Next time you're tempted to complain about baseball player salaries, consider this:

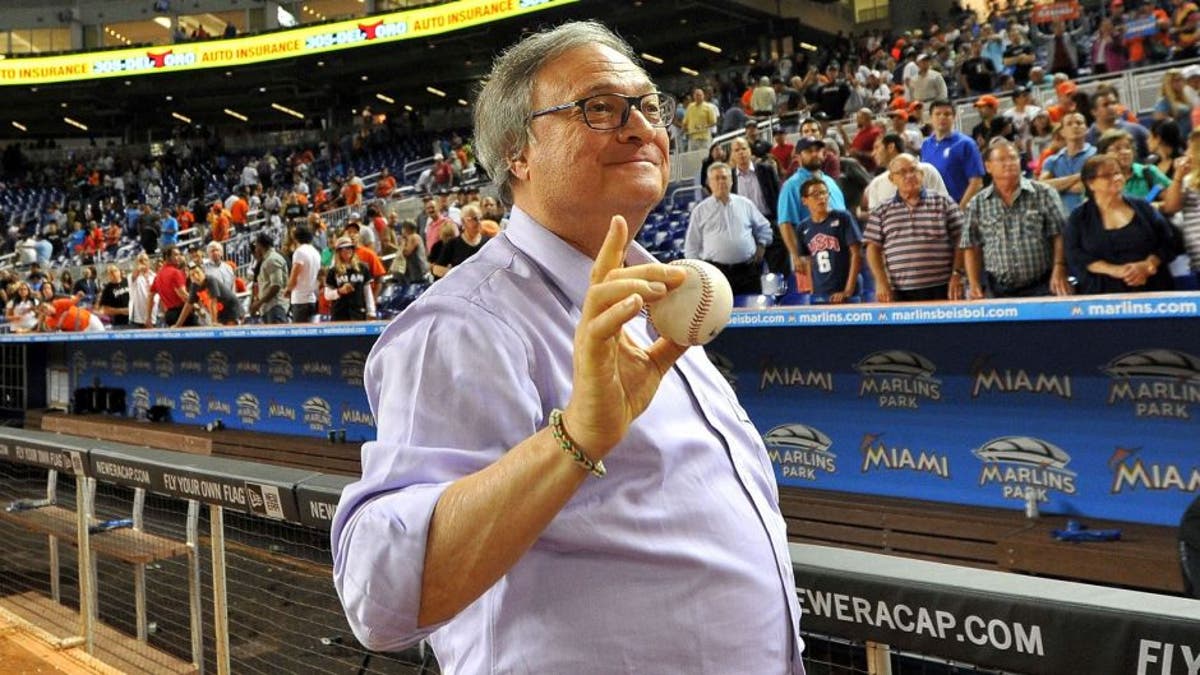

Jeffrey Loria bought the Marlins in 2002 for $158.5 million. Fifteen years later, he might sell them for $1.6 billion.

That's a 912 percent increase in less than 15 years, and the strongest possible evidence imaginable of how lucrative owning a major-league team can be.

The Marlins' sale -- a handshake agreement, according to Forbes -- is far from complete. The final price might not be $1.6 billion. But rest assured, if the unidentified buyer fails to complete the purchase or secure baseball's approval, Loria will find some other eager investor to meet some outrageous price.

Annual revenues are one thing, and the owners are doing just fine in that regard. But the real money is in skyrocketing franchise values -- a deal by Nintendo to sell most of the ownership of the Mariners to a group of minority owners last April placed the value of the team and its majority share in a regional sports network at $1.4 billion.

Are the Marlins, less than a year later, worth more than the combined value of the Mariners and their RSN? Seems doubtful, but that's a question for keener business minds than mine.

The Marlins in 2012 moved into a new $639 million ballpark funded mostly by Miami-Dade County. They are likely to land a new local television contract before their current agreement with FOX Sports expires in 2020.

Oh, it's good to be an owner.

Granted, it's also good to be a player, but the most recent collective-bargaining agreement, with its modest increases in luxury-tax thresholds, already seems to be stifling salary growth.

The sale of the Marlins for $1.6 billion, or even a lesser but significant sum, would only reinforce to the players that they should be getting more, setting the stage for labor friction in the future.

That's a story for another day -- a day when Loria will be on a beach somewhere, rejoicing over his investment for the ages, counting his money.