Deputy Attorney General Rosenstein: Barr memo didn’t influence our decision making in the Robert Mueller investigation

George Washington University Law professor weighs in on William Barr’s memo disagreeing with the Mueller probe.

This is a rush transcript from "Your World," December 20, 2018. This copy may not be in its final form and may be updated.

(BEGIN VIDEO CLIP)

PRESIDENT DONALD TRUMP: Walls work. Whether we like it or not, they work better than anything.

(END VIDEO CLIP)

NEIL CAVUTO, HOST: President Trump digging in, and stocks just selling off, way off, as the battle over that border wall funding heats up, and a government shutdown could see be on.

Investors moving on, the Dow plunging more than 600 points at one point, before finishing out about 472 points. What a day, rocking and rolling and selling.

Welcome, everybody. I'm Neil Cavuto.

And Fox on top of a shutdown on the brink and stocks in the tank.

We're going to be speaking with Wyoming Republican Congresswoman Liz Cheney, who was in that meeting with the president today.

We will also speak with Wall Street legend Byron Wien on where he sees stocks next.

First John Roberts at the White House, where the president is putting his foot down, and FOX Business Network's Kristina Partsinevelos on stocks that are just, well, way down.

We begin with John at the White House.

Hey, John.

JOHN ROBERTS, HOST: No question the president, Neil, digging in his heels.

This time yesterday, we thought that the president was going to have to accept the continuing resolution coming over from the Senate that would fund the government until February the 8th and give him no money for border security or a wall.

But after hearing an earful from conservatives, not just members of his own party, but conservatives across the nation, the president this morning woke up and said, you know what, I'm not going to accept that.

Here's what he said just a couple of minutes ago about what he wants to see.

(BEGIN VIDEO CLIP)

TRUMP: I have made my position very clear. Any measure that funds the government must include border security. Has to, not for political purposes, but for our country, for the safety of our community.

This is not merely my campaign promise. This is the promise every lawmaker made.

(END VIDEO CLIP)

ROBERTS: So the president started off this morning with a tweet that said: Hey, listen, when I signed the omnibus bill the last time around, you told me that, by the end of the year, I was going to get money for border security. And it's not there now.

So what he did was, he called up Paul Ryan. And he said, bring yourself and Kevin McCarthy and a bunch of other people, 12 in total, over to the White House by noon for a meeting, where I'm going to tell you exactly what it is that I want.

And there you see the 12 people who were brought over to the White House. I'm told -- we're told at least at FOX News that the president was in a good mood. He didn't see particularly upset, just very matter of fact.

Here's what Paul Ryan and Kevin McCarthy said after they came out of the White House.

(BEGIN VIDEO CLIP)

REP. PAUL RYAN, R-WIS, SPEAKER OF THE HOUSE: The president informed us that he will not sign the bill that came over from the Senate last evening because of his legitimate concerns for border security.

So what we're going to do is go back to the House and work with our members. We want to keep the government open. But we also want to see an agreement that protects the border. We have very serious concerns about securing our border.

REP. KEVIN MCCARTHY, R-CALIF, HOUSE MAJORITY LEADER: The president said what the -- what the Senate sent over is just kicking the ball, just kicking the can down the road. We want to solve this problem. We want to make sure we keep the government open. And we're going to work to have that done and get something happening.

(END VIDEO CLIP)

ROBERTS: So the big question is, what can the House come up with and what is the president willing to accept? The president has said all along he wants $5 billion for border security, including wall funding.

But the White House in the past few days has knocked that back to say that the $1.6 billion that was offered in one continuing resolution might be enough if they could plus up the money, getting it from other existing appropriations.

I asked a senior administration official, what's your floor here? And they said, well, we're not going to put down a floor, we're not going to demand what -- a minimum of what we have to have. Let's see what the House comes up with and what they can get voted out.

However, Neil, if it comes out as zero dollars, it's a pretty good likelihood that the government is going to shut down. But there's still some time.

CAVUTO: All right, buddy, thank you very, very much, John Roberts.

All right, as John, was pointing out here, stocks selling off on all of this uncertainty. I'm showing you the exterior of the Nasdaq right now in Times Square in New York, because that is as close to the bear market as you can possibly get right now, down -- losing a little bit more ground today, within just a fraction of being down 20 percent from its highs, which is the definition of a bear market.

Other averages that are already in there include the Dow Jones Transports and the Russell 2000, the latter, of course, a reading of very small company stocks and all. They had been soaring a little more than about six months ago. That was then. This is now.

The major averages, like the Dow and the S&P 500, they are still about 4 or 5 percentage points away from bear market territory. But we're watching Nasdaq closely now, very close to bear market territory, and all those once high-flying technology stocks not high-flying anymore.

Kristina Partsinevelos on the fallout from all of this.

Hey, Kristina.

KRISTINA PARTSINEVELOS, CORRESPONDENT: Hi, Neil.

And definitely right, that's a part of the reason we're seeing the NASDAQ down. And you mentioned bear market. You saw the S&P, tech sector also touch down in bear market territory today.

But let's talk about the Dow. We saw it hit a 14-month low. There's so much negative movement in the markets, especially towards the latter half of the day, a lot of that especially within the last 30 minutes or so. You saw that had to do with the government shutdown.

It's more uncertainty, even though earlier today, when I reached out to a few traders, they said it wasn't to do with the shutdown, it was more so going into 2019 and this constant fear of an economic slowdown, though, on your screen, you're seeing the S&P 500, I want to focus this, down 1.6 percent, 10 out of 11 sectors in the red for the S&P 500.

Let's take a look at some of those big losers on the Dow today. The Dow drags, you're seeing Wal-Mart down almost 4 percent, UnitedHealth and McDonald's. Those are the big heavy weights on the Dow as well.

You -- other companies like GoPro, Snapchat, they hit all-time lows today. You're seeing technology when many investors are saying overvalued. They're leaving risk, Twitter being an example. Look at that, down over 11 percent today.

So what's wrong? Many, many factors. You could claim that the yield curve is distorted and it's all about perception. There was some talk today, I saw on some notes, that some pension funds are rebalancing. So you're seeing a lot of sell-off there and a lot of movement. You can blame high algorithms and high-frequency trading. You can also say it's the government shutdown.

Earlier today, we had Treasury Secretary Steve Mnuchin on Fox Business, and he weighed in on the markets. Listen in.

(BEGIN VIDEO CLIP)

STEVEN MNUCHIN, U.S. TREASURY SECRETARY: I think the market reaction is completely overblown. And if you look at the U.S. growth vs. Europe vs. the rest of the world, the U.S. is still going to grow significantly higher.

(END VIDEO CLIP)

PARTSINEVELOS: And, Neil, I want to end on this, because I heard you say it earlier today. He also commented on machines being the reason.

And he's talking about the negativity, but he doesn't come up and speak when -- at least when the markets climb higher, which we saw in the summer.

CAVUTO: Yes, the high-frequency trades that seem to propel us on the downside here, he has a big problem with. I understand that. But they're the same high-frequency trades that propel the market on the upside.

PARTSINEVELOS: Exactly.

CAVUTO: So you got to be consistent.

All right, Kristina, thank you very, very much.

PARTSINEVELOS: Thank you.

CAVUTO: FOX Business Network's Charlie Gasparino is here. So is Keith Fitz-Gerald and Bob Iaccino over at the CME.

Bob, is there a sense here that there's more selling to come, that the market seems to have a hard time finding a floor here, huh?

BOB IACCINO, PATH TRADING PARTNERS: Yes, good afternoon, guys.

I think what there's a sense of is that there's not a lot of buying to come. The buying the dip that we have seen through most of this year has not worked, probably won't work.

We have been at about 70 to 85 percent cash back and forth since about October 17, but we have tried to put cash to work in these dips, and it hasn't paid. So we're going to be ready to do that again in 2019. I agree with the treasury secretary. Underlying fundamentals are good.

There's just too many binary events that could actually cause the market to spike in the way that in the past binary events have caused it to collapse, like these news conferences, Chuck Schumer, and then President Trump saying that they're not going to do this government funding.

Too many of these events in the way right now -- 2019, I think, is going to be positive.

CAVUTO: All right.

Keith Fitz-Gerald, there are a lot of uncertainties. We know markets used to brush off uncertainties. The fact that routinely now they do not, does that worry you going into 2019, whether we get a Santa rally or not here?

KEITH FITZ-GERALD, MONEY MAP PRESS: It does, Neil. It worries me a lot, because people are simply exhausted by the headlines.

They're not giving up, but selling into strength, selling the rallies has been far more profitable than buying the dips. And that does bother me.

CAVUTO: All right, so, Charlie Gasparino, what are you hearing from a lot of your sources you talk to about the breadth and the nature of this rally?

Peter Eliades, the famous bear, was telling me earlier today that the underpinnings don't look good to him; whatever you say about fundamentals, the markets are falling apart and telling us something about the general environment.

CHARLIE GASPARINO, CORRESPONDENT: Listen, there's a lot of concerns about everything from corporate debt, to a trade war, to a trade war coinciding with interest rates increases.

I mean, if you remember -- look what happened yesterday, he didn't say that would be no interest rate increases on the short end. He said two. Remember, the market was pricing in zero.

CAVUTO: Right.

GASPARINO: We should also point out that he's unwinding -- meaning he, the Fed, Federal Reserve Chairman Jerome Powell, is unwinding the long end, Neil, getting rid of the balance sheet that the Fed accumulated during the financial crisis.

And when you do that, you sell bonds, bond prices go down, interest rates go up. That's why you see a lot of the -- a lot of the flattening of the yield curve.

But there's one thing I want to -- and this is somewhat positive, I want to say. There are no bids right now. There are no bids right now also, not just because of fear. It's the end of the year. And people are not taking positions because it's the end of the year.

So you will see much more dramatic pushes down because of that, because there is an absence of bid. Nobody wants to be a hero right now in this market, at the end of the year. They have cut their -- books are sewn or whatever you want to say. They have closed their books and they're moving on to next year.

And next year, you could see a glass-half-full scenario. We get a trade deal. The Fed doesn't move very fast on interest rates. The economy -- that the tax cuts, the big corporate tax cut does give us more bang for the buck in terms of GDP than what's being priced in.

Conversely, I can't tell you what's going to happen. But every one of those things could go in the opposite negative direction. That's the fear. But right now, we're getting the big downsides, I think, because -- and you can ask your trader panelists here -- because there's no bid.

But that's because it's the end of the year. And no one's going to be a hero right now.

CAVUTO: All right. OK, guys, I want to thank you very much.

We're getting some updates on the House floor here about what's going to happen to avoid a government shutdown. That will be a Herculean task now, since the president has sort of drawn that line in the sand that it's either money for that wall or whatever he's calling it or not.

And right now, that is the source of the debate.

Mike Emanuel with more in Washington -- Michael.

MIKE EMANUEL, CORRESPONDENT: Well, Neil, good afternoon to you.

They're going through the final process to put this bill on the floor in the next 30 minutes or so. It includes $5 billion, 5.7, to be exact, for the border security, and also 8.7 for disaster relief.

Think hurricanes and fires. Majority Whip Steve Scalise talked to us after his meeting with President Trump earlier today.

(BEGIN VIDEO CLIP)

REP. STEVE SCALISE, R-LA., HOUSE MAJORITY WHIP: We're going to move today to add language to the bill that the Senate sent over on government funding to add $5 billion for the wall, as well as the disaster relief funding that's been agreed upon by both the House and Senate for the hurricanes and the wildfires.

So we will move that later on today. This is about securing America's border.

(END VIDEO CLIP)

EMANUEL: The president had a meeting with the top Democrats in Congress last week. He told Senator Chuck Schumer and Leader Nancy Pelosi he was demanding significant border security money.

Today, Pelosi said her members were prepared to pass the six-week funding extension that passed the Senate last night.

(BEGIN VIDEO CLIP)

REP. NANCY PELOSI, D-CALIF., HOUSE MINORITY LEADER: And the current version, we are prepared to not only support the resolution, but to support the rule, because that's what they will try to do, is bring down the rule.

By the way, they have a lot of people who are missing, who are absent here. So, they never did have vote for their wall. But they now don't even have a full complement of members here.

(END VIDEO CLIP)

EMANUEL: FOX News has learned Senate Majority Leader Mitch McConnell has told senators they may be needed to vote tomorrow in the noon range if the House passes a funding package. This is all a very fluid situation with the clock -- clock ticking toward a deadline -- Neil.

CAVUTO: All right, Mike, thank you very much.

With us now, Wyoming Republican Congresswoman Liz Cheney, at that meeting with the president. The congresswoman, as you know, has just been voted in as the House Republican Conference chair.

Congresswoman, is it your sense that this measure, this latest measure, would pass the House as it's -- as it's built now?

REP. LIZ CHENEY, R-WYO.: Yes. Hi, Neil. Thanks for having me.

Look, in the meeting that we had with the president this afternoon, it was absolutely clear that there's no distance between the House Republicans and the president. We know that we have got to secure our border.

So what we have just passed through the Rules Committee is a bill that provides $5 billion for the wall and for border security, provides additional funding, over $8 billion, for disaster relief that's really crucial and necessary.

And if you just look at the exchange that just went on moments ago in the rules Committee, you had my colleagues on the Democratic side saying things like the wall was -- quote -- "stupid," saying things like the wall was -- quote -- "offensive."

And we, the House Republicans and the president, know that what is really offensive is a refusal by the Democrats, by Leader Pelosi to refuse to secure the border. So, we are committed to doing that. We're committed to ensuring that that happens. We know we have got no higher obligation, and that's the direction that we're headed in.

CAVUTO: Is it your sense then, Congresswoman, that you would have the votes in the House to get this passed, it would go to the Senate, and presumably, with the Republican edge there, it would pass?

Or do you know some of your colleagues who don't want this, come hook or crook?

CHENEY: Well, look, I mean, I think the Senate is an entirely different animal. You will have to talk to the senators about what they're planning to do with this.

But I know that we in the House take very seriously our responsibility to secure the border. I also know that the continuing resolution that the Senate passed by voice vote yesterday is not something that the president is interested in signing.

And we have said all along that we believe that we're going to be able to put something on the floor and pass it. We have actually just, as I said, passed this text out of the Rules Committee that we will do our job, fulfill our constitutional obligation to secure our border.

And I would also say, I mean, I think it's very interesting to hear Leader Pelosi continue to talk about the Republicans not having the votes. I'm amazed she's got time to focus on that, given the struggles she's having on her side of the aisle to get the votes for her speakership.

So, we're working hard. We believe in securing the border. And we're going to continue to fight for that.

CAVUTO: All right. Well, you have also heard from Nancy Pelosi, Congresswoman, who is saying that this is all on Republicans, and that this was overplayed by the president and mishandled by Republicans as well, and that it's frustrating Republicans, because they don't know where the president is on this, just like they were surprised by his decision to pull American troops out of Syria. They don't -- they don't know what's going on.

Is that a fair criticism?

CHENEY: No.

I mean, look, at the end of the day, Speaker Pelosi-to-be, presumably -- I know she's trying to be that -- Schumer and Pelosi both, they're playing games.

And the American people who are watching this all across the country know the difference between putting a bill on the floor that's going to protect the borders, that's going to fund border security, the kind of bill the president has asked for, that we support, and the kind of gamesmanship we're seeing on the Democratic side.

Unfortunately, I think it's probably a taste of what we're going to see when they're in the majority starting in January. But you can count on the House Republicans to continue to fight for what we know is right. And there's nothing more important than the security of the nation.

So I'm proud to stand with the president on this. And we're going to make sure that we can provide him with the kind of funding we know we need to secure our borders.

CAVUTO: I know you don't obsess over the markets. Only nerds like I do, who cover them here.

(LAUGHTER)

CAVUTO: One of the things that has been raised, though, Congresswoman -- I don't know if it's fair or even right -- is that we are very close to a bear market in some averages precisely because there is concern that things are just falling apart in Washington, not to mention in some once high- flying stocks, and that Republicans are getting fingered for that.

Is that fair?

CHENEY: No.

Look, Neil, I think that -- that when the American people watch the kind of games we're seeing -- you look at that meeting that Chuck Schumer and Nancy Pelosi had with the president, where they were just interested in playing games. They were just interested in sort of trying to trap the president and trying to come up with sound bites.

What we all know we have got to do is secure the border. That's what the president wants to do. That's what we know we have to do.

And so the longer that you see this threat that the Democrats, the games that they're playing in terms of shutting down the government, the more the American people are going to say, wait a second. We don't want to be in a position where you have got to threaten a government shutdown to get the border secure.

We're seeing these -- the caravans. We're seeing the extent to which people are attacking our border guards. And that is absolutely unacceptable from the perspective of our security.

So, again, I'm very proud of what we're doing, as the House Republicans. And we're going to continue every single day to fight to make sure that we're securing our border and securing our nation.

CAVUTO: All right, now, I know you're talking about a secure border, and it might be a tad apples and oranges, but do you think the president imperiled that by pulling our troops out of Syria right now, and providing an impetus for ISIS either to regroup and, who knows, some of them to get to that very border that you want to secure?

CHENEY: Look, I think they are two separate issues. I think that, right now, what we're focused on is making sure we provide the resources to secure the border.

With respect to Syria, I don't want to see us pull out. I think it would be a mistake. I think we have got to make sure that we do not allow ISIS and other radical terrorist organizations to establish safe havens. We have been down that road before. It's not a road we want to go down again.

CAVUTO: Well, it sounds like he's going to do it anyway, Congresswoman, right?

CHENEY: Well, I think, across the board, we have got to ensure that we're putting the security of the nation first.

And my view is that we shouldn't be withdrawing from Syria, that we have got to make sure that we stay there. We don't want the Iranians to be able to create a land bridge. We don't want a situation where ISIS is able to be resurgent.

But, at the end of the day, we need to be able to do both things. We have got to be able to ensure that we don't allow terrorist organizations to establish safe havens anywhere in the world, especially in the Middle East, and we have got to make sure that our southern border is secure.

And, right now, the Democrats are standing in the way both in the House and the Senate of our ability to do that. So, as the incoming chairman of the House Republican Conference, and as a proud Republican member of this body, I'm going to continue to fight on all fronts to make sure that we keep this nation safe.

CAVUTO: Congresswoman, we're learning -- I'm ping-ponging here, and you have been very patient with me, but we're learning that this revamped spending bill is going to be on the floor, presumably in the next 20 to 30 minutes.

I assume you will vote for that measure that includes some of this funding financing. But do some of your colleagues get angry, knowing that they might be working through Christmas?

CHENEY: Look, Neil, we're absolutely committed. We had a conference meeting this morning. And the sentiment in our conference meeting was absolutely that we have got to do what's necessary, that we didn't want to put on the floor a C.R. that didn't address this issue, the C.R. that the Senate sent over to us by a voice vote.

And we're committed to being here. We know how important it is. People obviously want to be able to spend Christmas with their families, but we all have a constitutional obligation. We have all sworn an oath to the Constitution. And, as I said, there is nothing more important than making sure that our borders are secure.

And so we're willing to stay here as long as it takes to get this done. And if the Democrats in the House and the Senate would stop playing games, and stop saying things like it's stupid to secure the border, then I think all of us, as Americans, could come together and do the right thing.

CAVUTO: When you say secure the border, I take it that doesn't necessarily mean a wall. It could mean these steel beams or whatever. It seems to be morphing into a different definition of something to keep our border secure.

Am I fair in saying that?

CHENEY: Yes, look, one of the things that we talked about with the president at the White House today was the different types of walls that there are. And I think it's important.

Obviously, we have got technology,. They have got walls now. There -- we call them walls, and they are walls. They have got steel slats in them. There are different forms that this can take.

But there's no question that some kind of a barrier is crucially important, and that we have got to be able to provide the resources for a wall, for a barrier, as well as resources that we need for technology to secure the border by other means.

I would also point out that the Democrats have voted for exactly this kind of thing in the past. And it only seems to be now, because President Trump is for it, that they're suddenly against it.

And it's amazing to me every time I hear Minority Leader Pelosi or Chuck Schumer or any of the Democrats talk about this as immoral or offensive. What's immoral is for those of us who are elected representatives of the people of this nation not to do our job.

And our job is to secure the border, to keep the country safe, first and foremost, so we're going to continue to fight for that.

CAVUTO: All right, Congresswoman, thank you very much, the House GOP Conference chair, Liz Cheney of Wyoming.

CHENEY: Thank you, Neil.

CAVUTO: I hope you have a merry Christmas. Hope you get home for Christmas.

CHENEY: You too. Thank you. Appreciate it.

CAVUTO: All right, we will see.

That's what we're waiting to find out here. They're going to take up this measure that will address some of the president's concerns. Remember, for the time being, it's still a Republican House. They have only days to do this before it flips into Democratic control.

So, you might call this a Hail Mary pass. You might just say it's a waste of time. Whatever. I mean, stranger things have happened and yielded the results that the party in power wants to get. So, we will simply have to see, but they're going to put this to a test and a vote.

Then there's a hurdle of getting it through the United States Senate and dodging a big old bullet right before Santa -- after this.

(COMMERCIAL BREAK)

CAVUTO: All right, I called it a Hail Mary pass.

That might have been extreme, but the Republicans' latest attempt to get what they want, what the president wants, get that wall funding, or whatever they're calling it, and then keep the government doors open, so that they're not there through Christmas, and Chad Pergram isn't there through Christmas.

He joins us right now on Capitol Hill.

What are we looking at now, buddy?

CHAD PERGRAM, CORRESPONDENT: Sometime in the next 25 to 30 minutes, we're going to have what we call the rule on the House floor. This is important.

What they have done in the House Rules Committee this afternoon is put into the Senate-passed interim spending bill $5.7 billion for the border wall and $8.7 billion for disaster assistance.

This is one jumbo package. They have married everything together. And what you have to do first of all, the reason I talk about the Rules Committee -- I know this is in the weeds, but you have to first approve a rule to get to the bill. If you don't approve the rule, guess what? You're stuck.

And then if they do defeat this rule in the next hour or two here, all bets are off. They don't have a plan and this is an embarrassment to Republicans, because this was their plan B. And guess what? It didn't work.

If they do approve the rule, then they can actually debate the underlying bill. And that's where they will have debate on that and, probably later this afternoon or in the early evening, an up-or-down vote on this new plan.

Then it would go to the United States Senate. The House and Senate at that point, Neil, are not in alignment. But we also might see where this addition could be a poison pill. Sometimes, these amendments, sometimes these changes sweeten the bill to pass it. Sometimes, it hurts it.

We will see in the next couple of hours -- Neil.

CAVUTO: All right, let's take a leap here and say, odd as this might be, it passes in the House. Then what is its next stop?

PERGRAM: Yes, it has to go to the Senate then, because the House and Senate aren't in alignment.

And they're going to need probably Democratic votes over there. We will see. Now, I think it's interesting that, last night, they had a voice vote, not a roll call vote. So you don't exactly know where everybody stands on this piece of legislation.

And this is also an effort here for Republicans to kind of put their money where their mouth is. I reported many times over the past week that Patrick McHenry, the Republican congressman from North Carolina, who's the chief deputy whip, he argued on multiple occasions that they had the votes for this. The president argued that they had the votes for this.

Nancy Pelosi, the incoming speaker of the House, told the president in the Oval Office that they didn't have the votes. And she argued that same point at her press conference this morning. So this in the next couple of hours is really going to be a make-or-break moment for the Republicans.

CAVUTO: All right, we shall see, Chad Pergram.

With us now on the phone is market legend Byron Wien.

And, Byron, we have been noticing what's been going on in the markets certainly since you and I last chatted, but the uncertainty over a lot of, I guess, uncertainties aren't helping matters any.

What do you think is going on? Are the markets reflecting on this, or are they reflecting on other stuff?

BYRON WIEN, VICE CHAIRMAN, BLACKSTONE PRIVATE WEALTH: No, the markets are reflecting on the fact that their -- investors are worried that the poor performance of the stock market is going to create a recession.

Ordinarily, the anticipation of a recession creates a bad market, but here they're putting the cart before the horse. They're assuming that the market deterioration is going to produce a recession. And, actually, there's a decline in household net worth and changing consumer attitudes.

And they're in line with that kind of thinking. But valuations have come down here to very attractive levels. Yes, I have gotten blogs from short- sellers today that say they're beginning buying. So, maybe we're getting into a position.

But the one thing we haven't had, Neil, yet is, we haven't had a real selling climax that would indicate that all of the negativism has been flushed out of the market.

CAVUTO: In other words, that capitulation you wait for.

WIEN: Right. You don't -- people -- is this a gradual decline? I mean, it is a gradual decline in price, but it's a gradual decline in terms of the level of volume. And we haven't had a complete capitulation yet.

CAVUTO: You know, Byron, the treasury secretary was on FOX Business Network earlier today, talking to our Stuart Varney, and essentially saying the markets overreacted to the Fed move, that we had Jerome Powell of the Federal Reserve saying doesn't pay attention to markets, doesn't obsess on markets.

But what are the markets telling us? I mean, because you could argue that the deterioration in wealth would have an effect certainly on the economy, if this were to keep up.

WIEN: Yes, but not everybody own stocks.

CAVUTO: True.

WIEN: Even the people who do don't pay attention to every day. It's part of our life, so we know what's going on. And it does affect us.

(CROSSTALK)

CAVUTO: So, when the Federal Reserve is making a decision, does it pay attention to the market? Or does it worry about the market? Or does it try to go away from the market, and not think about the market?

I have just noticed the administration's stance was odd, because, in ignoring the markets or saying the markets are overreacting, they're overreacting on the downside, they weren't overreacting on the upside.

I understand you like it better -- not you -- but if you're in power, you like it better when market -- when stocks are going up than when they're going down.

WIEN: Yes.

CAVUTO: But that's the catalyst for all of this?

WIEN: Well, first of all, I think the Federal Reserve did the right thing.

They raised rates because they wanted to show their -- A, show their independence.

CAVUTO: Right.

WIEN: And, two, the economy justified it -- strength of the economy, not the inflation of it.

We will see what they do next year. My guess is, they will be very dovish throughout the course of next year.

CAVUTO: Dovish means more inclined to keep rates steady than to hike, right?

WIEN: More inclined not to raise rates.

(CROSSTALK)

CAVUTO: So, let me step back on the bear market stuff that keeps coming up.

I know the Dow Transports and the Russell 2000, dominated by small company stocks, I know they're technically already in a bear market, as the Federal Funds Rate has been inching up, up, up.

And I'm just wondering, the fact the Nasdaq is within just a half-a- percentage point of the bear market, or a decline of 20 percent from its highs, it seems like the Indians move first, the chiefs follow later.

Do you worry that this just feeds on itself?

WIEN: Look, every stock has its own individual value. I can see a number of stocks that have approached that value already.

All you need is for those people who are nervous about the market to do their final wave of selling. I think that's coming soon. But it hasn't come yet. And when it comes, I think there will be a terrific buying opportunity for 2019.

CAVUTO: All right, Byron Wien, we shall see. Very good chatting again.

WIEN: OK.

CAVUTO: All right, Byron Wien, market legend, has called a lot of turns in markets, saw recessions coming when no one else did, saw bull markets coming when no one else did.

His reads on it, that maybe, maybe we're very close to that capitulation that would define a turnaround and a comeback for stocks that sorely need it.

A lot will hinge on what happens in Washington these next couple of days and this crucial vote that now is just about 10 or 15 minutes away on a measure that gives what the president wants, and presumably what Democrats would want. Don't necessarily guarantee that Democrats would vote for it.

But there are enough Republican still in power and still in control of his body for the next few days who hope it will -- after this.

(COMMERCIAL BREAK)

CAVUTO: I don't think a lot of these folks at Chicago O'Hare International Airport are fretting too much about stocks.

They're fretting more about flight delays and all and just getting home, with a massive storm meant to delay flights. It could be messy -- after this.

(COMMERCIAL BREAK)

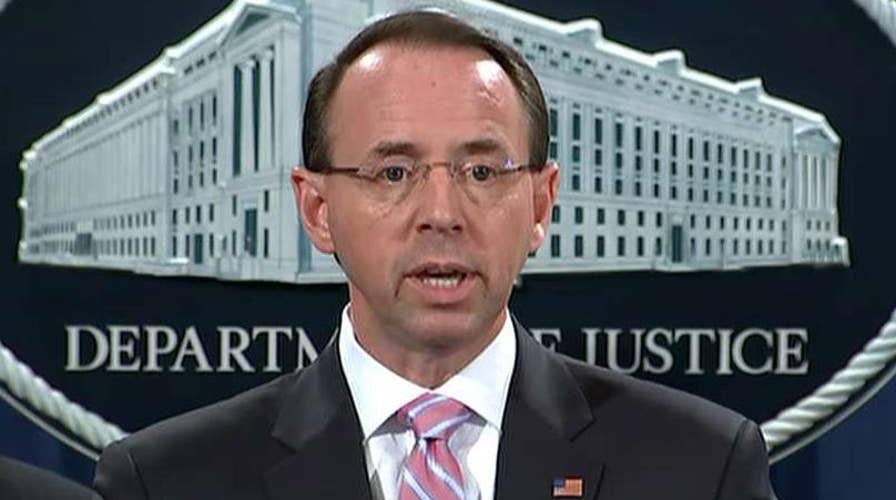

(BEGIN VIDEO CLIP)

ROD ROSENSTEIN, U.S. DEPUTY ATTORNEY GENERAL: Bill Barr will be an outstanding attorney general when he's confirmed next year.

The memo that you made reference to reflects Mr. Barr's personal opinion. And he shared his personal opinion with the department. Lots of people offer opinions at the Department of Justice, but they don't influence our own decision-making.

(END VIDEO CLIP)

CAVUTO: All right, that was a slap on the back and a big support from Rod Rosenstein for the guy the president wants to make his next attorney general, Bill Barr.

But there is, according to Barr's critics, a problem with all of this in a certain memo that raises questions whether there's an instant conflict of interests.

George Washington University constitutional law Professor Jonathan Turley on that.

What's the issue right now, Jonathan?

JONATHAN TURLEY, CONSTITUTIONAL ATTORNEY, GEORGE WASHINGTON UNIVERSITY: Well, individuals like Senator Schumer have argued that, because Barr in this memo questions the basis for the obstruction allegation against President Trump and firing former FBI Director Comey, that he's in some way conflicted, because he established in advance that he opposes the investigation.

That's simply not true. Schumer goes further and says it shows that he believes the present is above the law. That last statement is remarkably reckless and unfair to Bill Barr.

He says in the memo that there are various grounds upon which the president can be charged with a crime. He lays out that he believes that those types of investigation should go forward.

He is primarily addressing a small provision that he believes would have to be used to make out a case involving the Comey firing. And Barr is a lawyer's lawyer. He doesn't get into all of the spin. He's interested in how you make a prosecution case and what it would do to the Justice Department in terms of its previous policies.

That's what this memo goes to. And he's saying that this type of theory would stretch this provision to its breaking point

CAVUTO: I'm just wondering if it would be the ultimate irony if he would have to recuse himself on any matters having to do with this that bedeviled, obviously, Jeff Sessions.

TURLEY: Well, first of all, the same ethics people that suggested, correctly, in my view, that Jeff session should recuse himself came to the opposite conclusion on this memo.

The ethics experts at the Justice Department said that this is not disqualifying for Barr to serve in this position. But it's just facially ridiculous to suggest that.

What Barr is raising in great detail is the type of problem the some of us have been talking about for over a year, that people keep on referring to obstruction, like it's obvious that a criminal case could be made because you fire James Comey. It's not.

Obstruction is a crime that has elements. It has cases of precedent. And what really Barr's addressing in 19 single-spaced -- in a 19-page single- spaced letter is that there is a disconnect between that theory and the history and purpose of this provision.

CAVUTO: So, the configuration of the new Senate will be 52-48 Senate, ostensibly, with Republicans picking up, right?

So, as things stand now, is there anything that would get in the way, assuming the president sticks by him, of his getting the votes to be the next attorney general?

TURLEY: Well, as you know, in this city, it's dangerous to make any predictions.

But I would be flabbergasted if Bill Barr didn't get through easily. He is the perfect nominee for these times. He's -- the agents love him. He's a stabilizing force. And he's not going to be anyone's stooge.

She's not going to spend his entire career in prestigious, celebrated positions to throw it all away. His interest in going to the Justice Department is to try to bring greater stability to that department. He has a really profound connection to the Justice Department.

CAVUTO: All right, Jonathan, thank you very much, Jonathan Turley.

TURLEY: Thank you.

CAVUTO: All right, we will be watching that closely.

Also watching this imminent vote in the House. I called it a Hail Mary pass. Others are saying that it's a waste of time, still others wondering whether the Republicans, still in the majority in the House for another few days, even though a good many are not there, have the votes necessary to get it through there, ultimately get the president and his funding for the wall, and keep the government lights on.

It is a tall order, but Republicans think they have the votes to make it happen. We will find out within minutes.

Stay with "Your World."

(COMMERCIAL BREAK)

CAVUTO: All right, well, Santa might be able to cut through whatever Mother Nature throws at him. Traditional planes and trains and automobiles, that's another matter.

And to FOX News' Mike Tobin at Chicago's O'Hare International Airport, with people trying to get out of town and get home for the holidays ahead of what could be a big storm -- Michael.

MIKE TOBIN, CORRESPONDENT: Yes, it's not looking good, Neil.

And we're going to have some -- we're going to have some weather delays here in the States, but nothing like the travel snares they have overseas in London. A couple of drones made their way out over the runway out, above the runway at Gatwick, forcing a shutdown.

Of course, you could have a deadly impact if you had a collision between a drone and an aircraft. But the immediate result is tens of thousands of people who are stranded. According to the BBC, the shutdown at Gatwick is going to remain at least into Friday.

So you have got a lot of people stranded over there, a huge travel problem. The operators of the drones have not been apprehended. And at this stage of the game, police are not making a connection to terrorism.

Now, back here in the United States, let's talk about the weather. And it's not good. You got some 46 million people who are expected to fly this holiday period, and they're probably going to be delayed by the weather. You have got big windy storms on the West Coast stretching from Northern California up into the state of Washington, big windy storms on the East Coast.

You might even have some tornadoes in the southeast portion of the state. Also, the ground out there is already saturated. So AccuWeather says that some coastal flood watches are in effect as a result of these rains. And the rain is going to go all the way up into big transportation hubs like D.C., New York, Boston.

So keep an eye on your apps. That's really the best way to learn about the flight delays, even though you usually -- you usually learn about them after you're already in the airport.

And some of that rain is going to turn into snow when it hits the cold air coming off the Great Lakes, to the east of the Great Lakes. You're going to have snow stretching all the way into places like West Virginia. It is going to cover a lot of the interstate.

So you have got 102 million people who are expected to travel this holiday weekend. AAA is estimating they're going to rescue about 960,000 of them. With that in mind, keep an eye on the forecast. Keep yourself an emergency kit, particularly a cold weather emergency kit.

And, of course, just like your dad always told you, make sure the car is in good working order -- Neil.

CAVUTO: All good advice, my friend. Thank you very much, Mike Tobin, at O'Hare International Airport.

TOBIN: You got it.

CAVUTO: So, we will keep an eye on that and the big commute home to be there in time for Santa.

And then, of course, the shutdown in Washington that they're desperately trying to avoid. It might be a herculean task today, but what they're about to vote on minutes away would do that. The question is, who would vote for that?

After this.

(COMMERCIAL BREAK)

CAVUTO: All right, on the left of my screen here, we're looking at what's going on in Washington, D.C., right now, where the House is debating a measure that they hope will pass that calls for the $5 billion the president wants for wall funding, tying it as well to a number of other things that Democrats would want as well.

I could get into the weeds here. Suffice it to say this is a last opportunity here, a gambit, if you will, to keep the government open past Friday. And it's anyone's guess how it would go, because, even if it passes the House, then it would have to go to the Senate. No guarantees there, even with the Republican majority, that it would pass there.

With me now is the former CKE Restaurants CEO Andy Puzder.

Andy, we do this with the backdrop of markets selling off, concerns about whether the bull market has lost some steam here, whether the uncertainty around things like this and the prospect for interest rates in the next year, a lot of, a lot of uncertainty out there.

And it's rattling folks. Are they over-rattled, or what?

ANDREW PUZDER, FORMER PRESIDENT & CEO, CKE RESTAURANTS: Yes, well, number one, people are over-rattled. And we can come back to that.

But, number two, the shutdown, you really -- you really can't -- you really can't put the country's national interest at risk here because of what's going on in the stock market.

This is a national security issue. Schumer, Pelosi, Bill Clinton, Barack Obama were all in favor of increasing border security, even voted for a wall on the border. I know Schumer did for sure.

Now they're playing politics with it. It's because President Trump wants to do it that the Democrats are broadly opposed to it. That has to stop. Our national security is at risk. What the president's doing is right. That's the correct thing to do. And, though it may shake up the market, he still needs to do this.

As far as interest rates, look, we have raised -- the Fed's raised interest rates eight times in 24 months. That's once every three months during the -- that's since the election in November of 2016.

Prior to that election, when Obama was president, they raised interest rates once. Now, they need to raise them. They need to go up, so they have got an arrow in their quiver if we have another recession. But they're going up too fast. There's been too many increases.

I'm not at all surprised that the market is reacting. I think it's overreacting. But I'm not surprised it's reacting this way.

CAVUTO: Do you think any of this is on the president?

And, obviously, he liked them going up. And now they're going down. We know no president likes that. But is any of that on the mixed signals he has been sending, certainly regarding the Federal Reserve, regarding about what he wants to do with our troops in Syria that's rattled some folks, just that he's kind of all over the map?

PUZDER: I think that what the president's doing can have an impact on the market. I think the China trade has an impact.

I think that these are impacts that wouldn't be as significant, but for what the Fed's doing. I think the real impact here is the Fed. And if you look -- you look at the market before the Fed announced the interest rate increase and wasn't -- indicated wouldn't be as accommodative next year as people expected it to be, that's when you saw this huge drop in the market.

I mean, it's -- this is -- the Fed is driving this. And it -- and I don't think the Fed should design policy to the point where they're -- they're being driven by what the market wants, but I do think they need to look at economic growth. And what they're doing could have a negative impact on this -- this really strong, strong U.S. economy that we have.

And we would all hate to see that. I think that's a bigger danger than what's happening in the stock market.

CAVUTO: Right.

I understand you pointing a finger at the Fed. Many have and all. But a lot of it does go back to the president.

The only reason I say on the trade policy, which might be welcome, to get tough with China, but that that, too, is playing into this, and the trade stuff and the threatened tariffs and the rest are materially affecting the price of a lot of the goods that are at play here, and, by extension, our markets.

PUZDER: Well, they -- they -- there has been some impact on goods. It hasn't been a substantial impact.

I mean, inflation is not going up in any -- to any significant degree. Part of that's the fact that oil is so low.

CAVUTO: Right.

PUZDER: But the reality is, we export to China about $130 billion worth of goods a year. That was for last year, 2017.

You look at our $21 trillion economy, that's about half-a-percent. It's almost a rounding error. So -- and if you -- if you reduce imports, that actually improves GDP.

So, if we're importing less from China -- we import about $506 billion from China -- that would actually improve GDP.

CAVUTO: All right.

PUZDER: But all we're going to lose on export -- the maximum we can lose is $130 billion. I think the president knows that. I think the Chinese know that. I think they're going to come to an agreement.

I do think that impacts the market, but I don't think it impacts it anywhere near the amount that the Fed does.

CAVUTO: All right. We shall see.

Thank you, my friend. Hope you have a merry Christmas, Andy Puzder, the former CEO of rMD-BO_CKE Restaurants.

PUZDER: You too, Neil. Thank you.

CAVUTO: What is amazing about him, he worked the fast-food industry for decades, didn't gain a pound.

(LAUGHTER)

CAVUTO: I dislike that. Not him.

Anyway, more after this.

(COMMERCIAL BREAK)

CAVUTO: All right, we got a tweet from the president on this back and forth that you're witnessing on the House floor right now for a measure that will keep the government doors open, or so they hope.

"Democrats," he says, "it's time to come together, put the safety of the American people before politics. Border security must become a number one priority."

Democrats, of course, say this isn't that measure. Republicans say this is precisely that measure.

Chad Pergram, where do we stand right now?

PERGRAM: Well, right now they're debating the rule, which you have to get the rule through first, in order to put the underlying piece of legislation on the floor.

If the rule vote fails -- in other words, that sets up how you're going to play ball today in the House of Representatives -- if the rule vote fails, then this new revamped plan is toast.

If they're able to get through the rule, then you have general debate on the bill, and then you would have an up-or-down vote on the retooled package with $5.7 billion for the border wall, 8.7 for disaster relief, and then they send it back across Capitol Hill to the Senate.

Now, the Senate passed a different bill last night. Now, here's the problem in the Senate. If you get it through the House, and that remains to be seen, you're going to need 60 votes to overcome cloture to end a filibuster there.

The only option where you wouldn't have to have closure is if you just flush it back to the House of Representatives. In other words, you could see a scenario where somebody says, all right, we don't have the votes there. We can't accommodate this and just send it back. You don't need 60 votes for that.

But, otherwise, you would have to get 60 votes. And what does that mean, Neil? You need Democrats. And they are not going to vote for border wall funding at this point.

CAVUTO: All right, so let me understand this. If this fails, the government will almost certainly shut down tomorrow night, right?

PERGRAM: Right, unless they come up with another plan.

Now, what would pass is a bill that moved through the Senate yesterday with the help of Democrats. That can pass. Then the $64,000 question is, does President Trump again, for a second time, go back on his promise to shut down the government, to veto something?

That's President Trump twice going back and forth on what he had said previously. And then he starts to get into a real political problem there. And that would probably even inflame his base even more if he goes back on this promise.

CAVUTO: All right, so he can deal with the wrath that might be out there if the government is shut down through the Christmas holiday, right, because it's not as if anyone would run back to town or stay in town to cobble something together, right?

PERGRAM: Well, they very well could.

I mean, I think the Democrats, even if Republicans were to say, look, we can't pass anything, let's punt to January, Democrats would probably be here every day trying to win that optics argument, especially if the president goes off to Mar-a-Lago.

Keep in mind that the federal government has to process paychecks on the 24th. They would go out on the 28th. And those nine federal departments for federal workers who don't get money, they wouldn't be being paid at Christmastime.

That's an optics problem for the president, especially if he's in Florida.

CAVUTO: But, real quickly, it's not a full government shutdown, whatever the case?

PERGRAM: That's right. They have approved about 75 percent of the money, five of the 12 bills.

CAVUTO: All right, buddy, thank you very, very much.

As long as you're working through the holidays, I just feel better about that.

All right, my friend, Chad Pergram.

That's where we stand now. This is an uphill battle, but the Republicans are going to give it the good fight, and see where they stand. Even if they pass in the House, this good fight, it's anyone's guess from there.

"The Five" is now.

Content and Programming Copyright 2018 Fox News Network, LLC. ALL RIGHTS RESERVED. Copyright 2018 ASC Services II Media, LLC. All materials herein are protected by United States copyright law and may not be reproduced, distributed, transmitted, displayed, published or broadcast without the prior written permission of ASC Services II Media, LLC. You may not alter or remove any trademark, copyright or other notice from copies of the content.