can i get a 40 year mortgage? (goir)

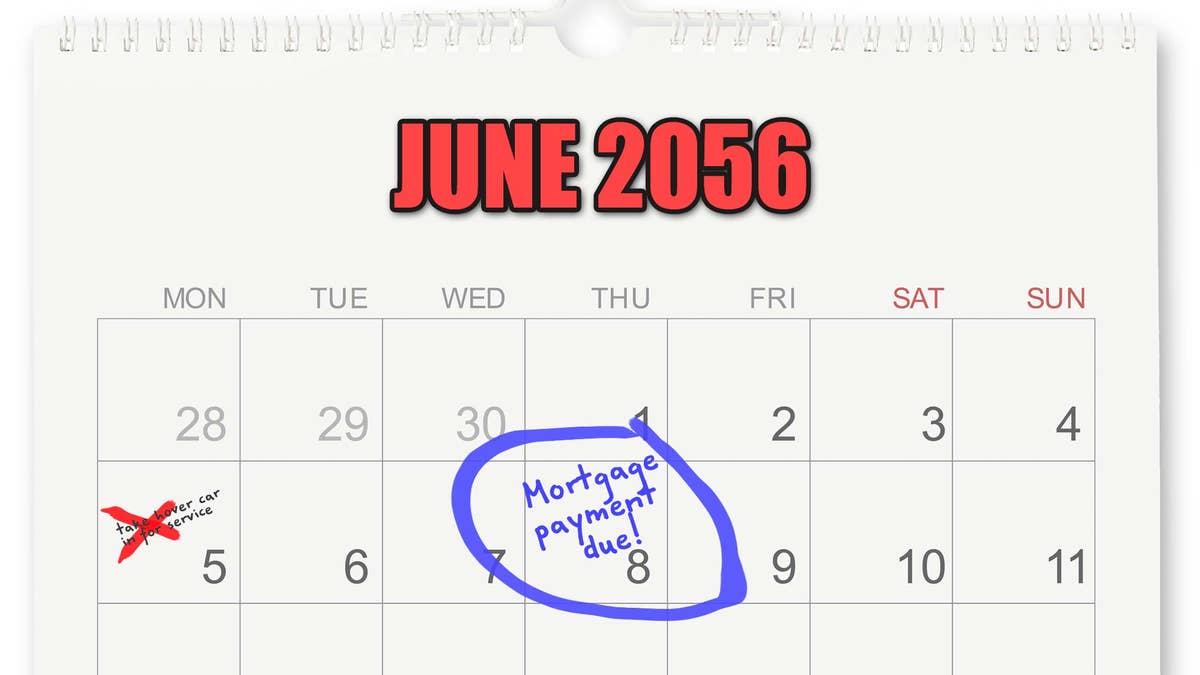

Paying for a home is hard -- even if you have a mortgage and stretch those payments out over 15 or 30 years. All of which may have you wondering: Can I get a 40-year mortgage? Does such a thing exist?

While a 40-year mortgage is not well-known or widely used, some lenders do indeed offer it. But before you get too excited, note that this loan option is rare for a reason: It comes with some major drawbacks for both the lender and home buyer.

The way a basic 40-year mortgage works is straightforward: Payments are spread out over four decades, usually at a fixed rate that's slightly higher than for a 30-year mortgage. Certain lenders will offer a 10-year extension to a 30-year mortgage, thus converting it to a 40-year mortgage, although other lenders may not offer a 40-year mortgage at all.

"From a lender's perspective, 40 years is a heck of a long time to wait for a return on investment," says Abby Shemesh, founder and CEO of Amerinote Xchange, a leading mortgage note-buying firm. "This is a mortgage product that should only be used for certain situations."

So what are those situations? A quick look at the pros and cons of the 40-year mortgage will help you decide.

The benefits of a 40-year mortgage

Here are some of the advantages of a 40-year mortgage to a home buyer:

- Lower monthly payments. Let's say you need a $200,000 mortgage. A 40-year loan with a 4.125% interest rate would make your monthly payments come in at $851. If you were to finance that same mortgage on 30-year terms, your rate might be lower, say 4%, but your payments would be higher, at about $955 per month.

- Since you've locked in your interest rate for 40 years, if rates go up, you'll have the lower rate for a longer period of time than you would if you had a shorter mortgage.

- With lower monthly payments, you can probably qualify for a more expensive home.

- Lower monthly payments might also allow you extra funds to pay off other debts.

- There are tax advantages to writing off the larger amount of interest you'll be paying on the 40-year loan.

The drawbacks of a 40-year mortgage

Despite the allure of lower monthly payments, 40-year mortgages are not common because of the following disadvantages for the home buyer:

- Since you'll be making payments over a longer period of time, you'll be paying more interest -- a whole lot more. You'll likely spend more than double the amount on interest that you originally borrowed for principal. For example, the sum of the interest you would pay on that $200,000, 30-year mortgage mentioned above is $143,739. But on a 40-year mortgage you'd be paying $208,708 in interest by the time those 40 years are done -- that's a whole $65,000 more than you'd have to cough up for a 30-year loan.

- You'll pay a slightly higher interest rate for the privilege of stretching it out over 40 years, usually between 0.1% to 0.3% higher.

- Your equity will take longer to build, because you're paying less principal and more interest each month, especially at the beginning of the loan. That means that when it comes time to sell the property, you might not have enough equity to cover your selling costs -- especially if the market has taken a dip.

In sum, there's a reason 40-year mortgages aren't all that popular. Most people find that the extra interest they'll pay over that time period just isn't worth the money they'll save in the here and now.

"The principal pays down extremely slowly, as the majority of the loan payment will go toward interest for many decades," says Shemesh.

Yet there are cases where a 40-year mortgage might make sense. If you absolutely can't afford your house payments any other way or have major debts you want to tend to first, it's worth asking if your lender offers 40-year mortgages and whether it's right for you. Another thing to keep in mind: Plan to stay put for a very long time. Since mortgages are tied to the house, you'd better be fairly certain you want to hunker down in this home for the long haul.

To find out what you can afford to pay for a home, enter your income and other info into realtor.com's mortgage calculator and check out mortgage rates in your area.