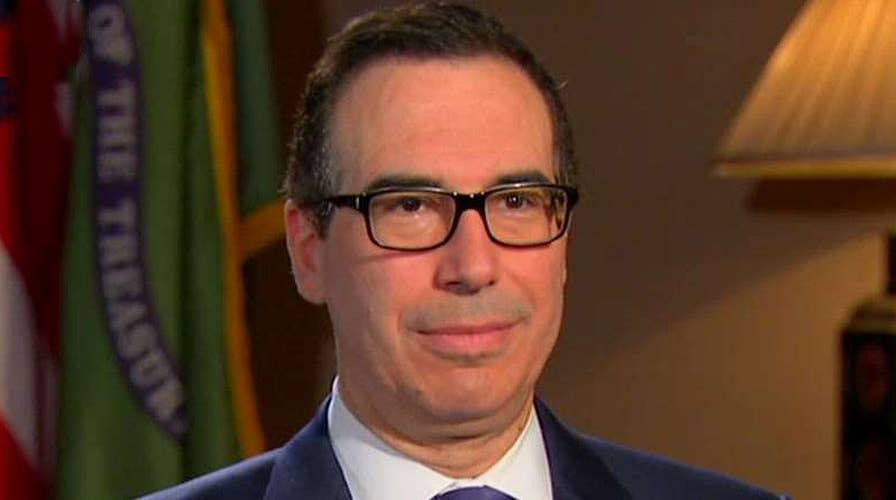

Secretary Mnuchin: President Trump will deliver on tax cuts

On 'Your World,' the treasury secretary discusses the infrastructure plan, defense budget, ObamaCare, tax cut plan

This is a rush transcript from "Your World," March 1, 2017. This copy may not be in its final form and may be updated.

NEIL CAVUTO, HOST: Well, this was a busy day for the treasury secretary of the United States, meeting with his counterpart from Canada visiting the Treasury Department here in Washington, D.C.

But before he had a chance to sit down with the Canadian money guy, he sat down with, well, the FBN money guy, one of them at least, a chat that we had a chance to get into what the president got into last night.

And, of course, it had to do with the do-ability of everything this president wants to get accomplished within the next few months.

Take a look.

(BEGIN VIDEO CLIP)

CAVUTO: After the president's speech, a lot more people seem to be confident, judging from the market reaction and elsewhere, that he will get a lot of what he wants done. Do you think he will?

STEVEN MNUCHIN, U.S. TREASURY SECRETARY: Absolutely. I think he's committed to it.

I think he's going to deliver on it. And I think you saw last night the excitement in the room. One of the things you just probably couldn't see on TV is this feel, the energy that was in that room. It was really quite extraordinary.

CAVUTO: Such addresses, I guess, are not meant to spell out a lot of details.

Some have expressed concern that there were very few, if any details, for example, how he would pay for a lot of the things he wants to do, including a trillion-dollar infrastructure program.

He obviously means that as a this-year event, right?

MNUCHIN: He does.

So, I mean, first, let me say, this was an address to the American public. And I think it was very clear. It was about unification, it was about optimism, it was about the goals that the president wants to accomplish. And I think he did an unbelievable job delivering that message.

And I think you have seen the reaction to that.

CAVUTO: But this year for the trillion dollars?

MNUCHIN: Absolutely.

CAVUTO: And where will that money come from?

MNUCHIN: Well, it's a trillion dollars. It will be a combination of a public and private partnership. It doesn't necessarily mean that it will be a trillion dollars off of the government's balance sheet.

But the president is determined that we're going to do an infrastructure plan that is going to be very significant, one of the most significant we have ever seen. And we're going to rebuild America.

CAVUTO: Now, part of that whole address was also saying that he still stands by these tax cuts, still stands by boosting military spending by $54 billion a year.

One of the means by which he was going to pay for that, I guess, Secretary, was to cut the State Department budget. That was a nonstarter, in Lindsey Graham's view, that it wasn't going to go anywhere. Mitch McConnell, the Senate Republican leader, Senate leader, saying much the same.

What did you think of that instant reaction, that, no, not there?

MNUCHIN: Well, let me tell you, the budget process starts with the president and the administration.

But it goes through a congressional appropriations process. So, this is the start of it. And the administration is going to work with Congress on this.

I think that the message that the president wanted to deliver was loud and clear. He wants to rebuild the military. It's important to do it. And we're going to pay for that by cutting other things, and not just ballooning the deficit. And I think that message is loud and clear.

CAVUTO: But the option for the State Department cutting wasn't enough to compensate for that increase. And that option is taken off the table.

Where else could you go? What else could you do? I know the EPA was mentioned. But even that would raise a fraction of the money you're adding to defense.

MNUCHIN: This was just a start. It's a start of the process.

I think what is important is the message. The message is the president wants to spend more money on military, make our military buildup competitive. And we're going to pay for that by cutting other areas.

Like any discussion or negotiation -- and you know the president is the best negotiator in the world -- we will work through these numbers. So, I think what is important is the message. And we will work with Congress to figure out how it's funded.

CAVUTO: The defense thing is curious, sir, because, in just two phone calls, the president was able to shave significant sums, hundreds of millions of dollars, maybe billions over the years between the Air Force One contract and a jet fighter contract.

That was what he was able to do to trim excess or maybe unnecessary spending in defense just in a day. So, why add $54 billion when maybe you can multiply that out and extract even more savings? You don't have to increase the budget at all.

MNUCHIN: Well, first of all, not only is he the commander in chief, but he's the negotiator in chief. And he's proud of, in two telephone calls, he saved a lot of money and he is going to continue to do that.

But this is not just about cutting back the costs. This is about adding additional resources, making investments, getting the military back to where it needs to be, so that it has the proper facilities to protect the country.

CAVUTO: Is it your sense the tax cuts hinge on getting, first of all, the ObamaCare, the Affordable Care Act repeal and ultimate replace done first, that that is an unequivocal stance, if that gets into trouble, that's another issue, but that first? Still stand by that?

MNUCHIN: Well, first of all, we're going to get it both done. The reason why we did ObamaCare first was, that is the priority right now. And we need more time.

CAVUTO: Do you regret that priority, the way that Congress is handling it?

MNUCHIN: Not at all. Not at all. Not at all. And I think...

CAVUTO: Were you surprised that it -- and the president has even mentioned that this was enormously complex, much more difficult than he thought. Were you?

MNUCHIN: No. I think these are complicated issues.

And we're working through these complex issues. And we're going to get it done. And we're working closely with Congress to get it done. I think that ObamaCare will get done first. And I think tax. We're working closely with the House and the Senate on coming up with a combined plan that.

We will be coming out with that in the near future. And our objective is to pass tax reform by the August recess. And I think that's a very aggressive timetable, but realistic and something that the president and I are very committed to doing.

CAVUTO: So, by August, voted, done, agreed?

MNUCHIN: And signed.

CAVUTO: And signed, effective retroactive to the beginning of the year?

MNUCHIN: I think it's too early to tell whether it's going to be retroactive or not. Those are the types of details we will work through as we get to drafting.

CAVUTO: All right.

The reason I go back to ObamaCare, sir, is this feeling, what -- I wouldn't call it a revolt, but a difference, dramatic difference of opinion we're seeing play out on the Hill between those who like Speaker Ryan's plan, complete with tax credits to help people buys insurance, and others who say that's just ObamaCare-like and will be a disaster.

There's not much wiggle room, right, two senators in the Senate, obviously, 22 House members in the House. So, are you worried that this is slipping away?

MNUCHIN: Not at all.

I think this is only natural, in the sense of there's a lot of different good ideas. And I think one of the things that you see from President Trump is, he's willing to listen. He's willing to listen to people who have different ideas. He takes it all in.

And then he figures out what he thinks is the best plan, being open-minded to these views, and getting it done.

And I think you have seen this in regards to we have met with lots of different business leaders. He's had manufacturing CEOs, he's had airline CEOs, he's had auto, he's had small businesses. This is a president that is willing to listen before he makes decisions.

CAVUTO: Still, as you know, Secretary, Jamie Dimon of J.P. Morgan Chase, the Pricewaterhouse CEO this morning expressing concerns about that timetable, both saying it appears increasingly unlikely, at least the way they're looking at thing, that August time frame, even a this-year time frame on the tax cuts.

Any message for them?

MNUCHIN: Well, my comment is, when you come out with a very aggressive plan that you want to get done, of course you start with the view that it's unlikely.

This president is not sitting around and having an agenda that is conservative and likely. This is a president who wants to get things done and wants to get it done on a fast timeline.

CAVUTO: But does it trouble you when a gigantic figure in the Wall Street community is still expressing great admiration for you and what you're doing, but says, I don't know, this year, maybe not?

MNUCHIN: Well, we will see. We're going to deliver on this. Again, I think it's aggressive, but we're going to get it done.

CAVUTO: All right, do you agree on the broad parameters to tax cut?

I talked to Kevin Brady of the House Ways and Means Committee, Secretary. And he says that you have broad agreement on some of the bigger issues, seven rates down to three, cutting the corporate rate from roughly 35 percent to at least 20 percent. Maybe you guys want to go even lower.

But is that right? Is he right?

MNUCHIN: Well, I have had many meetings already with Chairman Brady, with the Senate Finance Committee, with Speaker Ryan.

And we're working closely to come up with a joint plan. This isn't going to be a plan that is just the administration's plan.

CAVUTO: I know that, but the joint plan being to those guidelines, those parameters?

MNUCHIN: This is going to be a plan where we're working with the House and the Senate.

I think we have very broad agreement across the board on what we're trying to do. And now we're working on the details. And we're working on a process to make sure that we have a plan that everybody has bought into, so, when we come out with the full plan, we're going to have the support of Congress and we're going to have the support of the president to get this signed.

CAVUTO: Is it your wish, Secretary, again, that this, whatever you come up with, and if it's done by August, that it is retroactive to January 1 on the both the corporate and marginal rate basis?

MNUCHIN: Again, I think that's a detail that is just too early to determine.

What is important here is, we want to deliver a middle-income tax cut, we want to simplify personal taxes and we want to make business more competitive. Our businesses are uncompetitive. They're not on a level playing field.

And that's why we have trillions of dollars of cash sitting offshore. That's why we have jobs being moved out of this country. We are determined to make U.S. business competitive. And that's big business and that's small business. And we're listening to what people have to say, and we're going to incorporate that into the plan.

CAVUTO: Because they say to me, some of those businesses, well, then make it retroactive, because we will be more competitive more quickly.

MNUCHIN: And, of course, if there's a tax cut, people will...

(CROSSTALK)

MNUCHIN: ... retroactive.

(LAUGHTER)

MNUCHIN: So, again, these are the different things we're trying to price out, and we will figure it out.

CAVUTO: Sir, in the meantime, I want to get a little clarification, if you don't mind, of the upper-income tax cut.

You have referred in prior interviews that taking the top rate from roughly close to 40 percent, more than that if you add ObamaCare surtaxes, down to 33 percent, that the rich still will see that offset by limits in their deductions and write-offs, so that they don't net-net really see a tax cut.

Is that right? Do you still stand by that?

MNUCHIN: Well, let me first say that ObamaCare and the ObamaCare surcharges are going to be dealt with as part of the ObamaCare legislation and not tax legislation.

As part of tax legislation, OK, our main objective is a middle-income tax cut on the personal side. And our objective is, if we lower the top rates, that we will offset that with reduced reductions.

CAVUTO: But even if you take away those deductions, it is still a big tax cut for the upper income.

Are there other things you would do or phase out to compensate for that? Because we have crunched numbers where, take all those deductions, take the charity deduction away, take the mortgage deduction away, they still come out way ahead.

So, what calculation has you saying that net-net they wouldn't see a tax cut, it will be simpler, cleaner, but it wouldn't be a net tax cut?

MNUCHIN: Well, let me first clarify we're not taking away the charitable deduction. And we are leaving the mortgage interest deduction as is. We think those are...

CAVUTO: For the upper income as well?

MNUCHIN: Absolutely. We think those are both very, very important.

But what we are going to do is, we're looking at other things where the reduction in deductions will offset the rate. And you will see when we come out with the plan.

CAVUTO: That's 7 percentage points to address.

MNUCHIN: Well, again, you will see when we come out with the plan. It's a bit preliminary to talk about these results.

And when you see the plan, people will judge the plan and will look at the entire plan. It will stand on its own. And, again, we will see if it fits the objectives. The objectives are very clear, middle-income tax cut, simplified taxes, make businesses more competitive.

That's what we want to have the plan judged on. And when we come out with the final plan, people will look at the distribution and everything else and we will see if it fits the objective. I think it will.

CAVUTO: So, when you talk to your old Wall Street friends, your Hollywood friends, many in that upper, upper echelon who are expecting a tax cut, but they might not see one, how do you break it to them, or do you break it to them, you're going to get a simpler tax rate, you won't need as many accountants, but you're not getting a tax cut?

Are they not getting a tax cut?

MNUCHIN: Again, I haven't spoken to any of them who expect they're getting a tax cut. What I have heard from...

CAVUTO: Virtually every 1 percenter I have talked to, Secretary, says they're expecting one.

MNUCHIN: Well, then you're speaking to different people than I am speaking to.

(LAUGHTER)

CAVUTO: But your friends, those -- they know, I'm not going to get a tax cut, and they're OK with that?

MNUCHIN: Again, when we come out with the plan, OK, there will be a tax cut on an absolute basis.

We are looking...

CAVUTO: For everybody?

MNUCHIN: Yes.

CAVUTO: But not for the upper income?

MNUCHIN: On an absolute basis.

When we come out with the plan, there will be distribution tables, and we will show what this is intended to do and how it fits in.

CAVUTO: All right, so I don't want to belabor the point. You have very been patient.

But if you're not going to take away a mortgage deduction for anyone or the charitable deductions or readjust the percentage you can do there, I'm just wondering where else you could compensate for the cut of such a magnitude on the upper end.

MNUCHIN: I promise you, when we come out on the plan, I'm happy to come back on your show and we can talk about the details. OK?

(LAUGHTER)

MNUCHIN: We haven't released the details. And these are the types of things we're working on.

So, we have a team of over 100 people in the tax department in this building that are crunching numbers 24/7, OK, working on these things.

CAVUTO: Secretary, obviously, the markets think you will achieve this.

And they have had an enormous run-up, almost $3 trillion in market wealth added since the president's election.

Many say they're priced for perfection, that they're factoring in everything goes exactly right. I know you don't look day by day or tick at the market movements, but does the heady advance ever give you pause or make you think, wait a minute, this is still a big task here?

MNUCHIN: I have been involved in the financial markets for over 30 years.

And there's two things I'm 100 percent convinced of. Markets are not efficient and you can never predict these things day to day. What is important here is that the market is showing you that people believe in the president's agenda.

And that is what is important. And whether the market goes up or down or any given day or any given week, I have given up following that.

CAVUTO: But what do you make of that run-up, a 13 percent-plus run-up just since November, a nearly 4 percent run-up in the month of February? What do you think of that?

MNUCHIN: I think it's a huge vote of confidence in this president.

I think you couldn't see a stronger indicator of people liking the president's economic policies, the president's political policies, and a vote of confidence in the president.

CAVUTO: Finally, sir, there's been a great deal of attention paid to your wealth coming into this job. You're one of the richest Treasury secretaries this country has ever had. And that's a pretty elite group.

But it's a group that includes a number of Goldman Sachs representatives, yourself included. I was noticing, walking down the hall, there's a picture of Hank Paulson and Bob Rubin, who had your job.

Do you feel, given that background, when especially you hear the likes of Elizabeth Warren criticize the role of bankers and Goldman Sachs types in this administration, to be extra careful about that association? How do you feel about that?

MNUCHIN: Well, let me first say there's no greater honor for me than being in this job, being the 77th treasury secretary.

In my office, I have a picture of Alexander Hamilton. He looks down on me every day, as he has on the other treasury secretaries. There's an incredible history in this building. And when you walk down the halls and you see the portraits of all these people, you realize the history of the United States, and you realize that the Treasury has such an important function, many of which is nonpolitical, many of which is operating the U.S. government and focusing on the economy and focusing on growth and opportunities.

And I'm honored to follow a great tradition, not of only Goldman Sachs people. I worked very closely with Secretary Paulson. It's an honor to follow him and Bob Rubin, but other incredible individuals who have served in this role.

And I have been a regional banker for the last nine years. And I think that experience and being a regional banker, and having met with hundreds and hundreds of businesses, small, medium-size businesses, and understanding what they need to drive their business in this economy, and having traveled the last year with the president throughout this country, I have heard from the American public.

And that's what I'm committed to doing in this job and working with the president to grow this economy.

(END VIDEOTAPE)

END

Content and Programming Copyright 2017 Fox News Network, LLC. ALL RIGHTS RESERVED. Copyright 2017 CQ-Roll Call, Inc. All materials herein are protected by United States copyright law and may not be reproduced, distributed, transmitted, displayed, published or broadcast without the prior written permission of CQ-Roll Call. You may not alter or remove any trademark, copyright or other notice from copies of the content.