The US saw an economic boom with Trump tax cuts: Steve Moore

'America Reports' panelists Steve Moore and Robert Wolf discuss the impact of allowing the Trump tax cuts to expire.

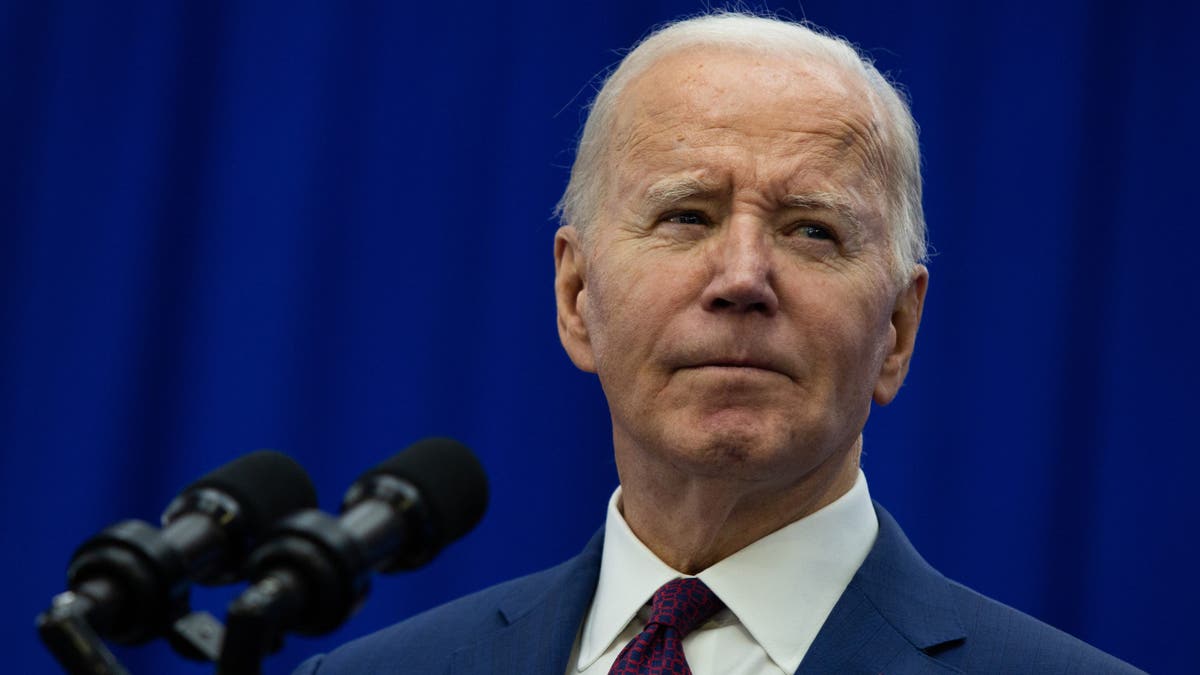

In a recent post on X, President Biden stated, "Donald Trump was very proud of his $2 trillion tax cut…. That tax cut is going to expire. If I’m re-elected, it’s going to stay expired." I’m unsure who writes these tweets for the president, but I hope it’s not anyone on his economic team – because this is just wrong.

Biden’s $2 trillion shortfall claim apparently originated in a May 2020 Tax Policy Center article. The article reported that, in late 2017 and early 2018, the Joint Committee on Taxation (JTC) and the Congressional Budget Office (CBO) estimated that President Trump’s Tax Cuts and Jobs Act (TCJA) would "substantially" reduce revenues and increase "deficits over its first decade... from about $1 trillion to $2 trillion."

Of course, the CBO and the JTC made those estimates before the TCJA had any actual impact. Trump signed the TCGA into law in December 2017 and it took effect in January 2018. The estimates assume it expires, as stipulated, in 2025. As with any economic projections, these estimates were educated guesses – and they guessed wrong.

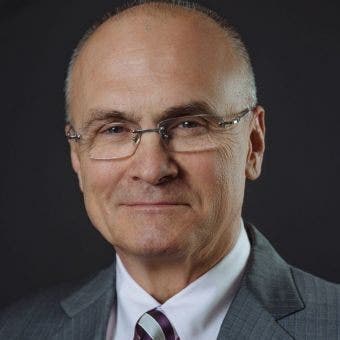

Trump's Tax Cuts and Jobs Act will result in at least a $1.3 trillion increase in tax revenue rather than a "$2 trillion tax cut," as Biden is falsely claiming. (Jason Bergman/Bloomberg via Getty Images)

We now have six years of actual data on how the TCJA impacted federal tax revenue and the deficit. We also have updated CBO projections for the next four years made with the hindsight benefit of six years of actual performance. Biden’s continued reliance on the upper end of outdated projections – as opposed to the readily available current data – suggests that he may be gaslighting in an election year.

Keep in mind that Biden recently claimed the annual inflation rate was 9% when he took office. It was actually 1.4%. With Americans significantly preferring Trump’s economic performance over Biden’s, the president is grasping at straws.

So, let’s look at what has actually occurred under the TCJA and compare it to what the CBO projected in 2018 to see if Biden’s claim of a $2 trillion tax cut holds up.

In April 2018, shortly after the TCJA took effect, the CBO issued its annual Budget and Economic Outlook report showing projected tax revenue of about $42 trillion over the next decade. That figure reflected a reduction in tax revenues of "$1.7 trillion for the 2018–2027 period," almost all of which stemmed "from the 2017 tax act." So, absent that reduction, the CBO’s projected tax revenue for the decade presumably would have been about $1.7 trillion higher or $43.7 trillion.

Looking at the actual revenue numbers through 2023 and the CBO’s most recent, better informed, and updated projections for 2024 through 2027, it's clear that the CBO’s 2018 projections grossly underestimated tax revenues under the TCJA. The actual numbers and updated projections show federal revenue totaling $45 trillion between 2018 and 2027, or $3 trillion more than CBO’s 2018 estimate.

JOE BIDEN'S OUTLANDISH PLAN TO CRUSH MIDDLE AMERICA

In other words, rather than costing the federal government $1.7 trillion in tax revenue, the Trump tax cuts are currently projected to add $1.3 trillion over what the CBO projected higher tax rates would have generated.

In the six years for which we have actual data (2018-2023), tax revenue is already $1 trillion ahead of the CBO’s 2018 estimate. As for another Biden’s claim – that those tax cuts benefited "the biggest corporations" – over the last three years actual corporate tax revenues have been the highest ever and have exceeded CBO’s 2018 projections by nearly $150 billion.

Some may attribute this increased revenue to the impact of inflation surging for the past three years – significantly above the CBO’s 2018 projections. But tax revenue under the TCJA has exceeded expectations not only in nominal dollars, but also as a percentage of GDP – which inflation also impacts.

In 2018, the CBO projected that federal revenue would average 16.9% of GDP between 2021 and 2023. It has actually averaged 17.9%, well above both CBO’s 2018 projection and the 50-year average of 17.4%.

THE ONE PIECE OF TRUMP’S LEGACY THAT HAUNTS BIDEN

None of this information is hidden. A Politico article titled "U.S. sees biggest revenue surge in 44 years despite pandemic" reported that tax "[r]evenues jumped 18 percent" in 2021, which was "the biggest one-year increase since 1977," sending federal revenue above $4 trillion for the first time ever. The CBO’s former top revenue forecaster tellingly said tax revenues "are just booming. It is very unusual."

The Politico article went on to state that while "Democrats are hammering the rich for not paying their fair share in taxes," it turned out that "the increase is being driven by levies primarily paid by the well-to-do." Who knew? The CBO added that "corporate tax receipts leapt 75 percent" and "easily top where they were immediately before Republicans slashed the corporate rate as part of the" Trump tax cuts.

Reporting on the CBO estimates for 2022, the Cato Institute stated that in 2022 "income tax revenue was 32 percent higher than CBO projected following the 2017 tax cuts, in April 2018. Similarly, payroll and corporate tax revenue outpaced the estimate by 6 percent and 20 percent, respectively."

CLICK HERE FOR MORE FOX NEWS OPINION

The Treasury Inspector General for Tax Administration, the watchdog that oversees the IRS, reported that the IRS collected "about $4.9 trillion of total tax revenue" in 2022, "the most revenue ever collected by the IRS."

In fact, 2022, 2023 and 2021, in that order, hold the records for the federal government’s three highest revenue years – ever – with each year coming in above $4 trillion. It’s the Laffer Curve in action – reduce tax rates, increase economic growth and tax revenue.

While impressive, even the additional $1 trillion increase in tax revenue already realized is insufficient to cover the costs of even one of Biden’s budget-busting spending programs – such as his March 2021 $1.9 trillion so-called American Rescue Plan – which, economist Larry Summers so aptly foretold would "set off inflationary pressures of a kind we have not seen in a generation."

CLICK HERE TO GET THE FOX NEWS APP

But the actual numbers do make two things clear. First, the TCJA will result in at least a $1.3 trillion increase in tax revenue rather than a "$2 trillion tax cut," as Biden is falsely claiming.

Second, and more importantly, our federal government clearly has a spending problem, not a revenue problem. Increasing tax rates – or allowing the Trump tax cuts to expire as Biden has promised – will not solve that problem. They will only exacerbate it.