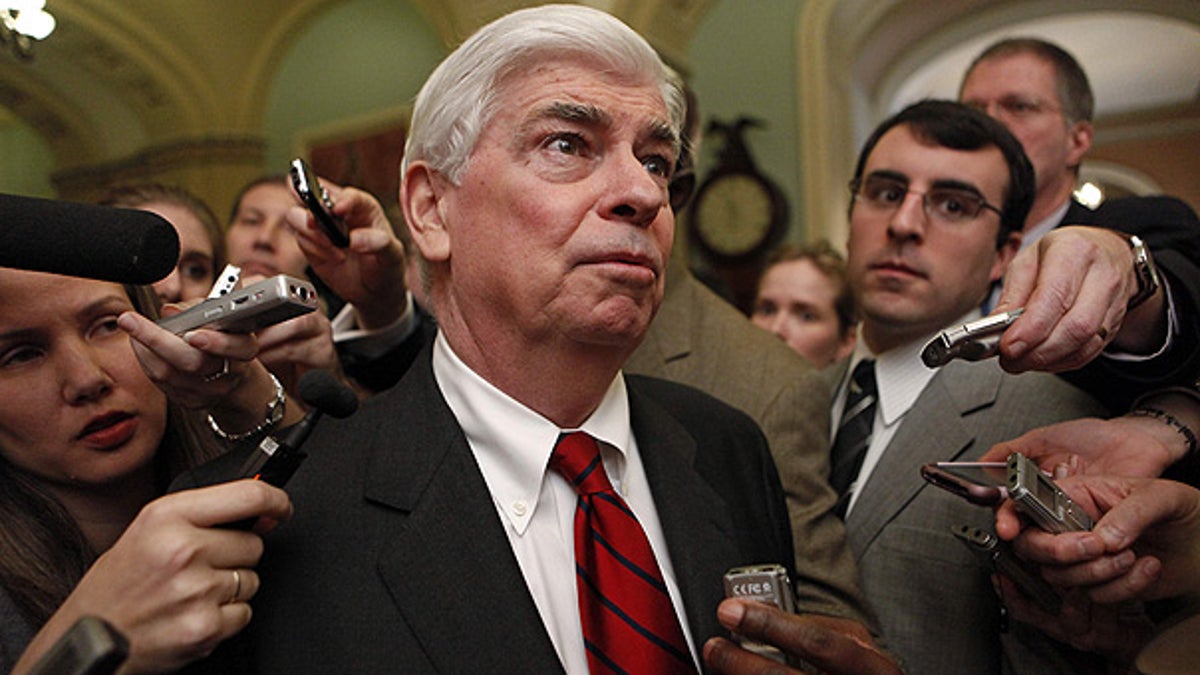

Connecticut Sen. Chris Dodd is expected to announce Wednesday he will not seek a sixth term in the Senate.

Sen. Christopher Dodd's decision this week to pack his congressional bags at the end of this year rather than face the strong prospect of defeat at the ballot box has sparked speculation over the fate of the massive Wall Street regulation bill that he is overseeing and his future after Capitol Hill.

Consumer activists are hoping that Dodd's retirement decision will help strengthen the financial reform legislation, compelling him to push for strong consumer protections and an independent agency to regulate and enforce consumer lending, despite organized opposition from the financial industry.

But some believe the five-term Connecticut Democrat, who is chairman of the Senate Banking Committee, is likely to water down the bill so he can cash in on the strong ties to Wall Street that he has built over a 30-year Senate career.

"There's nothing in Dodd's bill that Wall Street has anything to worry about," said Mark Calabria, the director of financial regulation studies at the libertarian Cato Institute and a former Senate Republican aide who spent six years working on the Banking Committee that Dodd has served on since beginning his Senate tenure in 1981 and has chaired since 2008.

Calabria told FoxNews.com that Dodd may be worried about his legacy but he isn't going to go "Ralph Nader," because he knows where the money is.

"This is certainly a tradeoff," he said. "You can set a legacy as the lion of the left or you can make some money. And thing is, he's not a Kennedy. I don't think he's ever ranked as the top 20 wealthiest senators."

Dodd is considered middle class among senators. In 2008, he was worth between half a million and $1.7 million, ranking him 66th among all senators, according to the Center for Responsive Politics.

Former Democratic Rep. Martin Frost and a Fox News contributor said that he doesn't believe that Dodd's role in shaping the financial reform legislation will be influenced by money or his future prospects on Wall Street.

"He will do what he thinks is right. He's a free agent," he said. "I'm sure he'll have more time to devote to this now. But no one should suggest he will take action on the legislation with an eye on another job. That's not who he is."

Graham Steele, policy counsel with Public Citizen's Congress Watch, told FoxNews.com that the administration ultimately has final say over the bill.

"We don't think it will change a whole lot," he said, adding that there is pressure on Democrats to do right by consumers and small businesses.

"Financial reform is all about jobs, protecting businesses and families that have been harmed by Wall Street excess."

Dodd's spokeswoman, Kristin Brost told The Associated Press: "Dodd is committed to continue working in a bipartisan fashion to pass strong financial reform this year."

As chairman of the Senate banking panel, Dodd has come under fire for his reliance on Wall Street contributions. He drew criticism for his role in writing a bill that protected bonuses for executives at bailed-out insurer American International Group and for allegations he got favored treatment on two mortgages with Countrywide Financial Corp.

The Senate ethics panel cleared Dodd of breaking rules by getting the Countrywide mortgages but scolded him for not doing more to avoid the appearance of sweetheart deals. The Countrywide controversy, however, dogged Dodd for several months.

Still, some believe there's a "pretty high chance" that Dodd will join forces with Wall Street once he leaves Capitol Hill.

"There's nothing in his history that leads me to believe he's ideologically opposed to the industry," he said, noting that Dodd has only played populist when his poll numbers dropped and that his wife once served as a director for an affiliate of AIG, the deeply unpopular insurance giant whose risky financial practices brought the global economy to its knees in 2008.

"He's not someone looked at as hostile to Wall Street," he said.

Calabria believes Dodd will end up working for a law firm lobbying on behalf of Wall Street instead of lobbying directly for the banks.

"That gives you some separation or cover," he said.

A spokesman for Dodd told FoxNews.com only that it's "way way too early" to start speculating on Dodd's future after Congress.

"He's got a year left to represent the people of Connecticut," spokesman Bryan DeAngelis said.

If Dodd decided to lobby for the financial services sector after departing Capitol Hill, he wouldn't be the first lawmaker. In 2009, 70 former members of Congress were lobbying for that sector, according to a report released in November by Public Citizen.

The list includes former House Speaker Dennis Hastert, R-Ill., former Senate Majority Leader and Republican presidential nominee Bob Dole, R-Kansas, former Senate Majority Leader Trent Lott, R-Miss., former House Majority Leaders Dick Armey, R-Texas, and Dick Gephardt, D-Mo., former Appropriations Chairman Bob Livingston, R-La., and former Ways & Means Chairman Bill Thomas, R-Calif.

The industry's "revolving door" lobbyists include 19 former members who served on the Senate Banking or House Financial Services committees.

A financial services executive who demanded anonymity because of his ties to Dodd, said he doesn't believe Dodd will lobby for banks because of his ties to Wall Street.

"He has too much baggage," the executive said. "He can't represent banks because that proves he was in big banks' pocket. He can't work for consumer groups because they don't pay enough."

The executive said he believes the senator will end up at a think tank or in the Obama administration. Dodd can exchange the goodwill he built this week by announcing his retirement for an ambassadorship or political appointment, he said.