Bipartisan push to revoke Biden administration's ESG rule

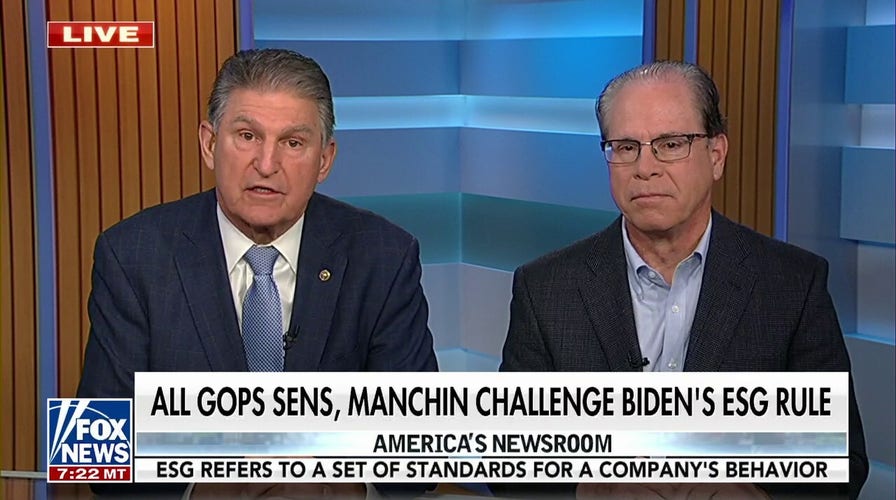

Sen. Joe Manchin, D-W. Va., and Sen. Mike Braun, R-Ind., joined 'America's Newsroom' to discuss the push to take politics out of investing and the latest over national debt negotiations.

The Senate on Wednesday passed a disapproval resolution, formally killing a Biden administration Department of Labor rule that encourages private retirement plan fiduciaries to consider environment, social and governance (ESG) factors when making investment decisions for over 150 million Americans.

The measure, which only required a simple majority to pass, passed the threshold in a 50-46 vote. The House of Representatives passed it Tuesday in a 216-204 vote, with only one Democrat voting for the bill.

Two Democrats voted for the bill in the Senate: Joe Manchin of West Virginia and Jon Tester of Montana.

"President Biden wants to sacrifice seniors’ retirement savings to fund his political agenda," Sen. Mike Braun of Indiana, who led the bill, told Fox News Digital on Tuesday. "Both the Senate and the House have now sent powerful, bipartisan rebukes of the Biden ESG agenda. I’m proud to stand up for Americans’ retirement savings to stop this harmful rule."

"President Biden wants to sacrifice seniors’ retirement savings to fund his political agenda," Sen. Mike Braun of Indiana, who led the bill, told Fox News Digital. (Ting Shen / Bloomberg via Getty Images / File)

Now that both the House and Senate have passed the legislation, it will head to Biden's desk. The White House warned Monday that Biden "will veto" the bill if it is sent to his desk.

"The President will continue to deliver for America’s workers. If the President were presented with H.J. Res. 30, he would veto it," the White House said in a Statement of Administration Policy defending the use of ESG factors in fiduciary decisions.

"The rule reflects what successful marketplace investors already know — there is an extensive body of evidence that environmental, social, and governance factors can have material impacts on certain markets, industries, and companies," the White House argued while slamming the Trump administration for "chilling" ESG investments.

Now that both the House and Senate have passed the legislation, it will head to President Biden's desk. (AP Newsroom)

If Biden does veto it, Congress would have to approve the resolution again in a two-thirds majority vote in both chambers.

Lawmakers have criticized the DOL rule, which went into effect last month, saying it "politicizes" and "jeopardizes" the retirement savings of more than 152 million Americans.

CLICK HERE TO GET THE FOX NEWS APP

Last month, Braun and Rep. Andy Barr, R-Ky., introduced the bipartisan disapproval resolution, which has the backing of all GOP senators, Democratic Sen. Joe Manchin of West Virginia and more than 100 organizations.

GOP senators discussed the legislation during a press conference Wednesday, saying the Biden administration's move with the ESG rule had "a certain irony," given the administration's rhetoric of working for the American public.

"And there's a certain irony here, since [the Biden administration] always billed themselves as actually caring about the person who's struggling. People are going to struggle more because of this rule," Sen. Bill Cassidy, R-La., said.

"This weaponizes their retirement accounts against both their future, but also their present," he continued.

If Biden does veto the measure, Congress would have to approve the resolution again in a two-thirds majority vote in both chambers. (Joe Raedle/Getty Images)

Organizations including Heritage Action, Consumers' Research, the State Financial Officers Foundation and others cheered the passage.

Consumers' Research head Will Hild said Wednesday: "Today, Congress sent a clear, bipartisan message to the Biden Administration and Wall Street elites that the American peoples’ voice is being heard and we will no longer allow the administrative state and their billionaire buddies to weaponize our retirements against us."

ESG standards are increasingly used by investors and asset managers to guide their decision-making.

The environmental factors considered often include how a corporation contributes to pollution or climate change. Social criteria examine a company's relationship with employees, ethics, engagement with nonprofits and stake in the community. Governance considers the corporation's leadership, overall ethics and standards, and it includes the makeup of the board of directors and the recipients of their donations.

Fox News' Haley Chi-Sing contributed to this report.