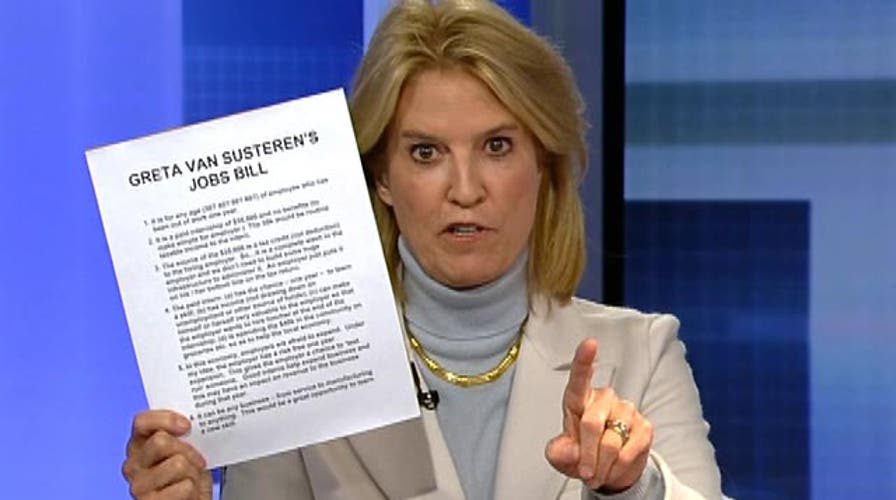

Greta: Check out my one-page jobs bill

'Off the Record', 2/27/14: I propose a revenue-neutral jobs bill - a 35,000 a year paid internship for anyone who wants a future, that can be a tax credit to employers and is at no cost to taxpayers

By Greta Van Susteren

Let's all go "Off the Record" for a minute. I have a one-page jobs bill. No kidding. One page. It's for anyone, any age, out of work more than a year who wants a job and a future. It's a $35,000 paid internship.

Any company, big or small, can hire an intern for one year. Now, the internship is a chance to learn a new skill, make contacts and make oneself valuable to an employer so, at the end of the year, the employer realizes he can't live without the work of the intern and will figure out a way to hire the intern.

Now you are asking, "Where do we get the $35,000 to pay the intern?" That's easy. A tax credit. Not a deduction. But a tax credit for the $35,000 for the employer. So this program is no cost to the business.

My plan is also revenue neutral. No cost to taxpayers. Think about it: the intern would be paying taxes on the $35,000. Also spending money in the community, which creates revenue for the IRS. And also - a big point - the intern will not be drawing unemployment insurance, saving the taxpayers. And the business? They get work out of that intern and can test-run expanding without running up costs.

This plan is simple, targeted, and matches needed skills with jobs available. We don't even need to add any bureaucracy. Businesses just take that $35,000 credit on their tax return.

That's my "Off the Record" comment tonight. What do you think of my one-page jobs plan? Go to GretaWire.com and tell us.