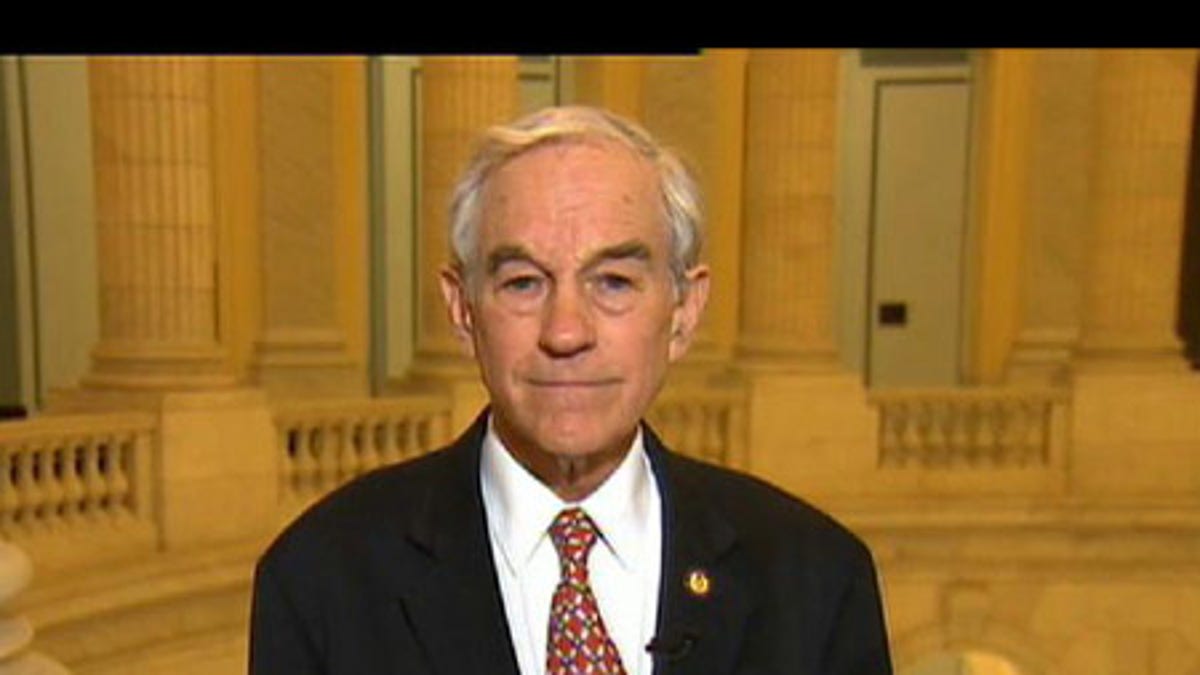

Rep. Ron Paul, R-Texas (FNC)

This is a rush transcript from "Glenn Beck," December 9, 2009. This copy may not be in its final form and may be updated.

GLENN BECK, HOST: We have Ron Paul, congressman from Texas. Hello, congressman. How are you, sir?

REP. RON PAUL, R-TEXAS: I'm fine. Thank you.

BECK: Tell me the latest. You have this bill. You've been trying since 1983 to audit the Fed. Tell me the latest on the audit the Fed bill. This is breaking news.

PAUL: OK. Last week — yes, last week we got that put into the reform package, which is a very, very complex group of regulations that aren't going to be good for the economy at all. But the good part of the audit bill got put in there.

But today, we were supposed to have — we were supposed to be, right now, in the middle of a three-hour debate for that bill, and then go into the amendment process tomorrow and finish it up tomorrow.

But all of a sudden we went into recess and they're arguing now in the Rules Committee, because some moderate Democrats are saying they're not satisfied with it.

There are some Democrats that think they have gone just too far and they are getting a message from, I guess, some of their people at home.

BECK: Good.

PAUL: And they can win some of these votes if they're brought to the floor. Of course, they wanted to bring this to the floor without any amendments or a very few. But now, there is a little rebellion going on and it's very healthy, I believe.

BECK: OK. Congressman, I want to ask one question. I haven't heard anybody explain this: AIG, the insurance giant — the treasury, gave money, right, to AIG?

PAUL: Right.

BECK: We bailed them out.

PAUL: Right.

BECK: We think, somehow or another, the Fed is funding, so they gave it to AIG. And then, what happened was AIG was getting pressure. You've got to pay some of this money back. So what they did was they took two companies and sold them to pay this money back that they got back from the Treasury.

So they took that money from the sale and gave it back to the Treasury. But what they sold these two companies to is the Fed. This circle here of money just being flushed in a giant circle seems like a — oh, I don't know — something you would go to prison for if you tried this in the private sector.

What is going on here, Congressman?

PAUL: Well, shenanigans, and that really makes the point of why we need to audit and find out what the Fed does.

Also, some of the banks are paying it back. They don't want any restrictions on salaries and everything. So all of a sudden, they're very rich and they're putting money back.

But what they're probably doing is borrowing money through the discount window of less than one percent. And you know, it's a carry trade: They put their money in a treasury bill or something else making a percent or two more.

And all of a sudden, the banks have regained all those losses. But like you say, they have churned it and it is literally money coming from the Fed, which is indirectly coming from the taxpayer.

BECK: When we come back, more with Ron Paul. And I'm going to explain this chart. It's going to chill you to your core. Next.

(COMMERCIAL BREAK)

BECK: Back with Congressman Ron Paul of Texas who is trying to audit the Federal Reserve which should absolutely be done. They will come up with all kinds of excuses not to do it.

I want to show America this chart here, Congressman. I'm sorry you're at a disadvantage. You can actually see it, but it is debt trajectories — debt to GDP.

Here is Luxembourg. Here is Switzerland. The only ones going up — New Zealand is coming down. Austria, Germany is here. France is here.

But here is the USA. Look at the trajectory on debt to GDP. We're now being talked to about possibly losing our Triple A status. I know when I talked to you two years ago — maybe even three years ago — everybody said that was crazy. We'll never lose it.

They said that a year ago that that's crazy. Now, it is starting to look more and more like a possibility. What does that mean to the average person?

PAUL: I think it is very serious and it means a whole lot that they're willing to admit what has been, you know, a reality for a long time. Because the Triple-A rating really doesn't mean anything, because nobody really invests in bonds.

What individual would buy a 20-year bond since they have money for their kids and, you know, in 20 years to send them to college? Nobody does that.

So all this rating is a gimmick. And if these gimmicks can be overcome, and even the Moody's rating system drops it, that means really, really bad news.

That means the dollar is in big trouble. But you know, the whole idea that these bonds are really worth something right now, it is only because the Fed can create credit and make deals with foreign governments and foreign central banks and push money into banks and say, buy up this debt, keep the interest rate low.

It is all a gimmick and they're raking off the profits. So I'm surprised that the rating hasn't gone down a long time ago, is all I saying.

BECK: Let me just say this. If you support audit the Fed, now is the time to call your congressmen, because they are talking about it even tonight. I want to talk to you one more thing about the EPA.

Yesterday, the EPA came out and said, if you guys don't do something in Congress with cap-and-trade, we will. Sir, isn't it true that the Constitution — you're in charge. Can't Congress just say, well, then, we'll just disband you or we'll create a law that says you can't do that?

Is Congress irrelevant?

PAUL: Yes. They are, because all haws are supposed to be written by the Congress. But every regulation written by the administration for 100 years, you know, is illegal and unconstitutional. It just is so blatant. Congress didn't act fast enough so we'll write the law.

BECK: All right.

PAUL: And you know, just think of executive orders. Those are laws, too. They are completely unconstitutional.

BECK: Keep up the fight. Thank you very much.

Content and Programming Copyright 2009 Fox News Network, LLC. ALL RIGHTS RESERVED. Transcription Copyright 2009 CQ Transcriptions, LLC, which takes sole responsibility for the accuracy of the transcription. ALL RIGHTS RESERVED. No license is granted to the user of this material except for the user's personal or internal use and, in such case, only one copy may be printed, nor shall user use any material for commercial purposes or in any fashion that may infringe upon Fox News Network, LLC'S and CQ Transcriptions, LLC's copyrights or other proprietary rights or interests in the material. This is not a legal transcript for purposes of litigation.