Fox News Flash top headlines for March 9

Fox News Flash top headlines are here. Check out what's clicking on Foxnews.com.

Markets are more flexible, more innovative, and move faster than the government. Still, repeatedly over the years we have seen the government decide to take antitrust action against innovative private companies, only to realize years later, as the markets in question matured, just how costly and counterproductive such moves truly were.

Now, as Yankees catcher Yogi Berra once said, it’s "déjà vu all over again."

In the 1960s, government antitrust lawyers at the Department of Justice targeted IBM. "Big Blue" was sued under the Sherman Antitrust Act, with the feds claiming it attempted to monopolize the market for "general-purpose digital computers."

Embarrassingly, a cottage industry of personal computers was coming into the computer market at the time, making IBM far from the only game in town. The case, however, lingered for more than a dozen years until, on January 8, 1982, the Department decided it lacked merit.

Democrats are attacking the proposed merger between JetBlue and Spirit Airlines.

In the 1990s, the Clinton administration targeted Microsoft for offering its Internet Explorer browser as part of its operating system, a move the Justice Department found unfair to Netscape, which at the time was its leading competitor. Today, neither browser exists. The market moved on despite government efforts to constrain it.

More recently, a federal court in 2018 threw out the government’s case against the AT&T-Time Warner merger, reflecting the reality that the idea of a cable company having a viewer monopoly was laughable, considering that YouTube, satellite TV, Netflix, Roku, and others were all competing for the attention of the viewing public.

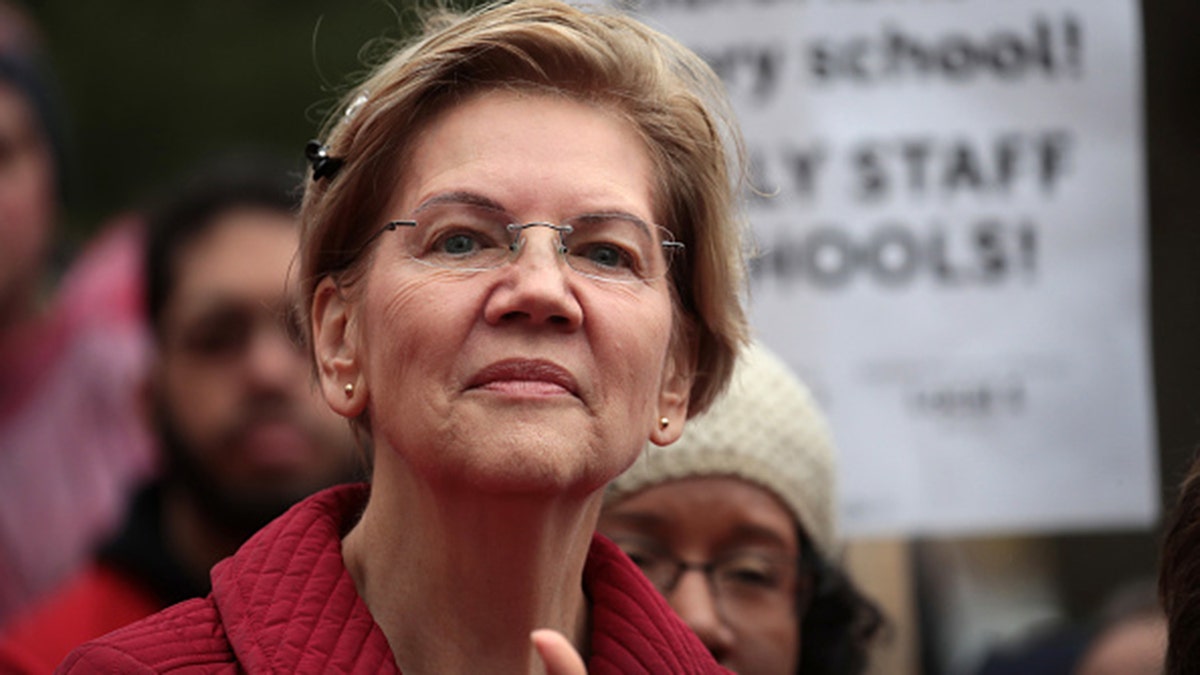

Today, we are witnessing this same antitrust folly repeating itself, with Sen. Elizabeth Warren, D-MA, attacking the proposed merger between JetBlue and Spirit Airlines, and now, Attorney General Merrick Garland filing a lawsuit to stop the proposed business deal.

In a recent letter to the Department of Transportation, Warren declared her opposition to the merger, because "the four largest airlines—American, Southwest, Delta, and United—control 80% of the domestic market, more than at any point in the modern history of commercial aviation" and the "proposed JetBlue-Spirit merger is just the latest threat to consumers in this long string of mergers."

On Tuesday, March 7, Garland brought the full weight of the Justice Department to bear in support of Warren’s misguided position.

It is difficult to look at all this without concluding that their approach, if successful, will simply protect the four largest airlines from competition by lower-cost carriers.

JetBlue’s proposed acquisition of Spirit, which will give the new company less than 10% of the industry’s market share, is designed to provide the company with the added scale it needs to better compete against the Big Four. It will increase the number of flights in JetBlue and Spirit’s current routes and add more flights in areas that the legacy carriers currently hold, thereby increasing choice and lowering prices.

And there’s a factual history here.

Sen. Elizabeth Warren is leading the charge to halt a major airlines merger. (Photo by Scott Olson/Getty Images)

Over the last two decades, airline customers have watched JetBlue, which is always near the top of the pack for airline customer satisfaction, successfully do both things – increase choice and lower prices.

An MIT study found that JetBlue’s initial foray into the market had reduced airline fees by an average of $32. Even the Justice Department has conceded that "JetBlue’s reputation for lowering fares is so well known in the airline industry that it has earned a name: the ‘JetBlue Effect.’"

CLICK HERE TO GET THE OPINION NEWSLETTER

Warren’s credo, and now the policy of the Biden administration, that the federal government must stop every company from becoming bigger is a relic of the so-called "Progressive Era" of the late 19th and early 20th centuries. The notion that "big is bad" as a principle of governance should have died with that anti-free market era.

Back then, politicians began demonizing the trusts for increasing their market shares. While there clearly were some problem actors, in many cases the so-called "trusts" brought market prices down to record lows. Government regulators targeted them anyway, with a hammer they continue to wield a century later against companies for the mere act of growing larger.

Today, we are witnessing this same antitrust folly repeating itself, with Sen. Elizabeth Warren, D-MA, attacking the proposed merger between JetBlue and Spirit Airlines, and now, Attorney General Merrick Garland filing a lawsuit to stop the proposed business deal.

While serving as a member of the House Judiciary Committee, the litmus test I used when analyzing antitrust matters was simple – if the merger benefited consumers, it deserved support it, and if it jeopardized their welfare, it did not.

CLICK HERE TO GET THE FOX NEWS APP

Sadly, the Justice Department has decided not to employ this same equation in concluding that JetBlue should not be allowed to increase its market share to a modest 9% so it can more efficiently compete with the big boys that control 80% of the airline industry.

If Garland succeeds in this anti-free market move, it will be the traveling public that will pay the price in higher airfares and diminished service.