CNN reported Monday that 72% of economists believe the U.S. is already in a recession or will soon will enter one. This news, which marks a contrast from the network's attempts to present the economy as being strong, was delivered by reporter Matt Egan during "CNN Newsroom With Ana Cabrera."

Egan cited a survey that was conducted by the National Association of Business Economics. "There is a lot of pessimism in this survey," he said.

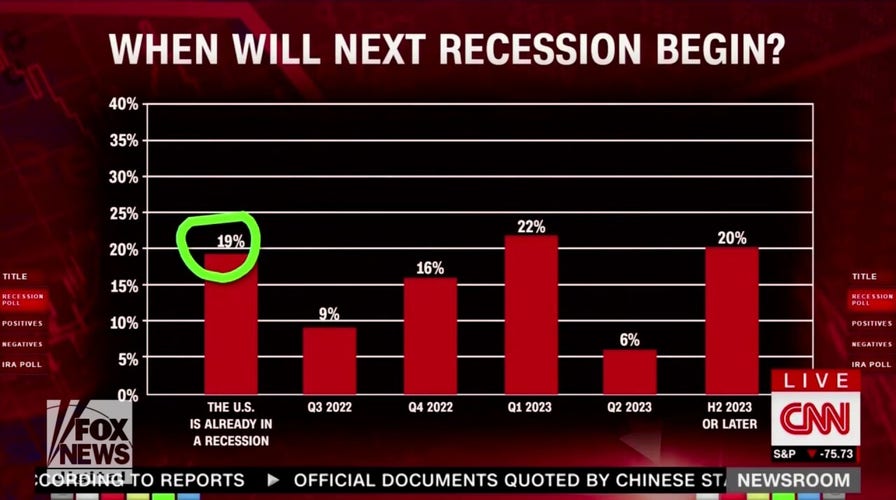

"[C]heck this out, 19% say the U.S. economy is already in a recession. That is the staggering figure. Also, a whole bunch more think in the next few quarters, you add this up, that's 53%," he continued.

MOST VOTERS BELIEVE US ECONOMY IS CURRENTLY IN RECESSION, ACCORDING TO NEW POLL

Economic data revealed on Thursday showed two-consecutive quarters of negative gross domestic product (GDP) growth, which has long been the measure that determines whether the U.S. is in a recession. (Fox News)

Egan noted, "Together, 72% say the U.S. economy is either in a recession or headed there very soon."

He alerted viewers that it is "not just economists worried [but] investors, too."

The CNN reporter also pointed to "paychecks shrinking" as a result of inflation - people can buy less with their same salary.

J.P. Morgan strategists predict the Federal Reserve will raise interest rates by another 0.75 percent in September, a move intended to bring down inflation to two percent, the inflation target set out for the Fed by Congress. In July, prices rose 8.5 percent compared to the previous year.

GEORGE SOROS, OTHER BILLIONAIRES FLOOD SCHUMER'S SUPER PAC WITH MILLIONS TO SAVE SENATE MAJORITY

U.S. President Joe Biden (C) meets with Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen, in the Oval Office at the White House on May 31, 2022 in Washington, DC. The three met to discuss the Biden Administration's plan to combat record-high inflation. (Photo by Kevin Dietsch/Getty Images)

While higher interest rates are intended to reduce inflation, they do so by reducing spending and making borrowing more expansive. Hence, as the interest rates on mortgages have gone up, the prices of homes have gone down. This is because it is more difficult for consumers to borrow mortgages, driving down demand and prices.

Many also blame American and European leaders' long term climate agenda - which limited the domestic production of oil - for elevated gas and electricity bills.

WASHINGTON, DC - NOVEMBER 30: U.S. Treasury Secretary Janet Yellen (L) and Federal Reserve Board Chairman Jerome Powell (R) testify during a hearing before Senate Banking, Housing and Urban Affairs Committee on Capitol Hill November 30, 2021 in Washington, DC. The committee held a hearing on "CARES (Coronavirus Aid, Relief, and Economic Security) Act Oversight of Treasury and the Federal Reserve: Building a Resilient Economy." (Photo by Alex Wong/Getty Images) (Photo by Alex Wong/Getty Images)

CLICK HERE TO GET THE FOX NEWS APP

It was announced in July that the United States experienced two back to back quarters of negative GDP growth, the definition of a recession.