Rep. Espaillat calls for investigation after small businesses failed to get assistance

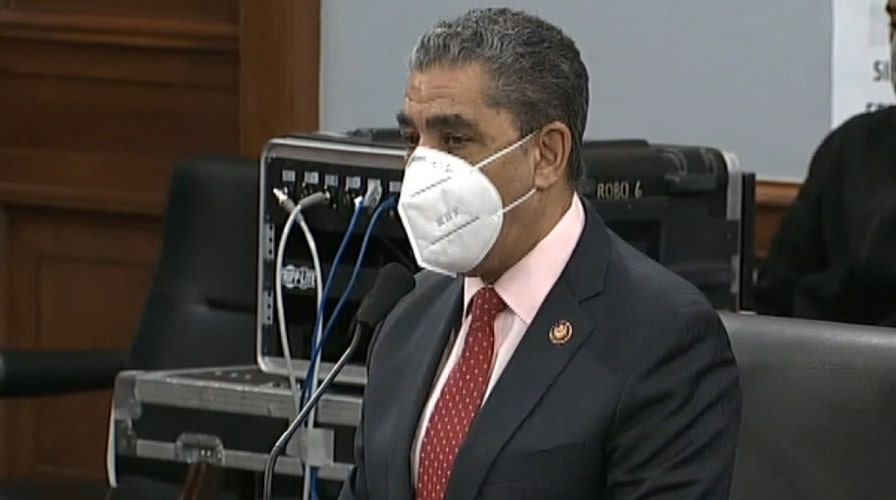

New York Rep. Adriano Espaillat delivers impassioned statement during House Small Business Committee hearing calling for Main Street to be bailed out.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

The House Small Business Committee on Thursday examined the difficulties small businesses have faced during the economic crisis caused by the coronavirus pandemic -- particularly how failures in the implementation of the CARES Act's Paycheck Protection Program led to many being unable to acquire forgivable loans before the pool of money ran out.

While restaurant chains such as Shake Shack were able to acquire millions of dollars in loans from the program, many small local businesses were left empty-handed. Rep. Adriano Espaillat, D-N.Y., recalled speaking to constituents who hoped for assistance and received nothing, as he hammered the system and called for an investigation.

PELOSI ACCUSES MCCONNELL, GOP OF HOLDING UP CORONAVIRUS FUNDS

“They got tricked! They got led astray! They got bamboozled! And they are, respectfully, Madam Chair, mad as hell," Espaillat said. "I am mad as hell!”

The New York Democrat who represents Upper Manhattan and part of the Bronx said he could "literally count on one hand" the small business owners who did get help under the CARES Act. He blamed this on improper use of the program and called for those responsible to be held accountable.

"This is a major problem. It is absolutely not how any of intended for this program to work," he said. "The actors who perpetrated this must be investigated and they must face consequences.”

The meeting came ahead of a full House vote on another stimulus bill that would provide additional funds to keep the program going so more businesses could apply.

CLICK HERE TO GET THE FOX NEWS APP

Espaillat suggested that moving forward, more local lenders should be allowed to participate so that business owners who do not have relationships with larger financial institutions can get help.

"We must do better," he said. "We must bail out Main Street!”