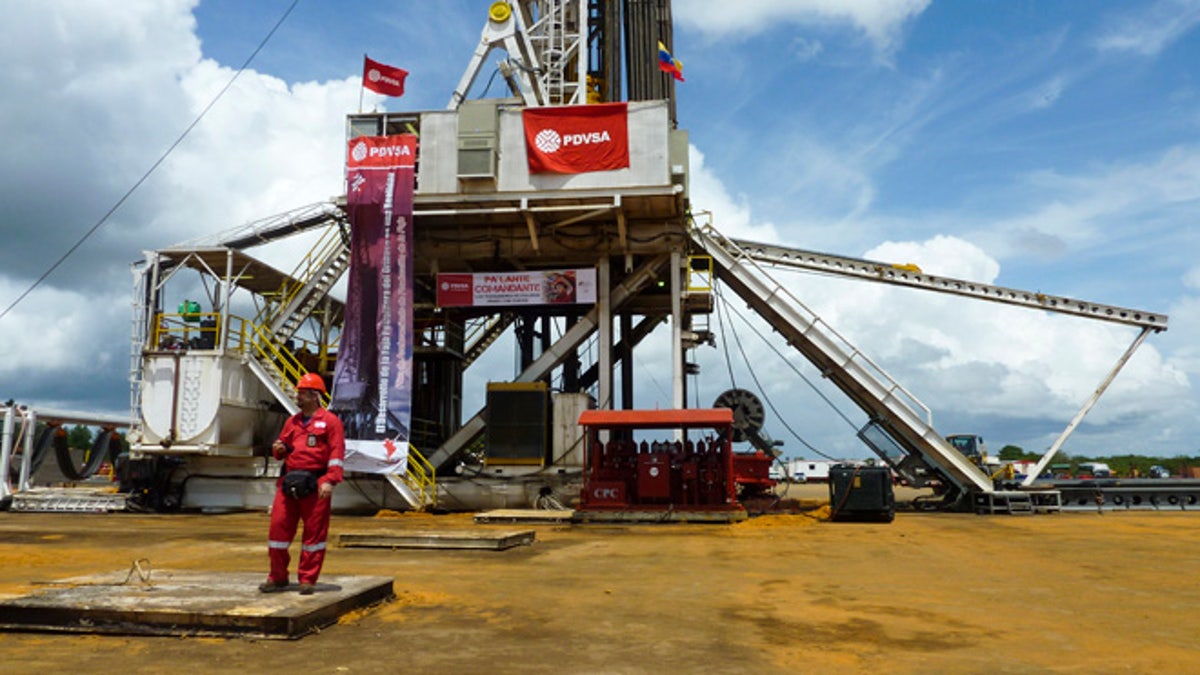

An oil well operated by Venezuela's state-owned oil company PDVSA in Morichal, Venezuela. (2011 AFP)

Caracas – The steady drop in global oil prices, which has only intensified in the New Year, may force Venezuela to introduce major economic changes to avoid default and ride out the current, acute financial crisis, experts said.

Last year the government resorted to borrowing money and limiting imports, which worsened the food and other goods’ shortages and has now people standing in line for hours for the most basic staples.

But this formula, experts say, will not work in 2016 if the oil prices stay low.

“Chavismo’s economic model can only work with a high oil price,” said Asdrubal Oliveros, head of the local firm Ecoanalitica, to Fox News Latino.

Earlier this week President Nicolas Maduro announced that Venezuela’s oil is selling for $24 a barrel, the lowest price in a more than a decade.

In 2015 the average rate was $44.6 per barrel.

“If prices stay like this, it would mean the government has a cash deficit of $25 to $30 billion to pay its debts and import the products the country needs,” Oliveros said.

This scenario has put Venezuela in the brink of financial default, unable to pay foreign creditors and limiting its capacity to borrow money and import goods – something crucial in a country heavily dependent on oil exports, used to buy elsewhere almost every item of the food basket.

According to Oliveros, the government has three options to obtain financial resources: “Request a bailout from the International Monetary Fund (IMF), privatize public companies or get into further debt. Or they could also mix those options,” he said.

The first two moves would imply major changes to the socialist model implemented by Chavismo and the third one, keep on borrowing – from China, most likely – won’t solve anything by itself.

“China has been Venezuela’s biggest creditor, but now they have their own economic problems and we calculate that it could lend just $5 billion this year, one fifth of what the country needs,” Oliveros said.

Alexander Guerrero, economist and professor at Universidad Catolica Andres Bello, noted that turning to the IMF is an option that comes with strings attached.

“They will request an immediate end to economic controls like price regulations and currency exchange restrictions, the base of Chavismo’s economic model,” he said. “This is why many think political change is needed in order to see an economic improvement.”

Of course, selling off some of the billions-dollars worth of state companies also goes against the socialist model carried on by Chavismo, which according to Venezuela’s Property Observatory committed at least 2,740 violations to private property rights since 2005. That was the year late President Hugo Chavez announced to the world he was a socialist and ordered the expropriation of an array of private companies.

Back to 2016, oil prices sinking on top of a multitude of other signs would indicate that the country needs to steer the ship in a different direction, and the sooner the better. However, so far the government’s moves have been vague and even contradictory.

Last week, Maduro announced a new cabinet that included some moderate ministers, but also people like Luis Salas, a leftist college professor, as head of the economic area under the newly created title of minister of Productive Economy.

“While the new team is heterogeneous in its views and approaches, we see Maduro’s choice of Salas as strongly indicative of the policy approach that we can expect going forward,” warned Bank of America Merryl Lynch in an investors report this week.

During the Chavez administration (1999-2013), Venezuela cashed in nearly $900 billion in oil exports, according to Ecoanalitica estimates. It was a time when the country’s oil sold for four or five times today’s price, peaking at $103 per barrel in 2012.

“We could have had a reserve of around $166 billion if the government had created a savings fund. With that, surviving the current drop in prices would have been easy,” Oliveros said.

For the most part, that money was lost due to a mix of bad economic policies that favored consumption over investment, and rampant corruption.

Now Venezuela's inflation is over 100 percent, according to economic firms — official data about inflation, shortages and growth hasn't been released in more than a year.

Former Finance Minister Jorge Giordani, now estranged with the government, revealed before leaving his post that the country lost as much as $25 billion during the course of 2012 due to corruption cases related to the monetary exchange control.

To put that number in perspective, the 2012 Olympics in London required a total investment of just $15 billion.