credit-history-inquiries (SpiffyJ)

No number is more important to prospective home buyers than their credit score. Put simply, these three digits are a numerical representation of your track record paying off your debts, from credit cards to college loans. If you've applied for a mortgage to buy a home, lenders check your credit score. If it's high, getting a mortgage will be a breeze; if it's low, you may struggle.

So now that we've got your attention, the question remains: Exactly what is a good credit score?

Here's the deal: A perfect credit score is 850. But all scores 760 and above are considered to be in the best credit score range. Since this means you've shown an excellent ability to pay off your past debts, mortgage lenders want your business -- and will try to entice you by offering loans with the lowest interest rates, says Richard Redmond, mortgage broker at All California Mortgage in Larkspur and author of " Mortgages: The Insider's Guide."

A good score is from 700 to 759; a fair score is from 650 to 699. Since a lower score means you've had some late payments or other dings on your credit history, lenders see you as more likely to default on your home loan. They may still give you a mortgage, but at a higher interest rate, says Bill Hardekopf, a credit expert at LowCards.com.

Credit scores below 650 are deemed poor, meaning your credit history has had some rough patches. This doesn't necessarily mean you can't qualify for a loan, but it may be tough, and you'll pay a higher interest rate for the privilege.

How credit scores are calculated

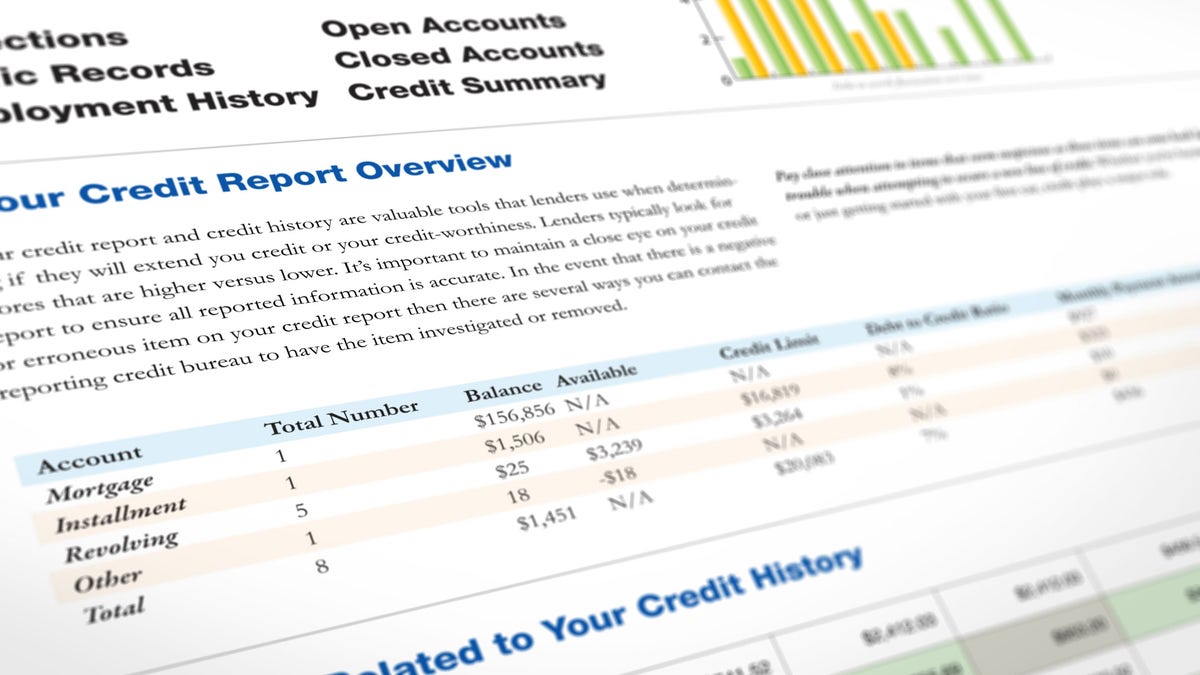

Three major U.S. credit bureaus track and tally your scores: Experian, Equifax, and TransUnion. Their scores should be roughly similar, although each pulls from slightly different sources (Experian looks at rent payments while TransUnion checks out your employment history). But by and large, here are the main variables that determine your score, and to what degree:

- Payment history (35%): This is whether you've made debt payments on time. If you've never missed a payment, a 30-day delinquency can cause as much as a 90- to 110-point drop in your score.

- Debt-to-credit utilization (30%): This is how much debt you've accumulated on your credit card accounts, divided by the credit limit on the sum of your accounts. Ratios above 30% work against you. So if you have a total credit limit of $5,000, you will want to be in debt no more than $1,500 when you apply for a mortgage.

- Length of credit history (15%): It's beneficial to have a track record of being a responsible credit user. A longer credit history boosts your score. CreditKarma.com, a credit-monitoring service, found that its members with scores above 750 have an average credit history of 7.5 years.

- Credit mix (10%): Your credit score ticks up if you have a rich combination of different types of credit accounts, such as credit cards, retail store credit cards, installment loans, and a previous mortgage.

- New credit (10%): Research shows that opening several new credit accounts within a short period of time represents greater risk to the mortgage lender, according to myFICO.com, so avoid applying for new credit accounts if you're about to buy a home. Also, each time you open a new credit account, the average length of your credit history decreases (further hurting your credit score).

How to check your credit score

You can check your own credit report -- and should, because it will help you pinpoint areas for improvement. Even if you're fairly sure you've never made a late payment, one in four Americans finds errors on his credit report, according to a 2013 Federal Trade Commission survey. Errors are common because creditors make mistakes reporting customer slip-ups. For example, although you may have never missed a payment, someone with the same name as you did -- and your bank recorded the error on your account by accident.

You're entitled to a free copy of your full credit report at AnnualCreditReport.com. Keep in mind, the report does not include your score -- for that, you'll have to pay a small fee. You can also check with your credit card company, since some (like Discover and Capital One) offer free access to scores and reports.

If you discover errors, take these steps to get them removed from your report. Or, even if your credit report does not contain errors, if it's not as great as you'd hoped, you can raise your credit score. Just keep in mind, you won't improve a credit score overnight, which is why you should check your credit score annually -- long before you get the itch to start house hunting.