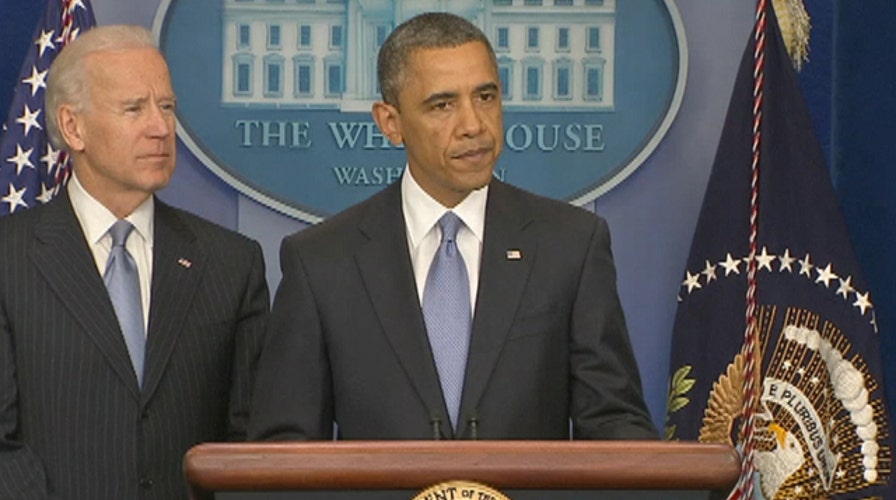

Obama, during brief remarks Tuesday night after the House passed the bill, reiterated that "cutting spending has to go hand in hand with further reforms to our tax code so that the wealthiest corporations and individuals can't take advantage of loopholes and deductions that aren't available to most Americans."

Many Republicans had complained that the legislation would raise taxes without making any significant cuts in government spending. Conservatives toyed late Tuesday afternoon with tacking on billions in spending cuts. In the end, that idea was abandoned and the House voted on the Senate-passed bill. That bill allows tax increases on households making above $450,000 -- it's a narrower swath of families than Obama was previously looking at, but the president still used it to suggest the dam had been broken on tax hikes.

The Obama administration and Democrats were able to apply pressure Republicans into making a deal, often taking their pleas public. On Monday, Obama held a midday press conference with a group of middle-class Americans standing behind him as he took shots at Congress for its clumsiness in negotiations.

Economist Doug Holtz-Eakin says the House GOP played the only hand it could with a deadline approaching that would have forced the nation to face historic tax increases on virtually every single American in the country.

“They did the best they could,” Eakin said. “Getting a deal is a victory – and that should be recognized – but it’s far from a slam dunk and more work needs to be done.”

Had the House not passed the legislation, tax rates enacted in the last decade would have expired and broad tax increases would have kicked in affecting nearly every working American. An additional $110 billion in automatic cuts to domestic and military spending would have also gone into effect -- it has instead been delayed two months.

Republicans say they didn’t get the spending cuts they wanted and plan to continue their fight in the next two months when another round of budget battles take place over the debt ceiling.