What happened in Niceville, Fla., was mean.

One or more very professional, coordinated computer hackers tapped into the records of nearly 300,000 students and employees at Northwest Florida State College, stealing names, birth dates, Social Security numbers and bank account data.

So far, close to 100 employees at the college had their bank accounts depleted of hundreds of dollars each.

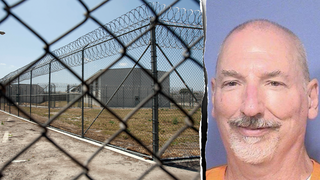

Dr. Ty Handy, who has made a career advising young people about the rights and wrongs of life, is one of the victims. He’s also the college president. And after discovering a $600 withdrawal from his back account, he discovered exactly how the cyber thieves are stealing the money.

“The more common mechanism is to go through a loan company and to secure a loan and to have that loan payment come directly out of the bank account,” says Handy. “And that’s how I was hit.”

The U.S. Secret Service and FBI are now assisting cyber crime detectives in Florida, which, according to the Federal Trade Commission, ranks No.1 among the states when it comes to identity fraud. So far, no suspects have been identified, but investigators say they’re impressed with the skill the hacker or hackers employed.

Earlier this year, the hackers secretly tapped into the college’s server, holding numerous files. The criminals then pieced together bits of personal data from multiple files to put together false “quicky” loan applications. Then, the hacker or hackers had the loan amount automatically deducted from the victim’s bank account into quick cash.

The potential number of victims is in the hundreds of thousands, and many of the victims, ranging in age from the late teens to mid 20s, may not be victimized for months or years.

About 200,000 of the records breached were from Florida’s Bright Futures program, which aids students who earned scholarship money through high GPAs and test scores. About 76,000 records are of current and former NWFSC students and 3,000 college employees.

“As a student here, that does really scare me because I do get financial aid,” says one student. “The fact that we don’t know where it’s coming from – my teacher said it could be coming from like Russia for all we know,” says another.

So far, those close to this burgeoning investigation say leads are taking them to computers used in the U.S. Southwest.

Experts in cyber Fraud and ID fraud warn: If you haven’t been victimized by this growing type of crime yet, the odds are one day you will be.

In 2011, there were 12 million victims of identity theft in the U.S., a 13 percent jump from the previous year, according to Javelin Strategy and Research.

And the cost, according to the Bureau of Justice Statistics, is about $8.5 billion a year.

The best advice: check your bank account online often. That’s what Dr. Handy did. His bank restored the lost $600 to his account, but he then had to spend hours working through the process of changing all of his financial accounts. His name, birth date and Social Security number, though, remain in the wrong hands.