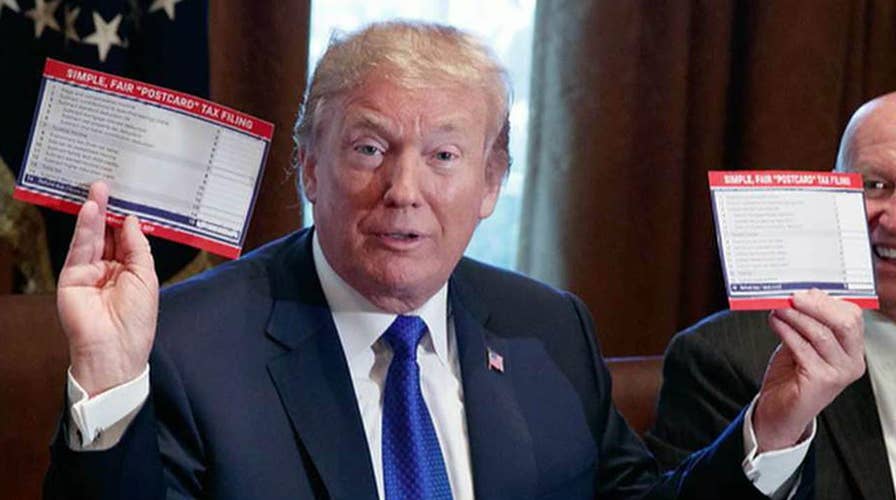

Trump visiting Capitol Hill ahead of tax reform vote

Griff Jenkins reports from Washington, D.C.

“It’s almost like a mirage,” said one senior House Republican aide. “We were just waiting for people to throw sand in the gears.”

There’s not much fretting from House Republicans about passing their tax bill Thursday.

Republicans are hardly breaking a sweat when it comes to the vote tally. President Trump even travels to the Capitol midday Thursday to talk about the bill with House Republicans. But the president won’t be a “closer.” The deal may already be “closed.” Instead, Trump’s visit may be a pep rally. A festival of appreciation and gratitude.

This pales compared to the various health care fire drills in March, April and May. The House Republican leadership yanked a measure to repeal and replace ObamaCare off the floor in March. The House finally eked out a win, narrowly nudging a revamped measure to passage in May.

Tax reform appears to be a little different. At least the initial version …

Fox News is told the House clearly has 218 votes to pass the bill. That’s the threshold for approval if all members are present and voting. The House currently has 434 members: 240 Republicans and 194 Democrats. There is one vacancy: Former Rep Tim Murphy, R-Pa., who resigned. That means Republicans can only lose 22 votes on their side of the aisle without facing problems. Twenty-three Republican nays would produce a tie. By rule, ties lose in the House. The GOP lost 20 votes in October on the budget framework for tax reform. So, there’s not much margin for error.

How many votes might Republicans get for tax reform? Fox News was waved off a suggestion that Republicans could hit 230 yeas. The more likely target is in the low 220’s.

Democrats expect at least one absence: Rep. Mark Pocan, D-Wis., who is recovering from heart surgery. Also, Rep. Jim Bridenstine, R-Okla., has refrained from voting of late. Trump nominated him to be NASA Administrator. Bridenstine awaits Senate confirmation.

Fox News is also not expecting any Democrats to vote yes. Several moderate and conservative Democrats signaled two weeks ago they could vote yes if it looked like it may pass. But those Democrats tell Fox News they can’t support this version.

Surprises? Senior House Republican sources say they’re a little surprised at how smoothly things have gone. The Ways and Means Committee advanced a bill last week. The GOP leadership whipped that plan Monday night. Now, it’s on the House floor and likely to pass.

It’s rare for legislation of this magnitude to come out of committee and not face alterations in either the leadership suite or before the House Rules Committee. Let’s say the GOP was short on votes. It’s likely the Rules panel would have made a few amendments in order when the legislation hit the floor. GOP leaders would have believed those amendments could alter the package in a way to court reluctant members to vote yes. In other words, the GOP brass would attempt to contour the bill in a way that was palatable for reluctant members to switch their ballots to yes.

There was chatter a few days ago about the House adding elements to satisfy New York and New Jersey members about the elimination of state and local taxes. There was also discussion about tacking on a repeal of the ObamaCare individual mandate. The Senate Finance Committee already latched the individual mandate repeal to that still-unfinished plan. But such a maneuver may have cost the House GOP votes. Moderate Republicans from the “Tuesday Group” would balk. That may have dropped the GOP vote tally below the magical number of 218.

“It’s eerie how quiet it is,” said one Republican source. “Almost no drama.”

Perhaps that’s because the real tax reform spectacle will unfold in the United States Senate.

There’s plenty of drama across the Capitol Rotunda.

The Senate Finance Committee is still crafting its tax reform bill in a markup session. Senate Finance Committee Chairman Orrin Hatch, R-Utah, elected to drop the ObamaCare individual mandate repeal into that package.

Remember, moving a health care bill stymied the Senate in June, July and September. But here’s the weird part: some Republicans argue the individual mandate repeal bolsters the Senate plan – even though the GOP struggled with health care. Including the repeal could help – if for no other reason than that the Senate stumbled in adopting a health care bill. However, it’s far from clear to see how Senate health care skeptics would receive the new provision.

But there’s lots of time for the Senate to grapple with tax reform. Senate Majority Leader Mitch McConnell, R-Ky., doesn’t intend to launch that floor debate until the week after Thanksgiving. The real battle will begin if the House and Senate both manage to approve tax bills. It will be a challenge to blend them into a single, comprehensive package which Trump can sign into law.

Back in the House, there’s some drama from Republicans representing high tax districts. Several New York and New Jersey Republicans are apoplectic about how the tax bill could adversely hit their districts.

“We could lose all the seats in the northeast,” argued Rep. Pete King, R-N.Y., one of the most ardent opponents of the legislation. “This is an unforced error. We’re doing this to ourselves.”

Think the bill is bereft of drama? Maybe it won’t materialize until the midterm elections a year from now.

“Speaker Ryan is about to brand them with a huge, middle income, suburban tax hike,” said House Minority Leader Nancy Pelosi, D-Calif. “[If] they vote for this bill, there will be a political price to pay.”

But for now, it’s quiet. As the aide said, almost eerie.

Capitol Attitude is a weekly column written by members of the Fox News Capitol Hill team. Their articles take you inside the halls of Congress, and cover the spectrum of policy issues being introduced, debated and voted on there.