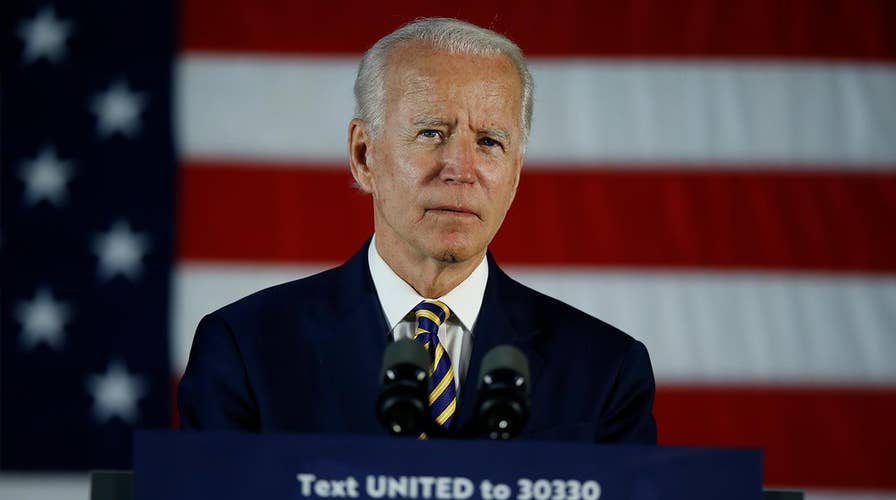

Raising taxes, regulations is ‘extraordinary flaw’ in Biden economic recovery plan: Dan Henninger

The Wall Street Journal Editorial Page deputy editor Dan Henninger argues presumptive Democratic candidate Joe Biden’s proposed economic growth plans would hit economic growth and job creation.

After a three-month delay, it’s officially Tax Day for all Americans.

This year, as a result of the coronavirus pandemic, the IRS extended the traditional tax-filing deadline from April 15 to July 15.

By shifting the deadline, the federal government allowed individuals and businesses to hold onto their cash longer as they dealt with the fallout from the virus outbreak. The three-month delay injected about $300 billion of liquidity into the economy, according to Treasury Secretary Steven Mnuchin.

Taxpayers must file or seek an extension by today — or face a financial penalty.

IRS, TAXPAYERS FACE HOST OF CHALLENGES AHEAD OF JULY 15 DEADLINE

As of June 26, the IRS had processed about 128.5 million returns, down 10.6 percent from last year. By comparison, it had received about 140 million returns, a drop of just 3.5 percent from the same time last year. The agency has issued roughly 93 million refunds so far, down 10.3 percent from this point in 2019.

If you haven’t filed yet, here’s what you need to know:

Taxpayers can request an extension until Oct. 15

If you haven’t filed your taxes yet, don’t worry — there’s still time to request an extension to Oct. 15. If you’re an individual, you can file for an extension online by filling out Form 4868 using the IRS’s “Free File” tool. The form requires an estimate of your tax liability.

However, if you owe taxes to the federal government, payments are still due on July 15. The IRS offers some payment plans to individuals who are unable to pay their taxes in full. The more you pay by July 15, the less interest and penalty charges you’ll owe.

You should file your taxes online if possible

Filing your taxes electronically is the fastest way to get a refund, according to the IRS, especially as the agency works its way through a backlog of paper returns that built up during its closure earlier this year in response to the pandemic.

The agency issues nine out of 10 refunds in less than 21 days. In 2018, about 90 percent of taxpayers filed their returns online.

However, some Americans are discovering they have no choice but to file a paper return for 2019 — a bug caused by their use of the "Non-Filers" stimulus check tool on the Internal Revenue Service's website.

JULY TAXPAYERS COULD FACE THIS IRS GLITCH - WHAT YOU NEED TO KNOW

"If you used the IRS non-filer tool or filed a return with $0 or $1 of income, then you need to file a new tax return by U.S. mail instead of electronically with “Amended EIP Return” written or printed at the top," H&R Block said in an alert posted to its website on Friday.

Your refund might be delayed

The IRS is dealing with a backlog of paper returns after the closure of its offices nationwide during the pandemic. Although the agency continued to process electronic returns and issued refunds via direct deposits, unopened paper returns piled up.

MILLIONS OF TAXPAYERS AWAITING REFUNDS FROM IRS COULD FACE 'EXTREME DELAYS'

IRS Commissioner Charles Rettig told lawmakers at the beginning of July that the agency had about 12.3 million pieces of mail, some of which included paper returns, to sort through. He said the IRS is processing roughly 1 million paper returns a week.

Taxpayers who filed before the April deadline in hopes of receiving a refund, have experienced lengthy delays in receiving their money, according to a recent report to Congress.

But the refund may also be bigger than expected

The IRS said it would pay interest on delayed refunds. Taxpayers with a refund issue date between April 15 and June 30 earn an annual interest rate of 5 percent, while refunds issued between July 1 and Sept. 30 earn an annual interest rate of 3 percent, the IRS said.

LAST-MINUTE TAX FILERS COULD RECEIVE SURPRISE IRS BONUS

Like it charges interest when taxpayers don’t pay on time, the IRS also pays interest to taxpayers when the government issues refunds too slowly. The decision stems from a quirk in the tax code and in the way the filing deadline was extended, according to The Wall Street Journal.

There’s still time to contribute to your IRA

The deadline for Americans to make contributions to their IRA for 2019 is July 15. The maximum annual contribution for traditional and Roth IRAs for most Americans is $6,000. If you're over the age of 50, you can add an additional $1,000.

CONTRIBUTING TO YOUR IRA BEFORE TAX DEADLINE? THESE ARE THE BENEFITS

Traditional IRA contributions may be tax-deductible – withdrawals are typically taxable – although there are several complicating factors, including income limits and whether you or your spouse are covered by a workplace retirement plan.

CLICK HERE FOR THE FOX NEWS APP

For instance, your deduction may be limited if you or your spouse are covered by a retirement plan at work and your income exceeds certain levels. But your deduction is allowed in full if you aren't covered by a retirement plan at work, according to the IRS.