China is America's foremost national security threat: Mike Gallagher

China Committee Chair Mike Gallagher, R-Wis., warns the Biden administration's handling of the threat China poses to the U.S. is 'sleepwalking potentially into WWIII' on 'Sunday Night in America.'

Chinese police last week raided several CapVision offices in China, following similar raids on the Mintz Group in Beijing and Bain & Company in Shanghai. Due diligence and corporate consulting are not usually lightning rod industries, yet these American companies suddenly had their employees detained, their property confiscated, and their offices shuttered.

While these American companies may have been doing normal business (according to the FT’s sources, Minsk ran afoul of the authorities by scanning supply chains for forced labor), the business environment in China is anything but normal.

Agents from the Ministry of State Security (MSS), one of China’s rough equivalents to the Soviet-era KGB, are "constantly in touch with the [due diligence] industry." "We call them the men in black," said one executive at a due diligence firm, speaking anonymously to the FT.

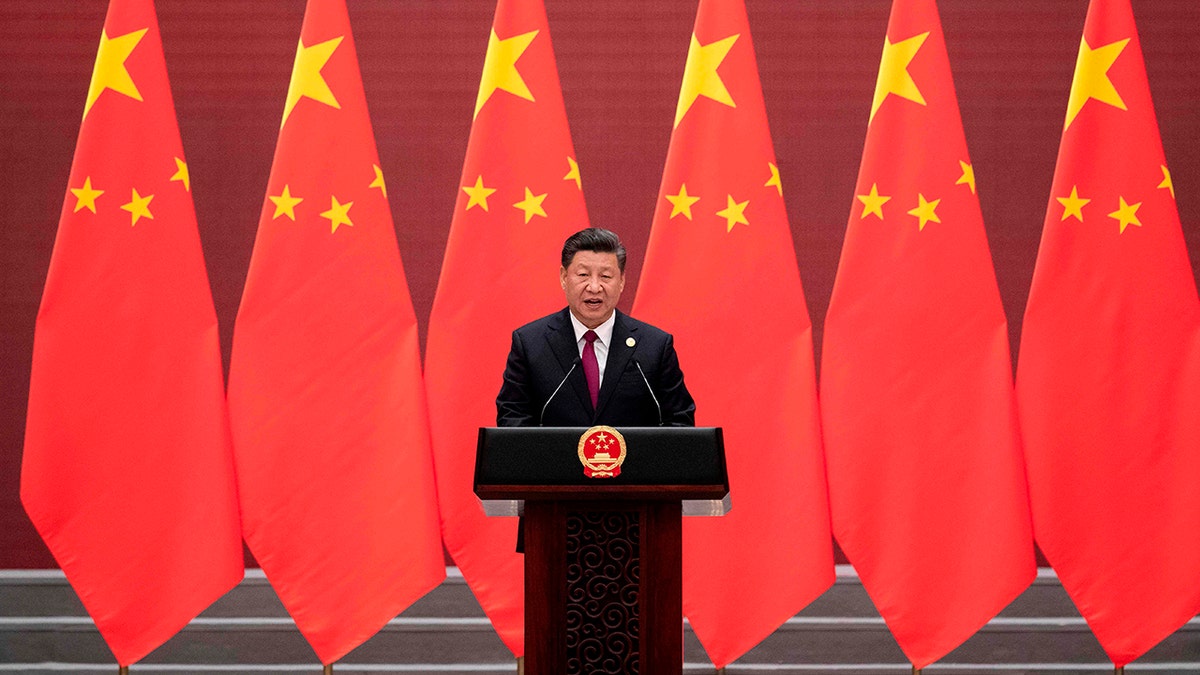

Chinas President Xi Jinping gives a speech to leaders attending the Belt and Road Forum at the Great Hall of the People in Beijing on April 26, 2019. (Nicolas Asfouri/AFP via Getty Images)

These raids weren’t a coincidence – they were part of a continued power grab for control over all business in China. At a recent meeting of the National People’s Congress, the Chinese Communist Party (CCP) updated their Counter-Espionage Law. The CCP now reserves the right, at its sole discretion, to arbitrarily seize any documents, data or property it deems relevant to national security.

This should be a wakeup call for American companies. It’s time for industry to remove the golden blindfolds, and recognize the growing hazards of doing business in China.

Any American citizen or company operating in China could face investigation, prosecution or even imprisonment for regular business activities, such as market research.

State security entities can arbitrarily inspect emails, files, iPhones and any digital devices and communications records. Private businesses can be searched and their trade secrets exposed at the CCP’s whims. No technology is safe. No business is exempt.

The law codifies a long tradition of exploitation. In 2009, MSS arrested Stern Hu and three of his Rio Tinto colleagues over a price dispute. Ten years ago, police raided AstraZeneca’s offices in Shanghai and detained their executives. They did the same to the offices of Microsoft and Uber in 2014 and 2015.

CHINA CLAMPS DOWN ON ACCESS TO PUBLIC DATA TO COUNTER US THINK TANK INTEL

The updated CCP Counter-Espionage Law also shows that we cannot trust PRC business entities, even those operating in the U.S. In America, investors have a fiduciary duty to understand the business practices of any companies in which they invest. Likewise, federal and state regulators require that firms operating in their markets provide accurate information about their business.

But there is no such thing as a private company in China and the counterespionage law forbids the disclosure of data the CCP deems sensitive.

By targeting due diligence firms, expert networks and consultants, the CCP is sending a clear message: Don’t ask too many questions, or else we will take action against you. That’s also why they’ve cut off access to key economic databases and cracked down on journalists.

CLICK HERE TO GET THE OPINION NEWSLETTER

How can American asset managers fulfill their fiduciary duty while investing in companies that may be legally prohibited from sharing even mundane corporate information? How can we trust that PRC companies are disclosing the truth to our government regulators?

American pension funds and retirement accounts are flowing into a "market" that is becoming hostile to many of the principles of corporate governance, transparency and investor protection that undergird our financial system. Executives and financiers must take off their golden blindfolds and recognize, with clear eyes, the risks of a business partnership with the CCP. Those who take fiduciary obligation seriously should derisk their operations and protect their companies, investors and the millions of Americans who depend on them to provide reliable goods and manage their money.

CLICK HERE TO GET THE FOX NEWS APP

I’ve had the opportunity to talk with business leaders and investors from across the country. They all say they want certainty – certainty in regulations, in law, and in markets. Congress should draw clear, bright lines for derisking – but industry needs to recognize that no matter how much clarity the American government provides, we can’t make up for Beijing’s capricious, erratic charge toward opacity.

It’s past time to recognize that what a "company," a "disclosure" and a "law" mean in the PRC are vastly different from what they mean in the United States. We need to stop playing economic make-believe before we put our entire financial system at risk.