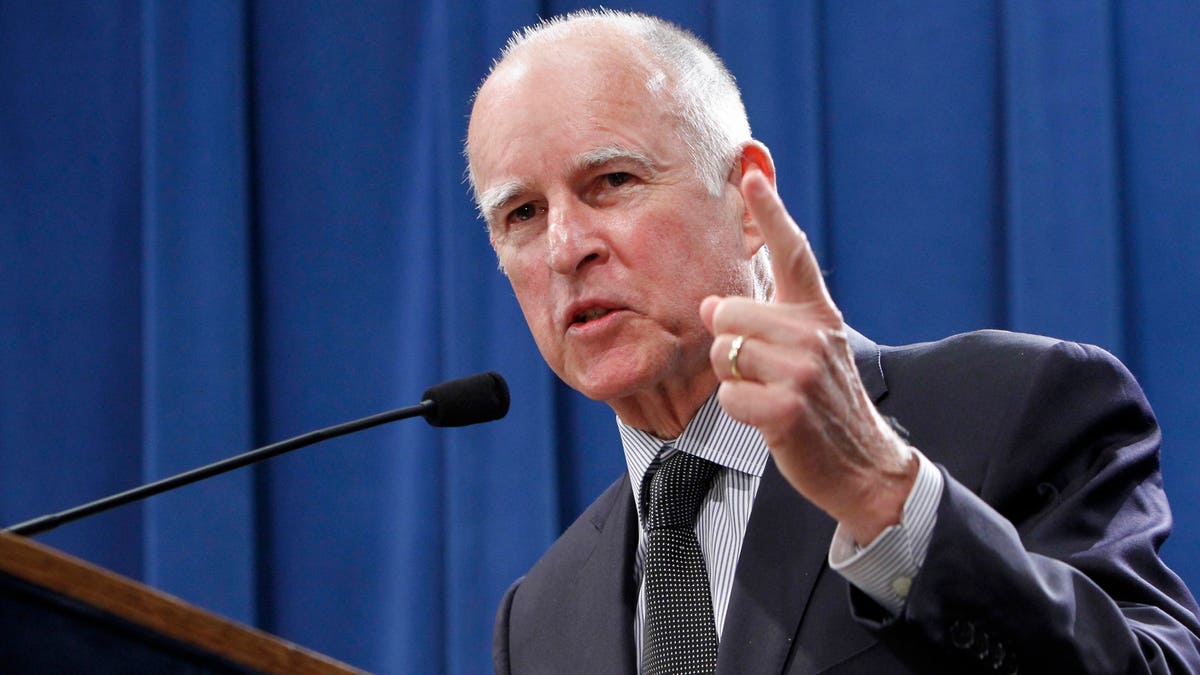

Gov. Jerry Brown discusses his proposal to rollback public employee pension benefits during a news conference at the Capitol in Sacramento, Calif., Thursday, Oct. 27, 2011. (AP2011)

Gov. Jerry Brown’s newly unveiled plan for a sweeping overhaul of the state’s pension system seeks rollbacks that are deeper than what the Democratic governor proposed in the spring, and risks putting him at odds with the very unions that helped power his return to the statehouse last year.

Brown outlined his long-term vision for turning around California on Thursday with his plan to move new state workers to a hybrid retirement system where guaranteed benefits are combined with a 401(k)-style plan. Civil state employees hired after the plan takes effect would be eligible for full retirement benefits at 67, instead of 60. He also wants current employees to contribute at least half of the cost of their pension benefits.

For example, new hires who are 37 years old wouldn't feel the effects of Brown’s plan for 30 years. According to Brown's office, the state would save $4 billion over that time period.

“Applying this is going to take some care,” Brown said at the state Capitol in a speech detailing his 12-point plan. “But I’ve laid out what I think is a minimum that every plan in California ought to meet – at a minimum protects taxpayers while being fair to the employees.

Brown's proposal, however, didn't go over well with unions representing teachers.

“Labor has been talking about its own pension reform issues. We know there are some problems,” Joshua Pechthalt, president of the California Federation of Teachers, told FoxNews.com. “But it worries me that (Brown’s plan) feeds into what I see as an effort to scapegoat public sector employees for the economic problems we did not create.”

Allan Clark, president of the California School Employees Association, said in a statement, “CSEA has been pushing for responsible reforms to prevent abuse and fraud in our pension system. However, some of the governor’s proposals go too far and run the risk of undermining retirement security for thousands of California school employees and their families.”

Brown wants the Legislature to put the measure on the ballot so both state and local government employees would be covered.

But Pechthalt’s union, which has 100,000 members, is pushing for its own ballot measure: a millionaires tax on residents earning at least $500,000 to help solve the state’s structural budget shortfalls. But the California Teachers Association, the state’s largest teachers union with 300,000 members, appears to be breaking from the pack with comments this week suggesting it's not going to support putting the proposal on the November 2012 ballot.

Dean Vogel, president of CTA, told the San Jose Mercury News that the tax won’t raise enough revenues and risks backlash from the business community, and he fears that more than one tax initiative on the ballot would alienate voters.

“If there is more than one tax initiative, it’ll confuse voters, and a confused voter will vote no,” Vogel told the newspaper. “The best-case scenario is everybody who’s looking at a tax initiative comes together and coalesces around one issue.”

Vogel, who declined through a spokesman to speak to FoxNews.com, said his top priority is killing a ballot measure that forbids union dues to be used for political purposes.

But the CFT is holding out hope that the CTA will eventually support its initiative.

“I’m pretty confident that we will in fact be on the same page” once the proposal is finalized, CFT spokesman Fred Glass told FoxNews.com. “We’re still in the process of building the coalition for this. We’re going to have inevitable differences. We’ll work it out.”

Pechthalt says that his union plans to officially unveil its initiative next month.

“Our folks want something positive to rally around,” he said. “We see this initiative as labor and the community putting together a vision to turn around California.”

Pechthalt acknowledged that his millionaires tax initiative won’t solve the state’s budget crisis, but he said it’s a “step forward.”

“We want to generate enough revenue to make a significant difference,” he said.

Vogel told the Mercury News that he thinks the millionaires tax would generate about $4 billion, far short of what is needed. He has said he wants to craft an initiative that is most likely to succeed at the ballot box.

Pechthalt said his initiative fits the bill.

“If there’s a better one, we’ll support it,” he said. “But there’s nothing yet. Time is running out for moving forward. If there were another initiative, we would have heard about it. Right now, we think ours will have the broadest support and is most likely to win.”

Winning the CTA’s support “would be very important,” Pechthalt said, adding that he and Vogel speak to each other often and have “talked a lot over the last few days.”

“I think we have very broad agreements. We have disagreements over some things,” he said. “The bottom line is that public education in California has been decimated over the last few years. We know there needs to be progressive tax reform.”