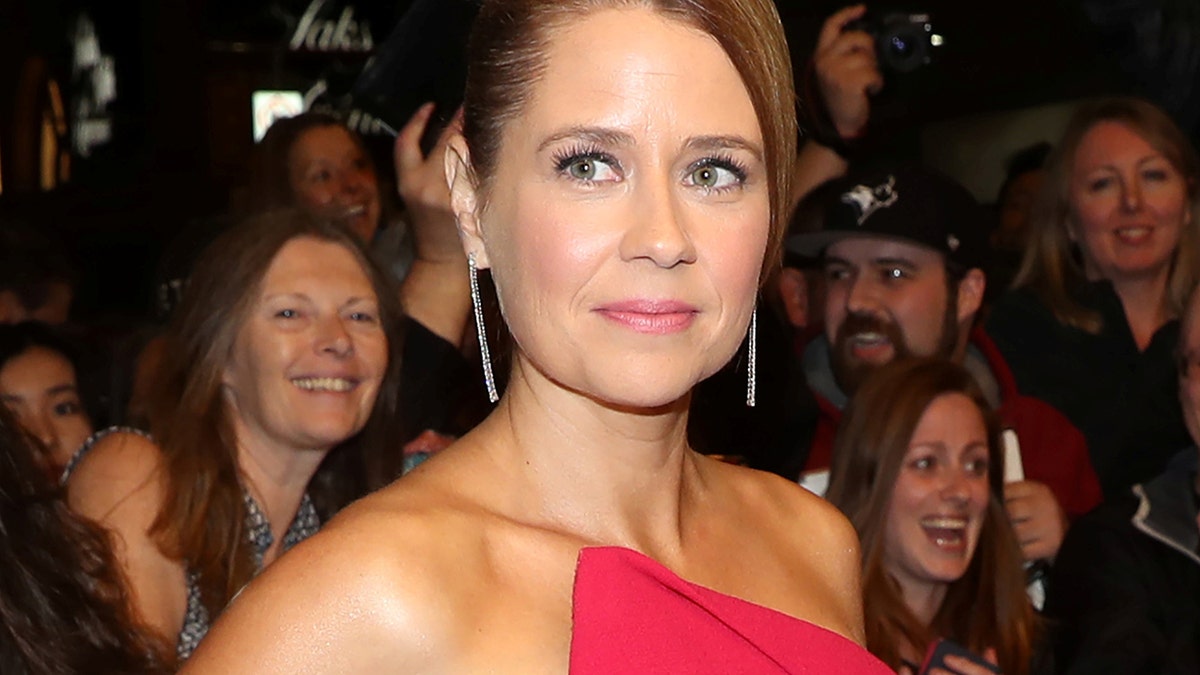

Actor Jenna Fischer arrives at the premiere of the film "Brad's Status" at Toronto International Film Festival (TIFF) in Toronto, September 9, 2017. (Reuters)

Maybe she should stick to comedy.

Actress Jenna Fischer, best known for her role as Pam on NBC's "The Office," found herself in hot water after she shared inaccurate information about the GOP tax bill on Twitter.

"I can't stop thinking about how school teachers can no longer deduct the cost of their classroom supplies on their taxes...something they shouldn't have to pay for with their own money in the first place. I mean, imagine if nurses had to go buy their own syringes. #ugh," Fisher tweeted on Saturday.

Twitter users were quick to point out that Fischer was misinformed; the $250 school supplies deduction was included in the bill.

Actors John Krasinski (L) and Jenna Fischer interact as they receive gift bags from the Screen Actors Guild Awards Committee including a certificate for their nomination for an outstanding performance by an ensemble in a comedy series in "The Office," on the set of the television show "The Office," in Panorama City, California, January 11, 2007. (REUTERS)

The 43-year-old followed up her tweet writing, "It was capped at $250 which is woefully insufficient especially considering they shouldn't have to go out of pocket at all. #iloveteachers."

However, the actress was still incorrect and the Twitterverse was more than happy to correct her.

"It was capped at $250 before the bill. It’s still capped at $250. Nothing changed. You are misleading people," one user wrote.

Another shared, "This deduction was not eliminated in the bill that passed. Given that you have hundreds of thousands of followers, don’t you have a responsibility to make sure you’re not giving them false information? Please consider at least deleting and tweeting a correction."

Fischer gave her final thoughts on Christmas Day admitting she didn't have all the facts.

"Thanks for your tweets! I had some facts wrong. Teachers surveyed by Scholastic in 2016 personally spent an average of $530 on school supplies for students. Teachers who worked at high-poverty schools spent an average of $672. The tax deduction was capped at $250."