How to handle your 401(k) if you're close to retirement during the market dip

Chris Burns, CEO of Dynamic Money, offers his investing advice during the coronavirus pandemic.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

Chris Burns, a financial planner and the CEO of Dynamic Money, provided financial advice on what to do if you're nearing retirement as the stock market experiences a historic plunge amid the new coronavirus outbreak.

Speaking on “Fox & Friends” on Thursday, Burns, a radio talk show host, encouraged people to avoid selling if possible and keep contributing to their 401(k) accounts.

“Conventional wisdom says the best thing to do is to just keep contributing to your 401(k) and not to touch it,” he said, adding that you should only do that if “you’re in a place where you have a lot of liquidity right now, where you have a lot of money sitting in the bank.”

He then noted that U.S. equity markets are “about 30 percent down right now” and compared stopping contributions to your 401 (k) to selling a home.

“Could you imagine selling your home if it was worth 30 percent less? You would want to wait.

“On the flip side, if you’re making contributions to it, you’re getting this incredible discount on those contributions and over time that pays off,” he explained.

“The problem is a lot of people right now don’t have much money at all sitting in savings and even though it’s great to have money long-term in a 401(k), the number one thing people need in a crisis-type situation is the actual ability to have cash on hand,” Burns went on to say.

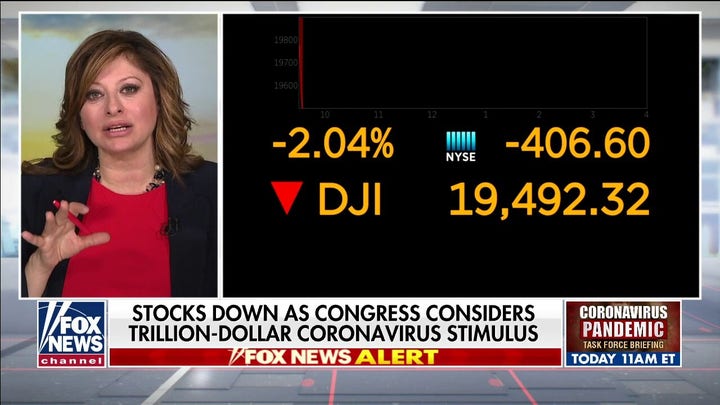

On Wednesday, U.S. stocks plunged again amid fears of the economic impact of the virus, with the Dow Jones Industrial Average closing below 20,000. At one point all of the gains from the Trump era were wiped out before recovery slightly.

CLICK HERE FOR COMPLETE CORONAVIRUS COVERAGE

Burns also said on Thursday that you should stop 401(k) contributions if you have less than three months of living expenses saved.

He said, “One important thing right now might be, if you don’t have savings, stop those contributions in the short-term because that’s going to put more money in your paycheck that you can put away and not just that, pay minimum payments on your debt right now.”

He noted that the suggestion “goes against conventional thought,” but added that “you need as much money sitting liquid as you can so you be can flexible for whatever is coming.”

Burns also recommended seeking professional advice if a person is planning to retire within the next five years.

He said, “If you are close to retirement right now, what you should do, what you should sell, how you should arrange your investments really needs to be based on the totality of your situation.

“Do you have a pension? Do you not? What are your options out there right now? So don’t make any moves without talking to somebody who can give you objective advice about that,” he continued.

CLICK HERE TO GET THE FOX NEWS APP

When host Brian Kilmeade asked whether people should consider withdrawals from their 401(k) accounts, Burns said a loan is the preferred way.

However, he warned that taking a loan “can be problematic with layoffs, because a lot of layoffs mean you have to pay back that loan very quickly.”