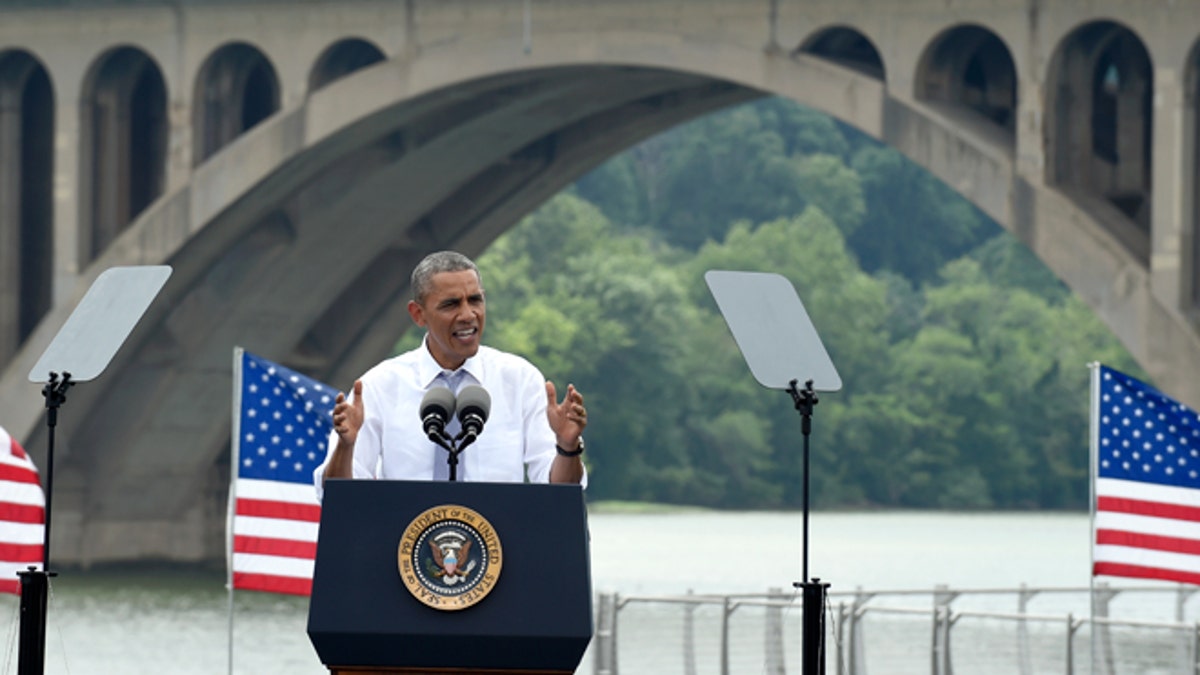

July 1, 2014: With the Key Bridge, linking Washington and Northern Virginia in the background, President Barack Obama speaks about the economy and transportation, at Georgetown Waterfront Park in Washington. The president said 700,000 jobs could be at risk next year if Congress doesn't quickly agree on how to pay for highway and transit programs. (AP Photo/Susan Walsh)

During the 2011 debate over President Obama’s American Jobs Act, which sought to subsidize local government jobs with hundreds of billions of federal tax dollars, Vice President Biden suggested that without Washington’s aid cities would sharply reduce police protection and violent crime would soar. Republicans killed the expensive bill anyway, and no such rise in crime occurred.

Now, in what has become a familiar pattern, the Obama administration is again warning of steep consequences, this time if Republicans in Congress fail to raise billions of dollars in new taxes to bolster the federal Highway Trust Fund. Transportation Secretary Anthony Foxx even claims that without the money, America will become “a slower, less safe nation."

[pullquote]

But if the Obama administration were truly worried about road safety, then it would put a greater priority on reforming the bloated highway financing program to be more effective with the money Washington already spends on everything from mass transit to urban bike paths to overpriced union labor.

The trust fund, which receives about $35 billion a year in gas tax revenues, has been slowly running out of cash because Washington spends billions more than that on transportation projects, including some of questionable value. The Obama administration wants about $200 billion for transportation spending over four years and has proposed taxing foreign operations of American companies to generate extra revenues. Other Democrats have suggested raising the nation’s gas tax.

The trust fund is a legacy of The Federal Highway Act of 1956, which authorized the construction of the nation’s interstate highway system. The fund was President Eisenhower’s way of assuring Americans that fees generated by taxes on gasoline would be dedicated to highways and bridges.

Although the states, with federal funding, largely completed the interstate highway system years ago, the trust fund lives on, and Congress has expanded its mission. For instance, about $8 billion a year from gas taxes finances urban mass transit, under the dubious proposition that this spending somehow reduces congestion for motorists.

In fact, after 30 years of federal subsidies paid for by gas taxes, mass transit’s share of commuting has fallen, according to a study by transportation expert Wendell Cox. One reason is that only a handful of cities like New York and Chicago have enough concentration of employment in business districts to attract enough transit users to make a difference in traffic.

Money spent elsewhere on everything from light rail to express bus service has accomplished little, but it has all helped to drain the transportation trust.

Congress also forces states to dedicate a percentage of the highway dollars to projects that encourage “alternate” transportation favored by environmentalists, including bike lanes, recreational trails, and pedestrian walkways. In 2014 the federal government designated $820 million for such projects even while the Transportation Secretary claimed our roads risk becoming less safe without more money.

Washington also obliges states to comply with the union-friendly Davis-Bacon Act, which requires that they pay the equivalent of union construction wages on transportation projects using federal dollars. One 2008 study by the Beacon Hill Institute estimates that Davis-Bacon increases construction costs by nearly 10 percent. Since states often mix federal funds with their own spending, repealing Davis-Bacon could free up $5 billion to $10 billion a year in additional spending on transportation.

The Obama administration shows no interest in such reforms, however, because they would anger its union and environmental allies in an election year. Sen. Ron Wyden, (D-Ore.), has proposed instead a short-term bailout of the trust fund by doubling the tax on heavy vehicles, part of legislation that contains proposals unrelated to transportation, including tightening mortgage interest reporting requirements.

Republicans object to new taxes and have suggested instead a short-term fix in the form of a controversial fiscal maneuver known as pension smoothing, which would allow companies to contribute less to their retirement funds next year, boosting profits and tax collections without actually raising tax rates.

The real solution may lie with giving states more freedom over current funds. Since 1956 states have performed virtually all highway construction, and today they finance most of it with only an assist from Washington. State politicians should demand that the federal government not tie so many expensive, politically-motivated strings to the gas tax money it collects from riders who use state-built roads.

Freeing up the states to make their own decisions on what to build, and how to build it, would be a far better alternative than continuing to have the federal government drive our local highway infrastructure into the ditch based on priorities dictated by Washington.