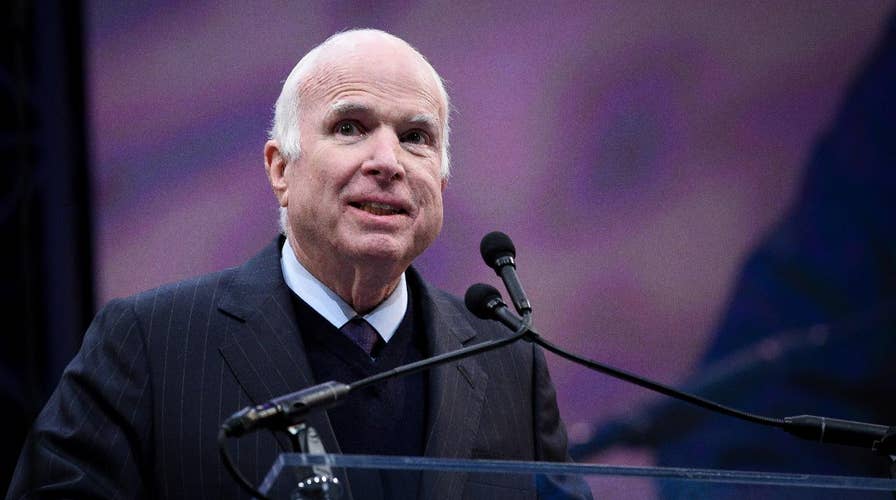

John McCain blasts nationalism when accepting Liberty Medal

John McCain (R., Ariz.) blasts 'half-baked, spurious nationalism' while accepting the Liberty Medal, which honors service and sacrifice to the country. Many speculate it was a harsh critique of the Trump administration.

Republican Sen. John McCain announced his support Thursday for the Senate tax reform bill, boosting the chances for passage of the sweeping legislation as it faces a likely final vote within hours.

“After careful thought and consideration, I have decided to support the Senate tax reform bill," the Arizona senator said in a statement. "I believe this legislation, though far from perfect, would enhance American competitiveness, boost the economy, and provide long-overdue tax relief for middle-class families.”

Republicans only have two votes to spare in the Senate, where they hold a 52-48 edge. Vice President Pence would break a tie, if needed.

McCain had not yet backed the overhaul and he has been thought to be a key vote in the effort to pass the tax bill.

Other Republicans who have not publicly said whether they will vote for the final bill include Steve Daines of Montana; Ron Johnson of Wisconsin; Susan Collins of Maine; Bob Corker of Tennessee; Jeff Flake of Arizona; Jerry Moran of Kansas and Marco Rubio of Florida.

On Thursday, even as he announced his support, McCain expressed concerns about the bill, including its impact on the deficit. Still, he said he believes the bill's "net effect on our economy would be positive."

"This is not a perfect bill, but it is one that would deliver much-needed reform to our tax code, grow the economy, and help Americans keep more of their hard-earned money,” McCain said.

The tax overhaul cleared a key procedural hurdle in the Senate on Wednesday on a 52-48 party-line vote, allowing senators to start debate on the legislation.

Ahead of the floor vote, President Trump traveled to Missouri to rally support for the bill -- and pressure Congress.

SENATE TAKES UP TAX REFORM: HERE'S WHAT THE PLAN LOOKS LIKE

“Now comes the moment of truth,” the president said during a rally in St. Louis. “In the coming days, the American people will learn which politicians are part of the swamp and which politicians want to drain the swamp.”

As it stands, the Senate’s tax overhaul plan is different from the House’s version. The two chambers would need to come together on a unified piece of legislation to advance to Trump’s desk.

Under the Senate bill, the standard deduction – which reduces the amount of income that is taxed – would increase to $12,000 for individual filers and $24,000 for married couples.

When it comes to reducing the corporate tax rate, both chambers want to see the tax rate lowered to 20 percent from 35 percent. However, the Senate measure would delay the implementation for one year.

The Senate’s tax plan would eliminate state and local tax deductions – meaning taxpayers in high-tax states would lose a write-off. This would impact mostly blue states, such as California and New York.

The Senate’s tax plan also includes a repeal of the individual mandate, the ObamaCare requirement for Americans to have health care.

The Senate tax reform measure would leave the mortgage deduction pretty much alone, capping it at $1 million. The House plan, on the other hand, would drastically reduce the cap on the popular deduction to mortgage interest to $500,000.

Fox News' Alex Pappas, Judson Berger and Kaitlyn Schallhorn contributed to this report.