Montana mom says her costs for groceries, bills have gotten 'crazy'

Lawrence Jones talks to diners in Bozeman, Montana about inflation and the economy under President Biden.

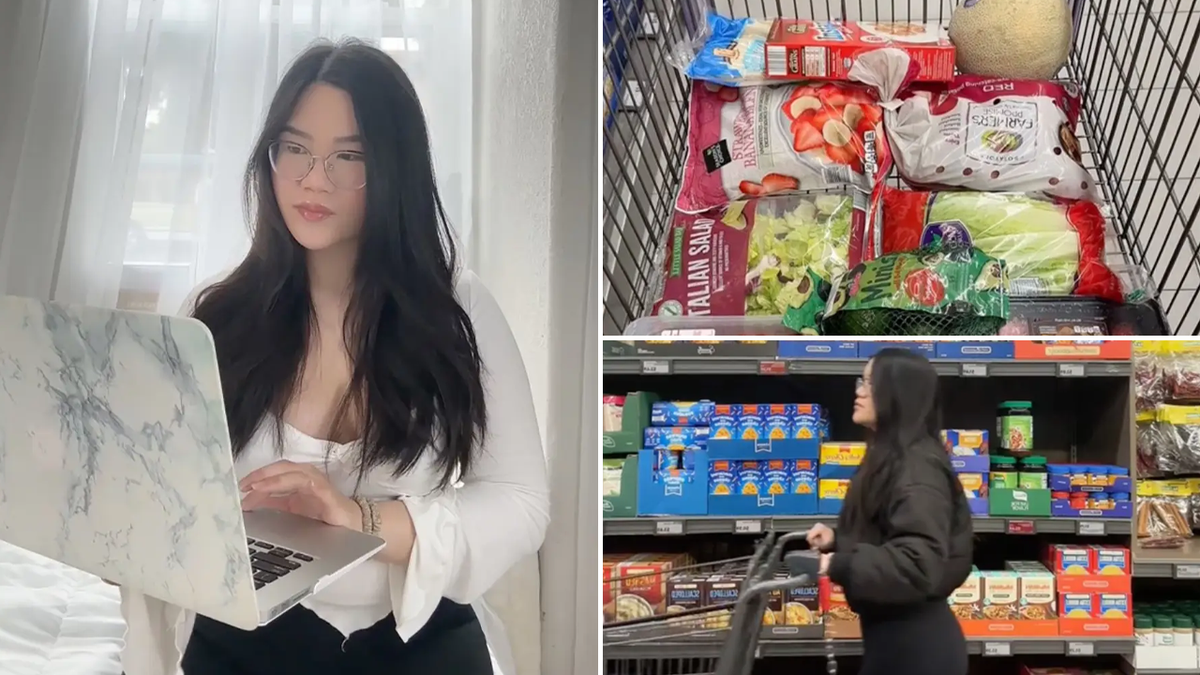

As Americans struggle with higher food prices after years of inflation, one young woman shared her rules and tips on how she lives in order to achieve her dream of owning a home.

The average American household spent $213 more in January to purchase the same goods and services it did one year ago due to persistent inflation. However, Kristy Nguyen, a 23-year-old from the Los Angeles area, has found industrious ways to make ends meet.

"Food doesn’t have to be expensive if you know how to find the best deals and budget properly," Nguyen told The New York Post, saying her grocery plan allows her to make three healthy meals a day.

She spends a maximum of $50 per week on food for her and her partner and sometimes as little as $35 a week if she has leftover groceries from bulk orders.

The average American household is spending $213 more a month compared to one year ago due to persistent inflation. (Kristy Nguyen)

HIGH INFLATION IS STILL SQUEEZING AMERICANS' BUDGETS

Nguyen, who dreams of eventually being able to buy a home, works as a full-time manager at Aldi and part-time sales associate at Walmart, generating an annual income of $60,000. She also works a side-job as a TikTok content creator @asap.kristy where she talks about her thrifty lifestyle.

"I didn’t settle for just one 9-to-5 job because in this economy, to even afford to buy a home by 25, I knew I had to work three jobs," she told The Post.

Nguyen shops at Aldi, claiming it has the best prices when compared to other grocery stores.

"A bag of spinach costs less than $1.50, and most of the fresh meats that they have available range from $3 to $12," she said.

She offered three specific tips on how she saves money, the first of which is planning meals ahead of time. She noted that she makes a specific, itemized list of the ingredients she needs for every meal she plans to prepare.

A woman shops in the dairy section of a supermarket in the borough of Manhattan, New York, on January 27, 2024. (CHARLY TRIBALLEAU/AFP via Getty Images)

FED'S FAVORITE INFLATION GAUGE ROSE 0.3% IN JANUARY

"This will make it easier to shop with purpose instead of impulse shopping on items you may not need," she said.

The second tip is to use lots of "staple" items throughout the week. This means that she frequently purchases the same items every week that can be used to make a variety of foods in different ways.

"Some of my most purchased items include ground turkey, ground beef, white rice, tortillas, bananas and frozen fruits," she said. "These are staple items that I can use to essentially make anything."

"My meals are quite healthy and nutritious," she added. "I still eat veggies, fruits and protein on a daily basis with the type of shopping list that I have."

The third tip is to compare prices at different stores in order to get the best deal.

"On Wednesdays, for example, Aldi usually has major deals on the produce section and some meats included," she said, noting that supermarkets often have sales for certain items on specific days of the week. "Every store has deals on a specific day — you just have to call and ask beforehand so that you’re aware."

CLICK HERE TO READ MORE ON FOX BUSINESS

Grocery prices have surged more than 21% since the start of 2021, outstripping the overall 18% pace of inflation during that same time period. And while the pace of price increases for food has slowed in recent months, the overall cost of many grocery store staples is still high. Experts say that relief for consumers is unlikely to arrive anytime soon.

Robert Frick, corporate economist at Navy Federal Credit Union, told FOX Business, "Prices very rarely go back," and, "It's going to take two or three years before people feel real relief from the surge in inflation, especially with things like food."

Fox News’ Megan Henney contributed to this report.