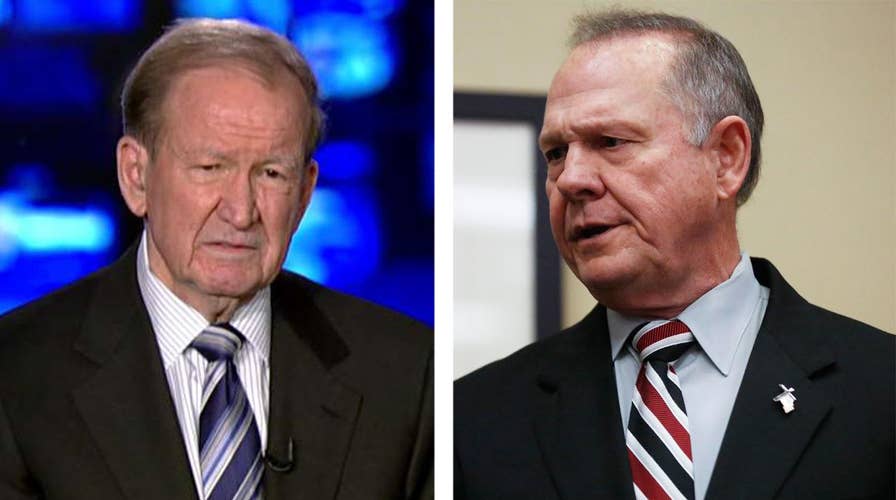

Buchanan on Washington Post 'kill shot' against Roy Moore

Former Republican presidential candidate says that while the claims of Moore accusers have 'a ring of truth' to them, there should be no doubt about the motivation behind the story.

This is a rush transcript from "Your World," November 14, 2017. This copy may not be in its final form and may be updated.

NEIL CAVUTO, HOST: Welcome, everybody. I'm Neil Cavuto. And this is "Your World."

And did stocks turn around -- they're off, substantially off their worst levels of the day -- on signs that there might be progress on tax cuts in Washington and, more to the point, combining it with progress on repealing Obamacare?

It gets kind of convoluted. Suffice it to say, the feeling seems to be -- this is in the United States Senate -- that they're going to try to marry something with repealing the individual mandate, the requirement that you have to get health insurance, with whatever tax cut they ultimately cook up.

Now, on the surface, this would look to be a fool quest, because they have had so many problems with this in the past.

But Fox Business Network's Blake Burman says there might be more to this than you know.

Blake, what's going on?

BLAKE BURMAN, FOX NEWS CORRESPONDENT: Well, Neil, Republicans point to the fact that there could be some $300 billion in revenue generated from repealing the Obamacare individual mandate.

So, now Senate Republicans are planning on including that in their tax reform bill. You might be wondering, though, what are Senate Republicans, the same folks who couldn't get Obamacare repeal and replace done earlier this year, doing including a portion of Obamacare in their tax bill?

Well, it turns out they actually might have the numbers, they might have the support on this one. Specifically, it appears as if Lisa Murkowski, who was a no on repeal and replace earlier this summer, she's signaled her support for this. And Susan Collins, a no as well, also just might back this measure as well.

That would put them over that 50-plus-one hurdle that Senate Republicans need. Here was the Senate majority leader, Mitch McConnell, earlier today.

(BEGIN VIDEO CLIP)

SEN. MITCH MCCONNELL, R-KY., MAJORITY LEADER: We're optimistic that inserting the individual mandate repeal would be helpful. And that's obviously the view of the Senate Finance Committee Republicans as well.

(END VIDEO CLIP)

BURMAN: Now, during the Senate markup process earlier today, Democrats were questioning, what does this Obamacare individual mandate have anything to do with the tax reform bill?

Keep in mind, though, Neil, it was the Supreme Court that ruled that the Obamacare individual mandate could exist because it was viewed by the Supreme Court as a tax.

However, with Senate Republicans putting this in their measure, now the courtship of Senate Democrats could be over.

Here was Chuck Schumer.

(BEGIN VIDEO CLIP)

SEN. CHUCK SCHUMER, D-N.Y., MINORITY LEADER: To take away people's health care and raise their premiums to lower the top rate, which is what President Trump suggested, is so against what the American people want that, again, they are just headed for failure.

(END VIDEO CLIP)

BURMAN: All right, Neil.

So, when you look at the schedule here, House Republicans, the House side now, they're set to vote on their bill on Thursday. Their bill does not include an individual mandate repeal. Senior House aides tell Fox that, at this point, they're not changing the bill.

So, the future here, it looks like House Republicans, as it's scheduled pass that. Senate Republicans do their own thing and pass it. And then this have to be married together.

Keep in mind, though, President Trump had signaled his support for this individual mandate repeal in a tweet yesterday, in which he said that money should go to tax cuts toward the middle class and also lowering that top- end tax rate -- Neil.

CAVUTO: I just have a hard time understanding how every Republican senator goes along with this, since that among the issues that was weighing on them with the health care repeal effort, not exactly the individual mandate, but anything having to do with redoing the health care thing, you would think it's like a third rail to them and they would avoid, but maybe not.

BURMAN: I was told a few days ago, I would say, that this individual mandate repeal probably wouldn't happen, because it would just muddy up the waters.

CAVUTO: Right. Right.

BURMAN: Now, I mean, here we are, and when you look at the numbers, it seems as if they have got 50-plus-one on the Republican side for this in the Senate.

CAVUTO: All right, we're a long way from finished here.

BURMAN: Yes.

CAVUTO: But we shall see, Blake Burman.

Former Republican presidential candidate Pat Buchanan, bestselling author here, with me as well.

These are sort of late-day developments, Patrick, but what do you think of this?

PAT BUCHANAN, FORMER WHITE HOUSE DIRECTOR OF COMMUNICATIONS: I think it excellent news.

If they can get in the Senate bill, even if it's not in the House bill, you go to conference, and you marry the two together, and you send it down to Mr. Trump, and I think you could have a tremendous victory for the Republican Party.

And I think failure is really not an option on the tax bill, Neil. They have got to get it done. That's what they were sent here to do.

CAVUTO: All right, now, they're also dealing with the reality of Judge Roy Moore and his presence still on the Alabama Senate ticket.

I get a sense as well -- and I was talking to a number of them today -- that they want to try to get all this done and wrapped up before that December 12 special election, an election that could go the way of the Democrat. This avoids that whole mess. Right?

BUCHANAN: Well, I'm not sure when whoever is elected in December takes office exactly.

But you're exactly right. I would sure get that all done. You have to have it done, I think, before the new year, because you could have Roy Moore in the United States Senate, and them arguing about whether to seat him or not.

CAVUTO: Right.

BUCHANAN: But I would really -- if I were the Republican Party -- they have all made their views clear. I would leave this up to the people of Alabama to decide in December. We could have a lot more coming out.

CAVUTO: Yes.

Now, obviously, what they're pushing, to try to get this tax thing settled before December 12, is make that a moot point.

But this tax cut itself that you like, that failure is not an option. But compared to the big aboard-the-board tax cuts we have seen in the past, I know different times, different history, whether JFK or Ronald Reagan or even George Bush's two tax cuts, this doesn't stack up to that.

But are you in the camp that says better this than nothing?

BUCHANAN: I certainly am in that camp.

And I think there's some good aspect to this tax bill. I do like the idea -- the corporate tax rate has to be cut to at least 20 percent if you're going to be competitive in what is still unfortunately a global economy.

You have got to cut that down. But let me tell you, Neil, I was on the plane with Ronald Reagan at the Asia summit. And I can remember to this day we got a phone can on Air Force One. Don Regan came back to me and said, "Packwood says we can get a top rate of 26 percent on the personal, but we are going to have to give up some deductions."

I just yelled two words: "Take it."

(LAUGHTER)

CAVUTO: That's funny.

BUCHANAN: And, eventually, we did get it down to, what, 28 percent.

Reagan had found it, I believe, at 72, got it down to 28 percent. Unfortunately, the capital gains went back up to 28 percent, too.

CAVUTO: Yes. But, if you think about it, that was such a sweeping series of tax cuts, marginal, across the board for everyone.

This is not across the board for everyone. And I wonder how that is going to weigh on folks, especially those waiting to see a big impact in their net pay come next year, assuming it's passed and it goes into effect next year. What do you think?

BUCHANAN: Well, my view is this.

Look, you have got to get it done. And the key question here, frankly, is, once getting it done, you have got to get the economy up and moving, jobs being created, pay of working-class Americans moving up. And that's got to be done by the time you get to 2020, I think.

It's got to be morning America by then. But, before then, look, I saw Mr. Schumer on the air just a minute ago on your show. And, of course, they're going to call the Republicans the party of the rich and the giveaways and all the rest of it.

I think that you have got very narrow margins. Be bold. Get it done. Get it into law. You can take another look at it in 2018, once you have got it into law. But I think they have really got to get it done.

CAVUTO: All right, now, that's assuming they can hang on to their majorities in 2018, because, after that, all bets are off.

But let me get your sense of what's going on with this battle back and forth over Roy Moore, whether to seat him or not, whether to even keep him on the ticket or not. It seems like half the Republican senators are saying, why don't you go and don't let the door slam on the way out?

Others are saying, let Alabamians deal with this. But the other issue that comes up is this battle between I guess the establishment, Pat, and the so- called renegade group that, you know, argue, hey, this is our guy. Roy Moore is our guy. These renegade-type primary challenger types that are our victorious are our guys.

Does this slow that? Does the Steve Bannon approach to this get slowed?

BUCHANAN: Well, I mean, quite frankly, Steve Bannon has a heavy, weighted investment in Roy Moore.

CAVUTO: Sure.

BUCHANAN: But I will say, I agree with some of those folks in Alabama.

Look, this stuff comes out, you know, one month before the election. It's The Washington Post. They have been digging on this thing with all these folks. And the clear shot -- this is a kill shot aimed at Roy Moore.

I'm not saying it's untrue, what they have been writing.

CAVUTO: Right.

BUCHANAN: But there's no doubt about the motivation. This is to try to get rid of a Republican Senate seat in Alabama.

So, I say, you know, more facts are going to be coming out. And I would just say, look, let the folks in Alabama decide this in December. If there's really a horrible situation in January, the Republican Caucus can deal with that then.

But there's no reason they should turn the Senate seat over to the party of Chuck Schumer because something was done wrong 40 years ago.

CAVUTO: So, when you hear Speaker Paul Ryan and others, like Mitch McConnell, say, "I believe the women," what do you think?

BUCHANAN: Well, I think they do believe the women.

And two of these incidents, the one involving the 14-year-old, one involving the 16-year-old especially, that is graphic, grim. It has a ring of truth to it. I agree with that.

But then you have got flat denials by the judge and the others saying that this is false. So I think wait until -- we have got plenty of time before all of the evidence is in. And by then, I think the picture is going to be pretty clear.

CAVUTO: You mentioned at the outset, with the size of the tax cuts and all, I have always believed that Republicans are playing on defense on this.

They afraid to look at across-the-board cuts. I know reconciliation and what is involved with that, and making the numbers add up. But it seems like, on every key issue, they retreat or they're afraid to be just who they are.

BUCHANAN: You know, I...

CAVUTO: And I'm wondering if that is going to come back to bite their heinies?

BUCHANAN: It does.

And that's -- frankly, that is the difference with Reagan. There's some -- one point at which you have really got to throw the ball long and put everything on it.

And if it were the Republicans, ignore what they're calling us. They're going to call us the same names they have always done. But do something that is dramatic, something you believe in, something you think is really going to get this economy going. And it may not, but roll the dice.

I have always believed in that. My view is, I would do away with the corporate income tax and replace it with a 20 percent tariff on foreign manufactured goods and foreign goods coming in. Take all that revenue, cut taxes on American production.

Businesses would come into the United States. This -- these inversions, these companies would be relocating in America, which has a zero tax rate.

I mean, Lexus, you could put a 20 percent tariff on Lexuses made abroad, zero on Lexuses made in the United States. I mean, this is the kind of boldness I really would like to have seen the party go for.

But this is still a good bill. I don't want to knock it. Those guys have worked very hard on it.

CAVUTO: That's what you call Buchanan half-hearted praise there.

(LAUGHTER)

CAVUTO: This is the best we can do, outside of that, you know?

All right, thank you, Pat. Very good seeing you again. Thank you.

BUCHANAN: Good talking with you, my friend.

CAVUTO: All right.

For Republicans urging a special counsel for Hillary Clinton, and Democrats hoping to nail Jeff Sessions on a Russian connection, did everyone then just sort of leave disappointed today?

(COMMERCIAL BREAK)

CAVUTO: All right.

This is Washington, D.C., The Wall Street Journal having a CEO forum. Their main speaker today will be the vice president of the United States. He is going to be there in about a half-an-hour.

He might outline and maybe update us on some of these new, rather dramatic developments, including a plan on the part of Republican senators, who have concocted a plan that would include repealing the individual mandate in the Affordable Care Act, i.e., Obamacare, and sort of weave it into the tax cut plan.

Now, the markets came well off their lows when we got wind of this about 10 minutes before the end of the trading day.

Let's go to FOX Business Network's Charles Payne on how this is factoring out.

Assuming they can get this, and they -- that's a leap, because that just reintroduces some of the controversy and fights they had in the past doing that -- but that would be a big deal, wouldn't it?

CHARLES PAYNE, FOX NEWS CONTRIBUTOR: It would be a big deal.

And, you know, Neil, you knew it was going to be a big deal last week, late last week, when the CBO said repealing the individual mandate would raise $338 billion over the next 10 years. That is a lot of money.

That would allow the House and the Senate, because this idea was floating around of the House, as a matter of fact, even before the CBO score -- it would give them elbow room so they wouldn't have to do anything crazy, like perhaps even not push off corporate taxes.

Remember, they wanted to push off the corporate tax rate going to 20 percent for one year to buy themselves some time, at least $100 billion. If they can pull this off, they wouldn't have to do it, although there's some -- to your point, there's some additional rules out there, including reconciliation.

But I think the idea would be that they could still just remove the penalty. So, in other words, the individual mandate would be there, but de facto it would be eliminated because no one would be penalized.

CAVUTO: Yes, in other words, there's no pain in this, all gain. The way the Republicans are telling it, that adding the repeal of the individual mandate -- this is coming from the Republican Study Committee statement -- "could be the most consequential step this Congress takes to date in fulfilling our promises to the American people to both reform the tax code and repeal Obamacare."

Having said that, however, we know how prior Obamacare fights have gone for Republicans. You could make the argument best to leave that alone here, because, the way you explained it just then, Charles, is right, but it might not come out that way, when this is ultimately sold to other members, who might be leery.

PAYNE: Well, they're going to have to remind other members that they were elected on this.

And, listen, let's be frank. Obamacare sign-ups are a lot higher than people thought it would be. Its popularity has gone up since the November election. Nevertheless, we know that the Republican Party, one of the main mandates when they were sent to Washington with this control of the House and Congress -- I mean, the White House and Congress, was to fix Obamacare.

And, by the way, Neil, this also gives senators a second bite at the Apple. Remember, the blame for not getting any sort of deal done on Obamacare lies squarely on the Senate. The House passed the bill. The Senate didn't.

This is a way of knocking out two birds with one stone and, by the way, raising perhaps $300 billion, so they don't have to do anything really crazy with tax reform.

CAVUTO: All right, thank you, my friend, Charles Payne.

No doubt he will be exploring that a lot more on his special show about an hour and 15 minutes from now on FBN.

In the meantime, did the attorney general of the United States just throw some cold water on Republicans' push for a special counsel to look into Hillary Clinton?

Republican California Congressman Darrell Issa is next.

(COMMERCIAL BREAK)

(BEGIN VIDEO CLIP)

REP. DARRELL ISSA, R-CALIF.: I don't speak Russian, and I don't meet with Russians. And I don't really want to ask about those questions today.

But I do have some very important questions.

JEFF SESSIONS, U.S. ATTORNEY GENERAL: Well, Congressman, honestly, you said that, but I bet you have met with some Russian.

And if you -- in your lifetime. And taking those words at face value, somebody might accuse you of not being honest.

ISSA: You're absolutely...

SESSIONS: That's what they have done to me.

(END VIDEO CLIP)

CAVUTO: All right, so a little fun there in that back and forth with the attorney general, Jeff Sessions, and California Congressman Darrell Issa at the House Judiciary hearings today.

A member of the House Judiciary Committee, California Congressman Darrell Issa, with us right now.

Congressman, I was surprised, your exchange notwithstanding, how nasty it got between some of your Republican colleagues and the attorney general, many of whom are very keen on his appointing a special counsel to look into all this Hillary Clinton stuff, the Bill Clinton stuff, the Uranium One stuff, the tie-in suit, the Obama administration, Clinton Initiative.

What do you think of that?

ISSA: Well, look, the man is caught between a rock and a hard spot.

He's a doing his honest best he can do. Like me, as a member of Congress, of course he met with Russians. Actually, I went to Moscow one time.

The reality is that he gets beats up endlessly for not having a perfect photographic memory, even when his absence of remembering something is because it's insignificant and he did nothing wrong.

He answered a lot of tough questions today. I'm proud that, on our side, they were substantive. They were either about things that he should be investigating, regulatory failures and so on.

But you're right. There's a pent-up desire by Republicans to feel that we should have wrongdoing that occurred by people during the last eight years also be investigated, not just...

CAVUTO: But I got a sense from him, Congressman, that he ain't going to do it, that he's not inclined to do it.

And maybe it's the appearance of being pressured by the White House, maybe to avoid that, maybe to leave it at a level with, you know, Justice Department officials, rather than a separate prosecutor and all.

What do you think of that?

ISSA: Well, I think, if he takes -- and I trust his judgment.

If he takes a career assistant U.S. attorney and people at the FBI who do this every day and says, look, do what you think is right, investigate fairly, and call me if you have something, then I think he's doing his job impartially.

We're not looking -- I believe none of my members should be looking for a witch-hunt. There may not be a there there in some cases, but we also shouldn't overlook them.

It's the same reason that the attorney general appointed -- recused himself, allowed for a special prosecutor to be selected. A very distinguished one was. And that person is looking into something, and, after a great period of time, so far has found nothing, no wrongdoing by the attorney general or the president or others during the campaign.

CAVUTO: Do you get any sense -- I know much was asked about whether he had conversations or any recollection of meetings with this George Papadopoulos, who agreed to plead guilty to lying to authorities.

The reason why I mention is that they're trying to connect more meetings to Papadopoulos, who might have been wearing a wire to enter this agreement, and that this could lead higher up the food chain.

What do you think?

ISSA: You know, I really don't know.

I think the nature of the investigations I have been involved with over the years, you follow the facts where they lead. If people tell you they don't remember, that's fine.

If you find that they were somewhere, you give them an opportunity to try to remember. You give them some coaching, and then you see if they tell the truth.

The attorney general at times didn't remember the specifics of some meeting, but he's never failed to tell the truth about what occurred, to the best of his ability, when -- when -- when prompted with, oh, don't you remember you met with him at a convention?

Yes, I met with him at the convention. He was just another guy with a badge on in a very crowded arena. We didn't have any substantive talks.

Ultimately, sometimes, there's no there there, and that's why you don't remember something.

Having said that, we know there were people involved in both campaigns who did wrong. There were people who, before they ever got involved in either campaign, did things wrong.

And we know that the Russians are bad actors and they do wrong every day. So, I don't think we should be surprised when we do find some there there. The question really is, can we move on to the work of the American people, while at the same time professionals look into the sins of the past?

CAVUTO: All right. We will watch what happens. It leaves a lot of folks confused, to your point.

Darrell Issa, House Judiciary Committee, in Washington.

ISSA: Thank you.

CAVUTO: All right.

Meantime, let's say across-the-board tax cuts are out. And the well-to-do know it and a lot of folks know it. Now, what happens with those well-to- do folks? They're not going to run to Democrats, right? That's the prevailing thinking.

What if they stop writing checks, or, worse, just don't vote?

After this.

(COMMERCIAL BREAK)

CAVUTO: You're looking live in Washington, D.C.

Yes, that's the former treasury secretary of the United States, Larry Summers. By the way, he's been a very big critic of the present treasury secretary, Steven Mnuchin.

We're going to hear as well from the vice president of the United States, all in an effort to sell tax cuts.

(COMMERCIAL BREAK)

CAVUTO: All right.

Republicans in Washington might want to listen to this. A GOP fund-already raiser noticing some very wealthy Republican donors are saying, take a hike, over talk that they're getting a tax hike.

But even worse would be if wealthy voters, who historically turn out in very big numbers, end up saying, all right, we're not going to vote for the Democrat. We're just not going to vote at all. How is that?

GOP fund-raiser extraordinaire Noelle Nikpour.

Noelle, I have talked to more than a few of that mind-set. They're frustrated. They're angry. They can understand in some cases not being included in what they thought would be an across-the-board tax cut. But now that they're getting a hike, they're not happy.

NOELLE NIKPOUR, REPUBLICAN FUND-RAISER: Well, you know, not only have been suffering from nothing getting done. Now the things that may be getting done are going to hurt them. So they're not real -- the job creators, the mega-donors, they're not very happy right now.

And I feel their pain. I feel their pain. So, you have got to look at these people writing the checks.

CAVUTO: But do you see them really closing the checkbook, Noelle, as a result? Would they do that?

NIKPOUR: No.

And I'm going to tell you what is happening on the ground with some of the donors that I deal with, Fortune 500 donors. They have actually been asking me about some good gubernatorial races to invest in...

CAVUTO: Whoa.

NIKPOUR: ... where they have interests. Either they have companies there, they have employees there, they have some sort of an interest in states.

So, now they're looking. And think about it. Look at Virginia. Look what happened in New Jersey. So, now they're thinking, you know what? We need to make sure that we're investing and getting some good Republican governors.

So, that may be the next trend, because they're very unhappy with a lot of the things that are going on in the House and in the Senate. And they can't even get along. And they can't pass anything.

CAVUTO: It sounds like they're not in the camp that something is better than nothing. I guess, if it's nothing for them, that says something, right?

(LAUGHTER)

NIKPOUR: Exactly. If it's nothing for them, it rings true to them that they might not want to write a check and rally behind.

(LAUGHTER)

CAVUTO: So, what happens now?

I know they're really rushing this thing in through Congress, I guess, presumably ahead of the Alabama, Roy Moore election, if he's still in the race, for December 12, because they figure that they have better odds before risking the possibility of a Democratic pickup there, to get this all signed, sealed and delivered before then.

NIKPOUR: Well, I mean, it's like this.

If you call donor XYZ and you say, hey, let's make sure that we support the U.S. senatorial Republican nominee and make sure that we win, their comeback to me is probably going to be what it's been, is, well, how is that going to do anything? Because you told me, if we had a Republican Senate and a Republican House and basically the presidency, a trifecta, that we're going to pass all these great things on the Republican platform for which we stand.

And guess what, Neil? Boom. Nothing. We haven't gotten anything done. And it's coming up on a year. Remember Steve Mnuchin saying over and over again, we're going to pass it here, it looks like this, it looks like this.

And every -- every time that they set this bar, now they're leery about saying any kind of timeline because they keep going past it. It's really bad. And then, with some of the tax cuts, they're increasing the deficit.

CAVUTO: What is really weird about it, too, is that I think, for tax cuts to be consequential, they have to be substantial. I understand the math they're dealing with and reconciliation, all of that. I understand that.

But what it's going to mean is that it won't be across the board and it won't be historic. It will be big. I don't minimize that, but it will not be enough to maybe, as Republicans hope, move the needle as much as they hope. I could be wrong. I would love to be wrong.

But what do you think of that and how that boomerangs politically?

NIKPOUR: I hope that you're wrong on that. And I hope that they do have deep tax cuts, because, after all, the one thing that is good about Republicans is the fact that we -- we know what we're doing economically. We know what we're doing with taxes.

We have always had a sound policy when it comes to taxes. We believe in deep cuts. We believe in less regulation. And I really -- if we can't get this done, and get it done the right way -- and right now, it's like a cluster.

You have got the House on one side. You have got the Senate. You have got the division within the party on getting these things straight. And if we cannot come together, if we can't get the tax cuts deep enough, then we have failed almost as a party.

CAVUTO: Yes.

NIKPOUR: And I know I'm going to get a lot of blowback on this, Neil, and I apologize in advance.

(LAUGHTER)

NIKPOUR: But if we cannot get this done, the one thing that unites a lot of people that are -- they're -- they -- they may like the Republican Party on the economic side, but they don't agree with it socially.

CAVUTO: Yes.

NIKPOUR: There's one thing that unites a lot of Republicans on both sides of the aisle, and that is economics. And if we cannot get these taxes done in an efficient way, then what do we stand for?

CAVUTO: We will see. We will see.

Noelle, thank you very much. Good seeing you.

(LAUGHTER)

NIKPOUR: Thanks. Yes.

CAVUTO: All right, well, the idea behind these tax cuts is that you fill them all out on a single card, right? Well, expecting a refund after filling one of these things out, you might find out something else.

(BEGIN VIDEO CLIP)

UNIDENTIFIED ACTOR: Refund? Refund? Are you crazy? Refund? Refund? Refund?

UNIDENTIFIED ACTOR: Refund?

UNIDENTIFIED ACTOR: Easy. Easy. Easy, Raymond.

UNIDENTIFIED ACTOR: Refund?

(END VIDEO CLIP)

(COMMERCIAL BREAK)

CAVUTO: All right, you're looking live right there on the upper right of your screen there, Four Seasons Hotel, Washington, D.C., Mike Pence expected to speak very soon. Larry Summers is there, the former treasury secretary, not a fan of this treasury secretary, not a fan of this tax cut, says it's a waste of time, going to do more harm than good.

I have a feeling the vice president will slightly disagree.

House Rules Committee meeting tonight to get the tax cut bill ready for a vote on Thursday, the same day the president will come to visit, and maybe twist some arms.

How much that is necessary, well, we will ask the House Budget Committee chair, Tennessee Republican Diane Black.

Chair, very good to have you. Thank you.

REP. DIANE BLACK, R-TENN.: It's great to be with you, Neil.

CAVUTO: All right, so the president is coming Thursday. I suspect the real battle for this is going to be in the Senate, not the House, but your thoughts?

BLACK: Well, we're glad that the president is coming, because we have been working closely with the president and his economic staff to be sure that we do our job and we put forward the president's agenda.

We hope that the Senate is going to do their job this time and be able to put forward the president's agenda as well.

CAVUTO: You know, Chairman, apparently, the Senate is cooking up this plan that will save $300 billion over 10 years or so to remove the individual mandate part of Obamacare, the Affordable Care Act.

The danger with that, even though it might secure some votes, is that it would probably revisit the third rail that caused so much problems for you guys before. Are you OK with that?

BLACK: Well, I was OK with the individual mandate being repealed in our bill that we sent to them. I wish we they had taken that up and we would have got that off the table. It would have been a good thing for the American people.

I'm still hearing this in my district about, if we just get rid of this individual mandate, we can let market can work and rates come down. But, look, if this is what we need to do in order to able to get this done, I think that it is going to be something that will certainly be a discussion worth having.

CAVUTO: All right, so, in other words, that whatever controversy could ensue, it does address a number of math issues for you guys.

BLACK: It does.

CAVUTO: It could mean that the corporate tax cut, which I believe the Senate the delays a year, could be back the way you guys have it next year.

So, that would be probably a plus for you?

BLACK: That would be a real plus. And it would be a real plus for the economy, because we know that, when we can lower those rates, and immediately lower them, we will see a big jolt to the economy.

And in my own home state of Tennessee, it's estimated by the Tax Foundation that there will be 20,000 new jobs created and people will have an additional $2,200 in their pocket from just the creation of these new jobs and the wages rising.

So, this is a big deal in all of our states, but particularly in my state, I'm interested in making sure that the folks in Tennessee are going to benefit by this.

CAVUTO: Chairman, what do your colleagues say who come from high-tax states? And some of them -- obviously, it depends on their districts, understandably.

BLACK: Yes.

CAVUTO: Say that their constituents are still going to get gouged, and they feel that, if the Senate gets its way and removes the deduction entirely for state and local taxes, removes that $10,000 provision that you keep, they would be hard-pressed to vote for it.

BLACK: And it is different in different places in the country.

But we have got to look at this and say, is this an equity issue across our country? So, take, for instance, in the state of Tennessee, where our property taxes are low. But you have another state -- and I won't mention those, because you already know those -- but their property taxes are high. They get a chance to write that off.

It's the federal government then that is subsidizing that, and not the state itself. So, there has to be an incentive in those states to bring those property taxes down, and not put that on the federal bill.

CAVUTO: No, I think you're right about that and the goal here. But I worry that the ones who pay for it up front are those he constituents who, until that is factored out, if it is, are going to end up paying more.

BLACK: Well, and you're right.

We will have to look at this all the way across the line. But those constituents that are in those higher incomes as well do benefit by things like the AMT being repealed and other provisions that are in there.

And remember that what our goal was is to look at those in the middle income and give them the greatest relief. And we have done that in our bill. I'm very proud of the product that we're going to be voting on, on Thursday.

CAVUTO: Real quickly, your thoughts on when. A lot of people have said they want to front-load this in your party ahead of the whole Roy Moore situation, Alabama and the special election, because they don't know where he's going to go, but get it all done before December 12 and that special election.

Doable?

BLACK: Well, I think it's very doable.

And we're going to have our plan come out of our House of Representatives on Thursday. We have good -- we have a good vote total. And we believe that is going to happen. And we will be on a schedule to be able to get this done, if the Senate does their job.

CAVUTO: All right.

Congresswoman, thank you very, very much.

BLACK: Thank you.

CAVUTO: All right.

All right, you ever wonder what the president thinks about all of this?

Why there's only a third-person way of finding out -- after this.

(COMMERCIAL BREAK)

CAVUTO: Nothing but net, that is how I describe what matters most to Americans on this tax cut. Are they going to net more in their paychecks? Are they going to see more in their paychecks?

Sure, filling out your taxes on a postcard sounds great, but not if the taxes you're paying are the same, or, worse, more than they were before.

The way I described it on this show, on my Fox Business show, is that Americans would happily fill out a tax form the size of the Manhattan yellow pages if it guaranteed lower taxes in the end.

Calton emails: "You're exactly right, Cavuto. And if I don't see a bigger paycheck, these guys pay big-time."

Alan in New Rochelle: "All I know is, these Republicans are going to enormous lengths to make sure these numbers work. That is for everyone but me."

Diana via SBC: "Did I hear you say better no tax cuts than this tax cut, Neil?"

Yes, you did, Diana. Something is not always better than nothing, particularly for those come next year if this passes and discover that net gain, well, it won't be much of a gain. Then what?

Sean in New Mexico writes: "Hey, stupido, Cavuto, go suck on it. I don't know about you, but I have seen the tax plan, and I am getting a pretty nice tax cut. You're just jealous and, by the way, a moron."

(LAUGHTER)

CAVUTO: Well, thanks for the added clarification, Sean.

Kevin emails: "Ah, perfect anchorman is upset. Wouldn't it be nice to be Neil Cavuto and not have a worry in the world? No illness, no pain, no real life-and-death issues. Just a silly tax cut to fuss over and whether he was getting one. You should get a clue about the things that matter, helmet head, because" -- I do like the "helmet head."

(LAUGHTER)

CAVUTO: "Because you're taxing my patience with your pathetic tax rant."

Ditto Sandra, who writes via AOL: "Neil, Donald Trump is giving me a tax cut from my medical bills. Do you know what those are? Do you know what medical issues are? Do you know how the not so lucky as you live? Walk awhile in my hospital gown, Cavuto, then lecture me on the things that are important. Let's just say I won't be holding my breath."

So, Sandra, I'm putting you down as a maybe of becoming a premium Cavuto "Your World" member.

(LAUGHTER)

CAVUTO: Not that we have such a thing. But, if we did, I wouldn't invite you.

Professor Thomas writes from Buffalo: "You're fond of quoting other president's tax cuts, such as John Kennedy's, proving you're a flaming lib and a certified Trump hater."

No so, Professor. I have also mentioned Ronald Reagan's tax cuts, as well as the last President Bush's two tax cuts. They were across the board and meaningful, as tax cuts should be to have any lasting impact. Going piecemeal doesn't cut it. And then combining with it zero spending cuts doesn't help it. I'm telling you, this something is nothing. Not worth it. Not cutting it.

Prentice via MSN: "Spoken like a true never-Trumper. It's time to drain the swamp by first draining these onerous tax cuts -- or taxes. Don't you understand, idiot?"

Well, I do, Prentice, but the only thing this package is draining is I.Q. points, probably like your own. It doesn't remotely resemble math, nor do anything substantial to change consumer behavior.

A.T. via AOL: "The problem with you, Cavuto, is you're sour and miserable, always in a bad mood, always criticizing, always finding something bad with anything good. And to think I worried about your health. No offense, but now I wouldn't give a lick if you just up and dropped dead, preferably live on air, so I could clap."

Well, A.T., that hurt my feelings. That really hurt my feelings.

Benita in Tulsa: "If Obama had come up with these tax cuts, you would love them."

Clarence emails: "You're just angry because your master, Trump, didn't cut your taxes, Cavuto. So much for sucking up to the White House."

Amazing. And both of these guys, they're watching the same show!

Val in Macon, Georgia: "News update, grapefruit skull."

Touche.

"Quit pushing your pathetic fake news. These are the biggest tax cuts in history. And that's a fact. Look it up."

Val, I did look it up. Not the grapefruit skull thing, the "this is the biggest tax cut ever" thing. It's not. It's not even close. Hate to break it to you. If you're going by just sheer size and overall cut in rates, Ronald Reagan's were bigger. And if you're going by just the sheer number of Americans getting those cuts, George W. Bush's were bigger.

I have repeated that annoying fact quite a few times on this show, on Fox Business, which really gets Tony's goat.

He emails: "You just love to rip President Trump any chance you can, don't you? What is the matter? Were your little feelings hurt when he passed you up repeatedly for interviews?"

Ditto Karen, who emails: "Just because the president turns down your repeated requests for interviews doesn't give you the right to smear him. He hates you. Deal with it, fatso."

(LAUGHTER)

CAVUTO: The fat thing again.

(LAUGHTER)

CAVUTO: Paul in Brooklyn: "Trump will never talk to you now. He knows who is on his side and who is just fake news. And hate to break it to you, snap-on hair."

What's the deal with the hair?

"You're the fake freak who is lying to the people, not the guy sitting in the White House. And, oh, yes, how is that interview request going?"

It's true. No presidential interview requests into the White House. Not a one. It's true, I swear. I have not asked for a sit-down with the president. I don't want a sit-down with the president.

I know that sounds crazy. That's not because I dislike the president. Remember, I talked to him quite a bit over the years, long before and certainly during the time he was a candidate for president.

I just see little to be gained getting him for the customary 10 minutes now or adding my name to the long and impressive list of people who have already interviewed the president now, including a lot of great people here.

I have learned something from every chat. I'm just not interested in joining the chat, again, not because I don't cover the president. Maybe because I can just as effectively do that without interviewing the president. Maybe that's because the one thing I have learned about interviewing presidents is, time is tight.

And Republican or Democrat, they're pretty good at running out the clock. That doesn't mean sit-downs with presidents don't add value, just that my sitting down with this one probably would not.

Now, some of you say it's a good thing I don't ask because it would save the president the trouble of turning me down. There's probably some truth to that, because, even as he was running for president, Mr. Trump wasn't exactly a fan of mine, especially when my coverage veered from what he liked, like when I had Mitt Romney on during the heat of the campaign, and the former governor let him have it.

(BEGIN VIDEO CLIP)

MITT ROMNEY, R-FORMER PRESIDENTIAL CANDIDATE: I cannot in good conscience vote for a person who has been as degrading and disruptive and unhinged.

(END VIDEO CLIP)

CAVUTO: My questioning months later President Trump's treatment of his own Cabinet officials and later Republican senators probably didn't help.

(BEGIN VIDEO CLIP)

CAVUTO: Pointing the finger at your team only invites them to point a very different finger back at you.

Who would have your back if you keep kicking the guys on your side in the ass?

(END VIDEO CLIP)

CAVUTO: Or maybe it was the time I pointed out the president can't demand loyalty from others if he doesn't show loyalty himself.

(BEGIN VIDEO CLIP)

CAVUTO: Loyalty works both ways, Mr. President. And whether you think you're justified or not, punching down ain't exactly helping you punch through.

(END VIDEO CLIP)

CAVUTO: Or when I tried to separate fake news from merely news the president doesn't like.

(BEGIN VIDEO CLIP)

CAVUTO: Mr. President, it is not the fake news media that is your problem. It's you. It's not just your tweeting. It's your scapegoating.

It's your refusal to see that, sometimes, you're the one who is feeding your own beast.

(END VIDEO CLIP)

CAVUTO: I guess that's not the way to secure an interview with the president, even if I also was reporting on good things happening under the president, the market surge.

(BEGIN VIDEO CLIP)

CAVUTO: Now, this is just looking at the first 100 days. He's right up there with other presidents, of course, in the first 100 days, coming from already heady levels, though.

Now, this does not take into account, if you really want to look at everything here, the roughly 14 percent gain he has experienced and the markets have experienced since he was first elected.

We have got $4 trillion added to market value.

Why those markets are up in the first place, that they're optimistic that this president will goose the economy.

On this day, we scored a 51st record close for the Dow and the year, more than any other full year in history.

(END VIDEO CLIP)

CAVUTO: You get the idea, fair stuff and balanced stuff, the regulation purge, the stuff that Wall Street liked, even as I reported on the personal behavior and emotional outbursts it did not.

Not the way to win friends in the White House, but the only way I know to cover the White House, yes, even if it means never getting an interview with this president, and, yes, even if it means never even asking for one in the first place.

Good night.

Content and Programming Copyright 2017 Fox News Network, LLC. ALL RIGHTS RESERVED. Copyright 2017 CQ-Roll Call, Inc. All materials herein are protected by United States copyright law and may not be reproduced, distributed, transmitted, displayed, published or broadcast without the prior written permission of CQ-Roll Call. You may not alter or remove any trademark, copyright or other notice from copies of the content.