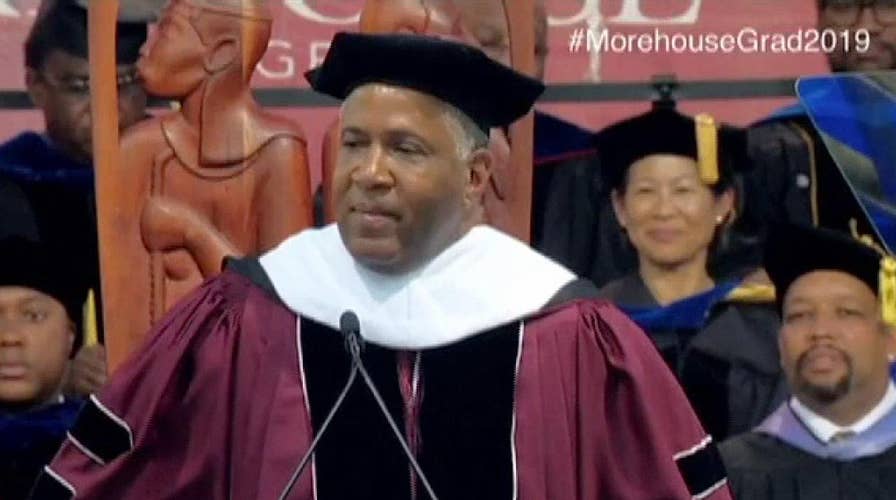

Billionaire picks up student loan tab for graduating class of Morehouse College

Technology billionaire Robert F. Smith's gift comes with a challenge: pay it forward; Jonathan Serrie reports from Atlanta.

The saying, "No good deed goes unpunished," remains an unfortunate reality for Robert F. Smith. Just a few weeks after the announcement that he, most generously, would pay off all student loan debt belonging to Morehouse College’s graduating class, the billionaire is receiving backlash from the self-appointed intellectual elites over at The New York Times.

“An affordable college education should not require an act of largess,” writes The Times Editorial Board. “It should not require our applause. It merely requires adequate public investment, funded by equitable taxation.”

It appears a couple of those writers are just a teensy-bit angry they had to pay for their overpriced journalism degrees. Join the club! It stinks. That doesn’t mean you spout off like a spoiled brat because a man helped 396 young men at Morehouse with an estimated $40 million gift. Now, to be fair, they did credit Smith’s expenditure as “generous” to those graduates — only to deliver a nasty right hook a sentence later.

"Their gratitude underscores the reality that hundreds of thousands of other members of the class of 2019 will be carrying unrelieved burdens of debt as they begin their adult lives," the Times wrote.

Taxation is rarely the answer, particularly when it comes to financing education. Even if there is a “free-college for all” utopia that somehow comes to fruition, there’s no guarantee that money won’t be wasted on bureaucratic nonsense.

So now Smith, just one man, should be guilt-shamed because he didn’t pay for the rest of 2019’s debt. Newsflash: Every class, particularly those graduating during and after the recession in 2008 have enormous student loan debt. Recently, the White House estimated that for my class, students who started college in 2004, 40 percent are projected to default on their student loans by 2023. Yes, this is a massive problem unchecked and steamrolling ahead that has and will obliterate the credit of a generation.

We need more individuals to step up and man-up. (Undoubtedly, a critic will lambast the lack of “intersectionality” of that expression. Too bad.) A tide of debt is engulfing America's youth.

The most aggravating issue when you try to explain college debt to Boomers? Nine times out of 10, they’ll respond with some variation of, "If you can't afford it, don't go to college. We didn't." Then please explain why your generation set up an American economy that relies so heavily on a caste system of education.

There are also those who belong to younger generations who immediately shut down any chance of substantive talks about student debt. It becomes the classic, selfish have or have-not debate.

"Go to a state school. I did."

"Who needs a fancy education? Just go to work first and save."

One answer to that question? Doctors. The men and women administering medicine and saving our lives. They need a fancy education. Their employment options rely on extensive schooling, similar to lawyers reliant on expensive post-graduate degrees.

Often the "best" schools cost more money. Should a student turn down acceptance into George Washington Law (ranked 22nd in the nation according to U.S. News & World Report) because it costs too much? The better the school, the better the law firm, and hence the more lucrative long-term career earnings. But we simultaneously straddle those students in never-ending interest payments because they dared excel.

If you refuse to recognize there’s a problem, you've turned your back on the prosperity of your peers and your country. We’ve seen government bailouts for the banking and housing markets, and that’s where we’re headed if we fail to figure out a solution to education debt.

Lower the federal interest rates first. Delineate the power of these money-making admissions and university front offices and push for programs that advocate different paths, like trade schools, when needed. The New York Times can rail as much as it wants on taxation loopholes and how Smith benefited from that with his private equity firm, but the bottom line is this: Smith donated big-time on his own.

CLICK HERE TO GET THE FOX NEWS APP

Taxation is rarely the answer, particularly when it comes to financing education. Even if there is a “free-college for all” utopia that somehow comes to fruition, there’s no guarantee that money won’t be wasted on bureaucratic nonsense.

Encourage the private sector as Robert F. Smith so magnanimously did with his contribution. Individuals giving back, with incentives to do so, will continue to feed a pay-it-back system. And lay off the hater-ade. Smith is the hero, not the villain, in this story.