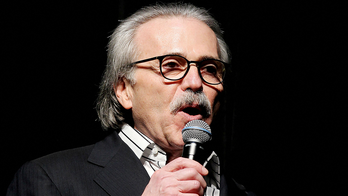

Defense Secretary Leon Panetta, accompanied by Secretary of State Hillary Rodham Clinton, speaks during an event at the National Defense University in Washington, Tuesday, Aug. 16, 2011.

Defense Secretary Leon Panetta said Tuesday that overhauling the military's retirement benefits system is "the kind of thing you have to consider."

During a televised conversation at the National Defense University, Panetta said a decision has not been made yet about a proposal from a Pentagon task force that would abandon the traditional pension system in favor of a 401(k)-style contribution program.

But he said if retirement benefits are changed, "you have to do it in a way that doesn't break faith with the military." Panetta added that the Pentagon would have to grandfather in current benefits.

The comments drew applause from military members who fear their retirement benefits won't be there when they hang up their uniforms.

Under the newly proposed Defense Business Board plan, all troops would receive yearly retirement contributions if they served at least 20 years -- a stipulation of the existing system. The money, however, would not vest until service reached at least three to five years and would then be payable at retirement age. If personnel left before that three- to five-year mark, the time served would be rolled over into Social Security.

Retired Gen. Bob Scales called the proposal "a bad deal."

"That's why the military retirement system was structured the way it was structured because war is a young man's game," he told Fox news. "We reward those who sacrifice when they're young. And the reward is when they retire, they are given a decent retirement pay to carry them over the time they leave the service, and this of course would just remove that."

The central feature of the new DBB proposal would be a mandatory "Uniformed Military Personnel Thrift Savings Plan (TSP)" in which the contributions by the Department of Defense and the individual service member would be deposited. There is already a TSP program in operation, established by Congress in 1986 for both federal employees and service personnel. But those TSPs are voluntary and only include employee contributions.

The new TSPs -- functioning as a 401(k)-style account -- could include a government contribution amounting to as much as 16.5 percent of the member's annual pay, as well as a maximum annual tax-deferred contribution limit of $16,500 by members. In addition, there is a $5,500 annual tax-deferred "catch-up contribution" for service people age 50 or older, and adjustments for those serving in a combat zone. The proposed DBB retirement program would not impact disabled veterans or current retirees.

Under the existing Defense Department pension system, personnel with at least 20 years of active service can retire with a lifetime annuity of 50 percent of their highest average salary from their last 36 months of employment. According to the DBB, the new TSPs would function much like the current voluntary TSPs for federal employees.

Members would get to choose once a year how they wanted their money invested. The choice of investments could range from bonds or equities, which would involve mutual funds or a life cycles program for the older military person, and involve the safest and most conservative investments.

There could also be a hybrid program, which would include a combination of cash payouts and equity investments, melding the old system with the new one.

But the TSPs would function as a typical, civilian 401(k), so there would be no extra protection against market fluctuations like we’ve recently seen. And one thing is clear from the DBB’s figures: The returns from the new TSPs would mean less money on the average for service members who currently retire at 20 years, with a 50 percent annuity.

Critics of the plan say it won't attract those who see the benefits of a military career as a safe bet.

“The whole issue here with this plan is about saving money, not maintaining the viability of the force,” Joe Davis, director of public affairs for the Veterans of Foreign Wars, told FoxNews.com.

While Davis acknowledged the DBB plan had its good points -- such as giving people something who don’t stay in for 20 years, and additional compensation for combat and hardship tours – he said the DBB proposal will actually provide a “disincentive” to stay in the service for 20 years unless people get grandfathered into the old system.

“And where will our future military leaders come from if people leave the service early because they’re losing retirement money,” said Davis. “We rely on the veteran service people to train the next generation in the military, so who’s going to do that job?”

Fox News' Justin Fishel and Jim Crogan contributed to this report.