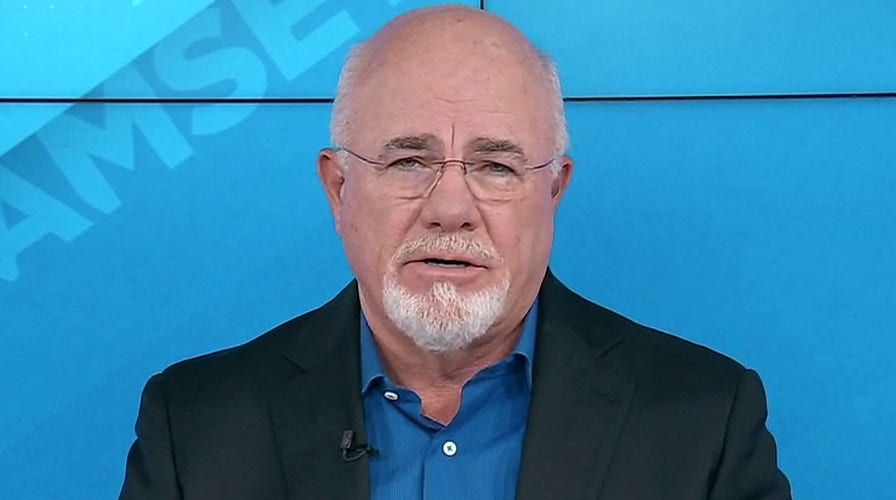

Dave Ramsey on inflation, supply chain, building wealth the right way

Financial expert discusses fixing the supply chain, calming 'scary' inflation numbers and his new book 'Baby Step Millionaires' on 'America's Newsroom.'

Ohio-based Josiah Poletta and his wife, Courtney, are finally free of $142,000 in debt — $126,000 of which was student loan debt — after tremendous struggle.

It's ultimately a story of triumph and positivity no matter how you slice it.

The husband and dad of two — a high school history teacher in Van Wert, Ohio — told Fox News Digital in a phone interview about the path he took to get to a much better place financially and personally. It was a path littered with hardship.

Still, he said he would not have wanted the government to bail him out of the financial straits that he got himself into, he said.

Today, he and his wife feel good about where they are, he said, and the steps they've taken to "get our finances in order."

Poletta said he graduated from college in 2014. After he bought a car, the couple was carrying "a total of $142,000 in debt — $126,000 of which was student loan debt," he said.

The Polettas of Van Wert, Ohio, during their wedding. The couple wanted to get debt behind them and be in a better place financially "instead of owing money to other people." (Poletta Family)

Most of the debt was his, he said — he went to a private school and took out a variety of different loans over time to cover his costs, he said.

"But I'm not here to play the victim," he said. "Basically the reason we decided we were going to pay off our debt was that we deemed it the best way to get our finances in order instead of owing money to other people," he said.

"We wanted to have our own money set aside if we needed it."

"We wanted to have things for ourselves and not be in a place of negative self-worth," Poletta also said.

"So," he said, "we basically began using the Dave Ramsey method of getting ourselves out of debt, step by step."

Wanted to start a family, buy a house

Poletta said he and his wife were motivated by a desire to start a family and buy a house — and they wanted a method of clarity and organization that made sense.

The Polettas at their wedding. Josiah Poletta told Fox News Digital that the couple wanted "our money to stay our money." (Poletta Family)

"We wanted to do a lot of different things that paying other people our money wasn't going to allow us to do," he said. "We needed to be able to get our finances in order and allow our money to stay our money."

Poletta explained how he and his wife used the Ramsey method: "You start by making sure you have $1,000 in savings for any emergencies that might come up — and a lot of people don't even have that," he said.

"They might use credit cards if they need to, but we wanted to have our own money set aside if we needed it."

DAVE RAMSEY SHARES SECRETS OF MANAGING STRESS OVER RISING COSTS

He then described step two, calling it "the debt snowball method. You list out all of your debts, from smallest to greatest, and using a snowball-down-the-hill type of method, you pay off one, using your own money. Then, you use the money that you were paying earlier to someone else for the next debt — and you continue that, on and on."

The Polettas are shown with one of their children in an image they shared with Fox News Digital. Their long-time goal has been to be debt-free. (Poletta Family)

The Ramsey Solutions team describes it this way: It's "a debt reduction strategy" in which "you pay off your debts in order of smallest to largest, regardless of interest rate."

"But even more than that," they also indicate on their website, "the debt snowball is designed to help you change your behavior with money so you never go into debt again. It gives you power over your debt — because when you pay off that first one and move on to the next, you’ll see that debt is not the boss of your money. You are."

DEEPAK CHOPRA ON MONEY AND FULFILLMENT: TIMES OF ‘ADVERSITY’ ARE MEANT FOR ‘OPPORTUNITY’

Step three, Poletta told Fox News Digital, is "saving three to six months' worth of expenses" in an emergency fund.

"When you pay off that first one and move on to the next, you’ll see that debt is not the boss of your money. You are."

Step four is all about putting money aside for retirement; step five "is for your kids — doing the same thing, putting money aside for them." Step six, he said, "is pay off your house." And seven, he said, "is you live debt free."

The Poletta family got their debt behind them finally — through planning, sheer hard work and a little bit of luck. (Poletta Family (Fox News))

The Polettas are currently in "what's called step 3B," he said.

‘Changing their family tree forever’

They have their debt behind them, "we've got our emergency fund in place — and now we're saving up to make a down payment on a house, which, in this housing market, requires more of a down payment than in the past," said Poletta.

"I went an entire winter without heat in my car because I wasn't able to afford to fix it."

He also described the hard times he went through in the recent past in order to make ends meet and pay off a huge chunk of his debt.

"I donated plasma twice a week," said Poletta, earning approximately $70 to $120 each time out, he said. "I also went an entire winter without heat in my car because I wasn't able to afford to fix it."

Poletta said he "didn't have a bachelor party or go on a honeymoon."

The Poletta family during a recent winter. Dave Ramsey described the couple as "people of integrity who work hard for their family." (Poletta Family)

Also, he said he and his wife "ate plain noodles since we couldn't afford groceries. I'd save money [on] lunches to make groceries last, never ate out, sold a vehicle so we had one vehicle to share — and kept our heat at 60 degrees in the winter."

Personal finance expert Dave Ramsey, host of "The Ramsey Show" and the author of eight number-one best-selling books, told Fox News Digital about the Polettas, "Courtney and Josiah are an incredible couple. They are people of integrity who work hard for their family — and unfortunately, they were two out of the 45 million Americans that fell into the trap of student loan debt."

DAVE RAMSEY ON FINANCIAL WELLNESS: ‘GET RICH QUICK NEVER WORKS'

He added, "I’m so proud of them for committing to ‘The Baby Steps,’ digging out of debt and changing their family tree forever."

Josiah Poletta — who lost his dad when he was young — described how he and his wife would pay off their debt "in chunks."

The Poletta family told Fox News Digital that "budgeting is what saved us." (Poletta Family)

He said their income fluctuated a little bit, so whenever they had extra money at the end of the month, "we would throw it all on the lowest debt," he said, in addition to paying a normal monthly amount.

He also said that "budgeting is what saved us — and paying off the debt is what got us out of the hole."

"I personally decided it was time for me to pay off those loans. So I don't really think the government should bail me out for that."

The couple were aggressive about their debt repayment for about two-and-a-half years, he said. He acknowledges that he had help in paying off all of his debt. He and his wife didn't do it alone; they are grateful for the help they received unexpectedly.

By October 2021, their debt was behind them.

Regarding the notion of student loan forgiveness today, Poletta said again, "I'm not here to play the victim."

CLICK HERE TO GET THE FOX NEWS APP

"I realize that I am the one who made the decisions to get where I was," he also said — "so I personally decided it was time for me to pay off those loans. I don't really think the government should bail me out for that."