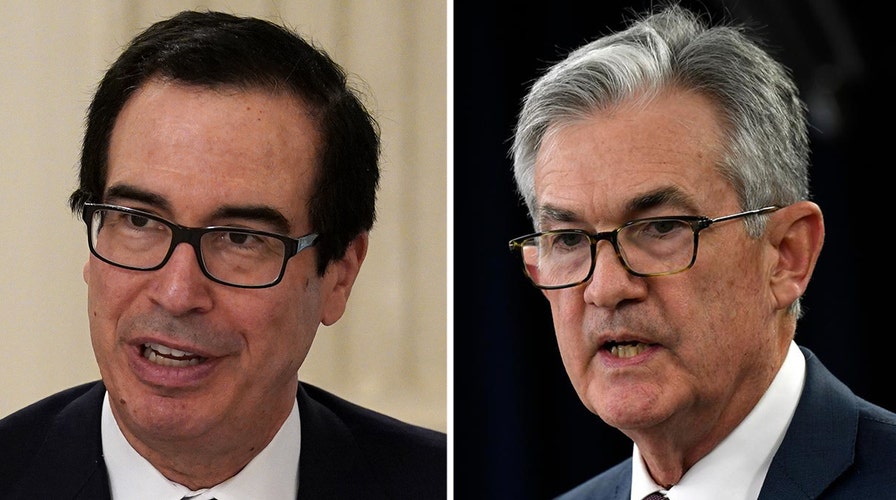

Mnuchin, Powell to face tough questions from Congress on economic response to COVID-19

Treasury Secretary Steve Mnuchin and Federal Reserve Chairman Jerome Powell are set to testify on the CARES Act before the Senate Banking Committee; Chad Pergram reports.

The Treasury Department is defending its decision to protect information about businesses that received Paycheck Protection Program loans amid the coronavirus pandemic, citing small business privacy concerns.

Congressional Democrats have called on the Treasury Department and the Small Business Administration to release more information about the nearly 4.6 million recipients of PPP loans and grants, including the amount of money each small business received from the program -- despite applications for the funds telling would-be recipients that their information would be kept private.

Most recently, Rep. Jennifer Wexton, D-Va., on Wednesday morning, led 34 Democratic colleagues in a letter to Treasury Secretary Steven Mnuchin and SBA Administrator Jovita Carranza urging "the immediate disclosure" of information on PPP loans distributed to businesses with multiple employees and seeking "to require the collection of demographic data in all new PPP loan applications and PPP loan forgiveness applications."

"Secretary Mnuchin has indicated that he is in support of ‘proper oversight’ of the PPP program, and this is what we believe proper oversight entails -- full transparency of the recipients, amounts, and dates of distribution of the hundreds of billions of dollars of taxpayer funds and the collection and publication of demographic data,” Wexton wrote Wednesday. "We cannot allow the administration to distribute more than $500 billion in secret -- taxpayers deserve to know where their money is going, and that means full disclosure of PPP loans, not just those above a certain threshold."

Last week, Senate Minority Leader Chuck Schumer, D-N.Y., slammed Mnuchin for not disclosing the names of PPP recipients, saying it raised "further suspicions about how the funds are being distributed and who is actually benefiting.”

And earlier this month, Senate Small Business Committee Chairman Marco Rubio, R-Fla., and Sen Ben Cardin, the committee’s top Democrat, also requested that the Trump administration release the names and other details of PPP loan recipients.

But Mnuchin testified last week on Capitol Hill that there could be confidential and proprietary information included in the applications.

A Treasury Department official told Fox News this week that Mnuchin is willing to work on a bipartisan basis with members to achieve balance and ensure the appropriate level of transparency.

“The notion that the administration is hiding something is false,” a Treasury Department spokesman told Fox News. “We have already released more information than the CARES Act requires, and will continue to implement the programs with transparency. ... The secretary’s point is that loan level data with identifying information would risk disclosing proprietary data of millions of small businesses and the salaries of sole proprietors and independent contractors.”

The spokesman added: “We are fully committed to transparency while protecting sensitive information.”

Separately, House Majority Whip James Clyburn, D-S.C., earlier this week penned a letter to eight national banks seeking documents and information on the disbursement of funds under the PPP.

“The Administration should release the names of all PPP borrowers—as the SBA routinely does for similar loan programs,” Clyburn wrote, in a letter also signed by Reps. Maxine Waters, D-Calif.; Carolyn Maloney, D-N.Y.; Nydia Velazquez, D-N.Y.; Bill Foster, D-Ill.; Jamie Raskin, D-Md.; and Andy Kim, D-N.J. “Contrary to Secretary Mnuchin’s recent testimony, there is nothing ‘proprietary’ or ‘confidential’ about a business receiving millions of dollars appropriated by Congress, and taxpayers deserve to know how their money is being spent.”

Interest in which companies are receiving the funds was heightened following a Politico report that a group of four lawmakers—including Democrats and Republicans—have acknowledged being associated with companies that have received PPP loans. The businesses, according to Politico, are either run by the lawmakers’ families, or have their spouses in senior positions.

But a Treasury official told Fox News that PPP loans are different than other loans issued by the Small Business Administration, because those PPP loans (which can become grants if certain conditions are met) are calculated from a business’ payroll, and noted that making all the applications public would publish small business owners’ personal income, which the official described as “very invasive.”

Clyburn did not specifically call for publishing applications but sought a "complete list" of the applications and requested extensive information from them.

The official also told Fox News that, according to loan approvals as of June 12, more than 85 percent of loans were for less than $150,000, while only 1.7 percent were for more than $1 million. The official said that the average PPP loan amount is $112,000.

Rubio, who initially pushed for all information surrounding PPP loans and recipients to be made public, pointed out during an interview on CNN last week that he has heard concerns from small business owners that releasing that information could put them at a "competitive disadvantage."

“If you’re a small business, this is about payroll. And so people are going to be able to tell how much your payroll is based on your loan amount,” Rubio said. “In essence, you know your competitors can figure out how much their competitor somewhere else in the country is making and sort of either poach employees or undercut their own.”

On Wednesday, Rubio spokesman Nick Iacovella said in a statement: "Chairman Rubio plants to work closely with SBA and Treasury to ensure enough data is disclosed about the program to determine its effectiveness and ensure there is adequate transparency without compromising borrowers' proprietary information."

WHITE HOUSE SAYS PAYROLL TAX CUT FOR EMPLOYEES COULD COME IN PHASE 4 STIMULUS PACKAGE

The PPP was created as part of the more than $2.2 trillion “Phase 3” stimulus package, known as the CARES Act. It ran out of funding in early April, spurring Congress to pass the “Phase 3.5” relief package to replenish the funds.

Earlier this month, President Trump also signed into law bipartisan legislation giving small business owners who tapped the federal aid program more flexibility in how they spend the loans, the latest effort by the federal government to blunt the economic pain of the coronavirus pandemic.

The new law, the Paycheck Protection Program Flexibility Act, eases the restrictions on how the money must be spent in order to be forgiven. Loan recipients now only have to spend 60 percent of the aid on maintaining payroll — including salary, health insurance, leave and severance pay — rather than the previous 75 percent rule. The remaining 40 percent can go toward operating costs like rent and utilities.

Businesses now have 24 weeks to spend the money instead of two months. The bill also lets small businesses that accessed the fund defer payroll taxes.

Fox Business Network's Megan Henney contributed to this report.