Elizabeth Warren calls out billionaire 'freeloaders', apologizes to Cherokee nation

Sen. Warren introduces 'ultra-millionaire' tax and apologizes for her DNA test ; David Spunt reports.

Newly empowered Democrats in Washington and statehouses across the country are flexing their legislative muscle with a host of tax proposals that would affect billionaires and blue collar alike.

From D.C. to Sacramento, the controversial levies include everything from a "wealth tax" to new charges on ammunition and groceries. Some of these are meant as a deterrent against certain kinds of purchases -- like guns and ammo -- while others are intended to help pay for ambitious new programs.

WEALTH TAX FACES CONSTITUTIONAL QUESTIONS

Here are just some of the proposals being considered since the start of the New Year:

Wealth Tax

Massachusetts Sen. Elizabeth Warren, who is about to formally launch her Democratic presidential campaign, has proposed a 2 percent tax on net worth above $50 million and a 3 percent tax on net worth above $1 billion. The proposal is unique in that it targets assets and not income, and has already faced some constitutional questions.

While critics also note it would be difficult to enforce since it would require the government to value assets, the proposal would be estimated to affect about 75,000 households.

The senator has pitched it as targeting those at the tippy-top of the wealth scale, in order to pay for programs like government-backed child care and more.

While Warren targets wealth, other lawmakers have floated the possibility of simply raising the income tax rate for those at the very top. Rep. Alexandria Ocasio-Cortez has pitched, albeit not formally, a 70 percent marginal tax on incomes over $10 million. The democratic socialist lawmaker’s plan is not unprecedented – from 1957 through the 1970s, the tax rate was at 70 percent or higher – but the idea has drawn sharp criticism from Republicans and some moderate Democrats.

And billionaires like ex-Starbucks CEO Howard Schultz and former New York City Mayor Michael Bloomberg, both of whom are weighing a presidential run, have hit back. Schultz has called a number of the ideas from Democrats “ridiculous,” while Bloomberg last weekend compared Warren’s plan to the type of policy that destroyed Venezuela’s economy.

“We need a healthy economy, and we shouldn’t be embarrassed about our system,” he told reporters during an event in New Hampshire.

"Billionaires like Howard Schultz & Michael Bloomberg want to keep a rigged system in place that benefits only them and their buddies. And they plan to spend gobs of cash to try and buy the Presidency to keep it that way. Not on my watch," Warren tweeted.

California Gun Tax

With a supermajority in both houses of the state legislature and a new governor who wants to take a firm stance on gun control, California lawmakers are hoping to quickly pass Assembly Bill 18, which among other things looks to tax the sale of handguns and semiautomatic weapons in order to generate funding for gun control programs.

The bill, which was sponsored by Democratic Assemblyman Marc Levine, would implement “an excise tax on the sales of handguns and semiautomatic rifles” and then hand over the resulting revenue to the California Violence Intervention and Prevention Grant Program (CalVIP).

“California needs to bolster violence prevention initiatives so that they are commensurate with our state’s tough gun laws and as effective as violence prevention programs of other states,” Levine said in a statement earlier this month.

CALIFORNIA VS. TRUMP: NEW STATE LAWS TAKE ON CLIMATE CHANGE AND WHITE HOUSE ENERGY AGENDA

The gun-tax legislation has, unsurprisingly, drawn heavy criticism from gun-rights and hunting groups.

“While the legislation lacks details of how the actual proposal will look, it expresses the intent to place an additional tax on handguns and semi-automatic firearms for distribution to various community-based intervention and prevention programs,” the National Rifle Association’s Institute for Legislative Action said in a statement. “Once again, lawmakers are saddling lawful gun owners with additional taxes and fees for the misdeeds of criminals.”

Connecticut Ammo Tax

California is not the only state looking at gun-related taxes.

A Democratic Connecticut state legislator introduced a bill on Monday that would raise the tax on ammunition in the state by 50 percent.

"Currently, ammunition is taxed at the same rate as other products, but we want to increase it by 50 percent, because we see it as a prevention measure," Rep. Jillian Gilchrest said in a video posted on Twitter. "For example, if someone were to buy a 50 cartridge box of ammunition, which goes for about $10, it would increase the price to $15."

Gilchrest goes on to explain that military and law enforcement members would be exempted from the tax, though those exemptions do not appear in an initial draft of the bill posted to the Connecticut state legislature's website.

In a statement Tuesday, the NRA condemned Gilchrest's effort.

“This dreadful legislation punishes law-abiding citizens and makes it harder to learn how to safely use firearms,” the NRA said in a statement posted to Twitter.

Connecticut Grocery Tax

Along with a tax on ammunition, Connecticut is also looking into a possible tax on groceries and prescription drugs.

Connecticut Gov. Ned Lamont is mulling including the tax as part of his administration's first budget proposal due later this month.

While the details of the possible sales tax are unclear, a local report stated that the tax, if implemented, could be set at the current 6.35 percent sales tax, or limited to 2 percent as recommended by a "fiscal stability commission."

Even the consideration of such a tax, however, is sparking a backlash against the Democratic governor in the state with a history of high taxes.

“People throughout Connecticut are bracing themselves and their financial plans so they can manage the brunt of Governor Lamont and Connecticut Democrat lawmakers and their new taxes and proposals,” House Republican Leader Themis Klarides told Fox News. “Targeting groceries and medication to generate revenue is a terrible strategy.”

New Jersey 'Rain Tax'

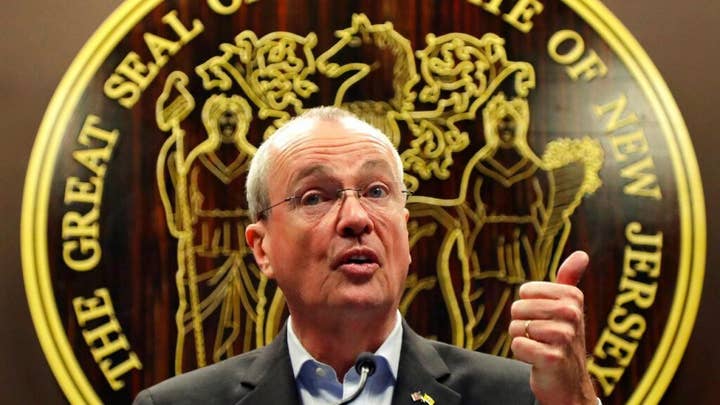

New Jersey residents could be hit with what Republicans are calling a "rain tax," if Democratic Gov. Phil Murphy signs newly passed legislation.

The bill, approved by the New Jersey Assembly and the Senate, would allow municipalities to create utilities that can collect fees from homeowners and business owners that have large paved surfaces, like driveways and parking lots. During storms, rainwater mixes with pollutants on those surfaces before running into sewers and drains. The funding from the fees could be used for upgrades to reduce the impact on the environment.

“With all the salt that we’ve had on roads recently, that’s all running into the sewer systems, so you can’t ignore the problems because they don’t go away,” New Jersey Senate President Steve Sweeney told CBS New York.

The bill would establish a “Clean Stormwater and Floor Reduction Fund,” which would be used for stormwater utilities in the state, as well as water quality monitoring, pollution reduction projects and outreach programs, according to the legislation.

But Republicans have blasted the plan, dubbing it a “rain tax” and complaining the state already has implemented too many costs on residents.

“We all want to protect our environment. We all want to preserve it for future generations, but this is a weighted tax,” Sen. Tom Kean Jr. told CBS New York. “The citizens of New Jersey…really [have] no way to defend themselves against tax increases at local levels.”

Nebraska Beer Tax

It’s not just Democrats who have introduced recent tax proposals.

Two Republican state senators in Nebraska, Tom Briese and Curt Friesen, have introduced two bills that, if enacted, would amount to a 345 percent increase in the tax on beer, wine and liquor.

While the lawmakers contend that the tax would only amount to a 10 cent increase in the price of a mug of beer and is part of the solution to lowering property taxes on the state’s farmers, brewers in the Cornhusker State are not happy.

"We're really scared that if this passes, it will stop the growth of this industry," Gabby Ayala, the executive director of the Nebraska Craft Brewers Guild, told the Omaha World-Herald. "Other states that have high taxes don't have as many breweries — it stops people from wanting to invest and expand."

CLICK HERE TO GET THE FOX NEWS APP

Craft brewers in Nebraska argue that their businesses are reviving small communities and are an economic success story in a state heavily reliant on farming.

"These breweries are the only real bright spot in a lot of little towns," said Caleb Pollard of Scratchtown Brewing Co. in Ord, a town of 2,100 people.

While the bill has faced some opposition, lawmakers looking into property tax relief proposals say that so-called “sin taxes” – those on alcohol, tobacco and gambling – make sense.

"We do have a property tax crisis in Nebraska," Briese told the newspaper. "The responsible approach to provide immediate and substantial relief is to access other taxes."

Fox News' Brooke Singman and Gregg Re contributed to this report.