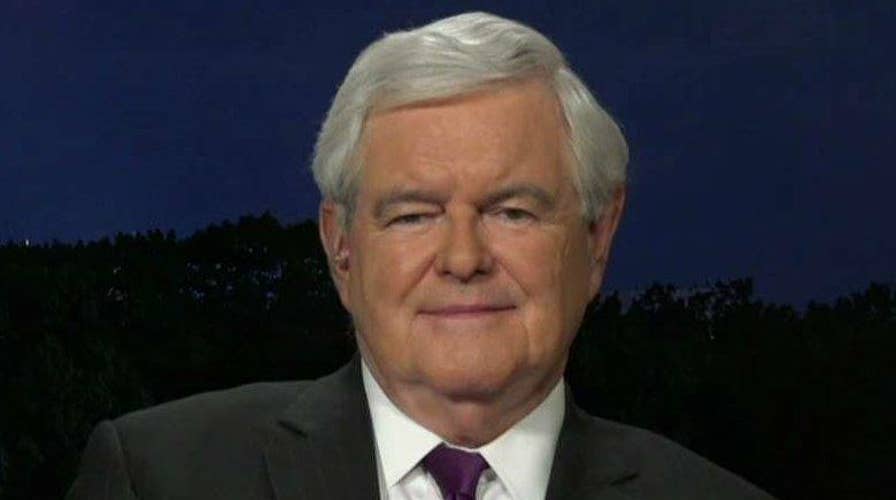

Newt Gingrich calls for GOP to focus on deep tax cuts

Former House speaker goes on 'Hannity' to weigh in on GOP agenda, revelation that Trump did not tape Comey

At the end of last month, I launched a multi-part series on the 2017 Republican tax cut bill. My first piece focused on the importance of making the tax cut bill deficit neutral rather than revenue neutral in order to achieve real economic growth.

Today, I would like to continue the series by detailing the second critical piece of legislation needed in the bill: Cutting the corporate tax rate from 35 percent down to 15 percent.

Over the last several decades, the United States has built one of the most anti-business tax systems in the developed world. As I explain in my #1 New York Times bestselling book, "Understanding Trump", this has resulted, in historically slow growth for our country. The first three months of 2017, the U.S. economy saw only 1.4 percent in annualized growth.

A main driver of this sluggish growth is the unusually high rate at which the American government taxes business. When you combine the 35 percent federal business tax with the average state tax rates, the United States business tax rate is 38.92 percent, according to the Tax Foundation. This is the highest business tax rate in the developed world – and the third-highest overall.

To put this in perspective, the average business tax for 188 tax jurisdictions analyzed by the Foundation is 22.5 percent. This puts us at a serious disadvantage for attracting new businesses to our country – especially manufacturers.

Why would a business come to the United States and pay the third-highest corporate tax in the world, when it could go somewhere in Europe, where the average corporate tax is even lower, at 18.8 percent?

On the same note, why would a manufacturer stay in the United States, when it could move its operations to a place like Macao, in Southeast Asia, where it will be taxed 12 percent for business profits?

Traditionally, placing an exorbitantly high tax on something is the government’s way of convincing people not to buy or produce it – think cigarettes, sugary soft drinks, or air pollution. This technique is typically called a “sin tax.” In the case of a high corporate tax rate, the United States is effectively trying to dissuade business and economic growth. It is lunacy.

Bringing the corporate tax rate down to 15 percent is the simplest, fastest way to jumpstart business activity in the United States – which will also create and protect millions of jobs.

Critics of this plan – mainly the Left and Washington elites – say cutting business taxes by more than half of what they are currently will force the federal government to increase taxes elsewhere or cut supposedly vital programs to make up for the loss of revenue.

This is simply false.

Cutting the tax on business will create more businesses, which will create more jobs and higher wages and drastically improve growth. All of this economic activity will generate more revenue for the government, not less.

When we passed the Reagan tax cuts, which were the backbone of the growth of the Reagan era, federal revenue increased from $517 billion in 1980 to a staggering $909 billion in 1988. This effect is explained by the Laffer Curve, which was named for Reagan’s economic advisor, Art Laffer.

The Laffer Curve shows that there is an optimum point for tax rates and production. If taxes are too high, fewer businesses will be able to make profits, impacting their ability to grow, and causing economic activity to decrease. Businesses that do not make big profits pay far fewer – or zero – taxes. But if tax rates are set at a level that encourages businesses to thrive, government revenues can also grow, creating a virtuous cycle of success.

Cutting the tax on American businesses is clearly a necessary step to pull our country out of economic malaise, and it’s also necessary, politically, for Congressional Republicans.

If, in 2018, America has drastically more jobs, workers are earning higher wages, and economic growth is approaching 3 to 4 percent levels, Republicans will make huge gains in the House and the Senate.

If this strong American economy continues into 2020, then Republicans will keep the White House, too.