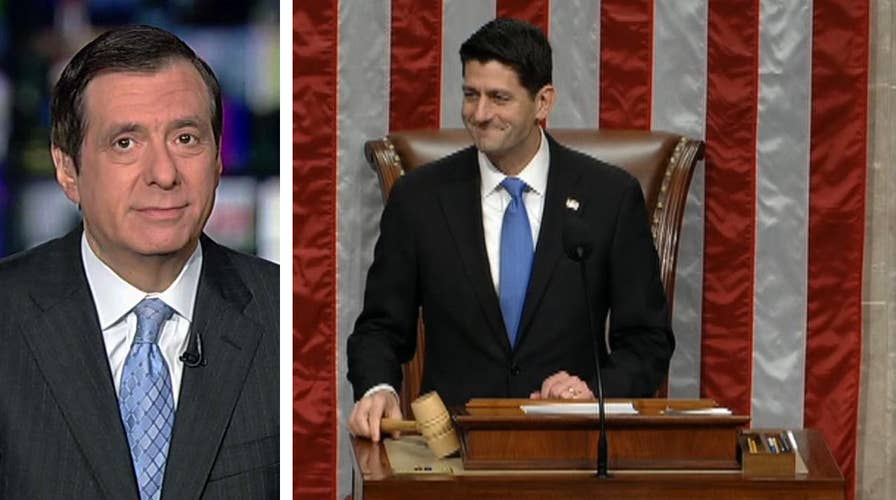

Kurtz: Will an unpopular tax bill get more popular?

'MediaBuzz' host Howard Kurtz weighs in on why Trump’s tax reform triumph isn't matched by public enthusiasm.

After a long political drought on Capitol Hill, tax reform is a big win for President Trump, no question about it.

So why isn’t there a celebratory mood?

The legislation, passed by both the House and Senate yesterday, has been so widely disparaged, by opponents and many in the media, that it just isn’t very popular with the public. (The House will revote today because of a rules glitch.)

In a USA Today poll, 32 percent support the bill, 48 percent oppose it.

In a CNN poll, 33 percent support the bill, 55 percent oppose it.

In a Wall Street Journal/NBC poll yesterday, 24 percent say it is a good idea, 41 percent say it’s a bad one.

And many surveys echo one by the New York Times and Survey Monkey, that only a third of Americans expect their taxes to go down.

Now the numbers reflect some undeniable partisanship. A majority of Republicans support the measure, which makes sense because it is passing only with GOP votes. It’s no surprise that Democrats and some independents who don’t like Trump don’t think much of his tax bill, either.

The pounding by the press focuses on the fact that the lion’s share of benefits go to corporations and that some middle-class families, especially in high-tax states, will pay more, either now or in the future. Even some in the top 5 percent aren’t happy, as reflected in this Times column: “Tax Cuts Benefit the Ultra Rich, but Not the Merely Rich.”

A Wall Street Journal headline: “Middle Class to Get 23% of Tax Cuts for Individuals Under GOP Bill.”

The street obviously likes the tax cuts because the market has continued to climb, now gaining 5,000 points during Trump’s tenure to finish yesterday at 24,754.

The bill’s image got scuffed a bit by what is being called, somewhat unfairly, the Corker Kickback (a play on the Cornhusker Kickback used to pass ObamaCare). After Sen. Bob Corker flipped from no to yes, it was revealed that Orrin Hatch had added a big fat break for real estate profits—and Corker is a Tennessee developer who would benefit (along with another prominent Republican).

Thus, a Times editorial is headlined “Tax Bill Lets Trump and Republicans Feather Their Own Nests.”

At yesterday’s White House briefing, NBC’s Hallie Jackson said: “You’re getting a lot of questions what will benefit the president, what won’t benefit the president. I get he doesn’t want to release taxes. That would obviously put all of these questions to rest.” Sarah Huckabee Sanders repeated the standard answer that Trump remains under audit.

Whatever the sniping back and forth over tax reform—which is normal in a bill so complicated—public sentiment may change over time. ObamaCare, having survived years of Republican criticism and Trump’s attempt to repeal it, is above 50 percent approval for the first time.

If the measure delivers real tax relief to enough Americans—and the corporate cuts keep the economic expansion going—the bill could rise in popularity. And if not, the Republicans will face some heavy lifting in 2018.