Will postcard tax reform put tax preparers out of business?

Jackson Hewitt Chief Tax Officer Mark Steber discusses how GOP tax reform will impact his business' bottom line.

Republicans have often used a 14-line oversized postcard to pitch the simplicity of their massive tax overhaul – but with all of the recent changes, will most Americans really be able to file their taxes on a half sheet of paper?

Many professional tax preparers say no. The Trump administration says yes. It might just boil down to whether millions of Americans stop itemizing.

Treasury Secretary Steven Mnuchin said again on "Fox News Sunday" that almost all Americans will be able to file their taxes on a postcard under the Republican tax overhaul that is expected to pass this week.

“Over 90 percent of Americans are going to fill out taxes on that postcard or a virtual electronic postcard,” Mnuchin said. “This is about simplifying taxes and simplifying the business system.”

“So there will always be people who complain that are losing tax breaks, but this is about making it simple for the American public,” he said, adding that the Trump administration is already in the process of “designing new forms so Americans don’t have thousands of pages of tax forms.”

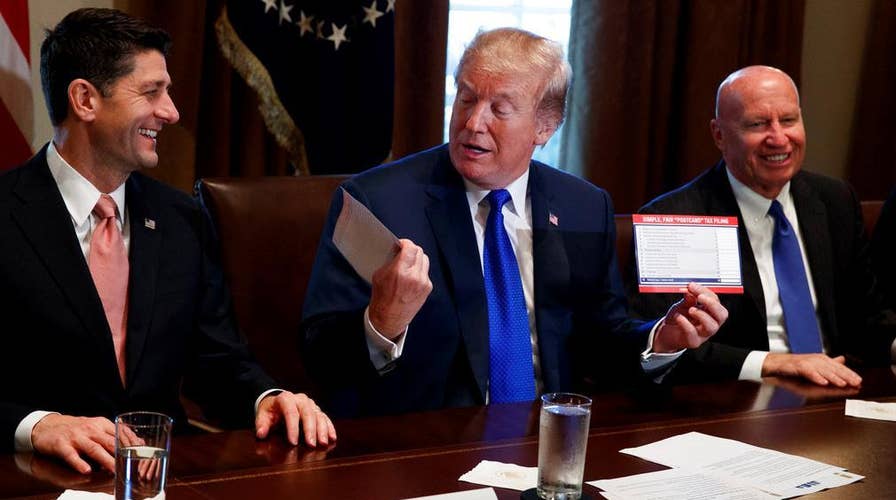

President Trump was so tickled when Republicans rolled out their tax postcard prop in November, he actually kissed one on camera.

Trump added that “the only people that aren’t going to like” the new simplified plan would be tax professionals hired to help people file complicated forms.

Mark Steber, chief tax officer at Jackson Hewitt Tax Service, isn’t worried.

“I think the demise of the tax business is a bit premature,” he said in a statement. “I don’t think you’re going to have millions of people filing their taxes on a cell phone.”

Mark Mazur of the nonpartisan Tax Policy Center says few people are likely to take Republicans up on the idea of sending in their tax information on a postcard.

“It’s kind of crazy to say you can file a postcard, when, first, no one is going to put their Social Security number on a postcard,” he told Reuters.

Mazur says if people are looking for a simple form, they already have one – the 1040EZ form is a “giant postcard.”

More taxpayers, however, may gravitate toward that form thanks to the proposed near-doubling of the standard deduction -- to about $12,000 per individual and $24,000 per married couple. The standard deduction is a write-off that most filers get if they don’t do an itemized filing that factors in things like mortgage interest, student loans and charitable deductions.

Currently, about 30 percent of tax filers itemize. The hope is that bumping up the standard deduction would encourage more people to take the standard deduction, thereby simplifying the process for them and the Internal Revenue Service.

At the same time, for those who do itemize, the Republican tax bill maintains a complex system -- one quite different than the simplification Trump envisioned when he said in September he wanted to “make the tax code simple, fair and easy to understand.”

Overall, the Tax Cuts and Jobs Act represents one of the largest cuts in the corporate tax rate in U.S. history. It also would lower taxes for the vast majority of Americans – though those cuts expire after eight years.

However, other changes in the tax bill including curtailing the state and local tax deduction could force millions of households to continue to make complicated calculations on their tax forms.

“Even though we’re talking about simplification for a large number of taxpayers, there’s still many taxpayers who will have complicated tax situations,” David Williams of Turbo Tax told Yahoo! Finance.