People could be allowed to pay taxes with bitcoin in Arizona

If passed, the bill would allow taxpayers in Arizona to pay with bitcoin and other cryptocurrencies.

Digital currency can be used to pay for flights, furniture, music and even pizza. Now, pretty soon in Arizona, you may be able to use bitcoin to pay your taxes.

Arizona has bills on the floor that would revolutionize the way government considers cryptocurrencies, such as bitcoin. One bill would recognize bitcoin and other cryptocurrencies as currency, not a commodity. The other would allow taxpayers in Arizona the option to pay their taxes with bitcoin.

“It’s one of a litany of bills that we’re running that is sending a signal to everyone in the United States, and possibly throughout the world, that Arizona is going to be the place to be for block chain and digital currency technology in the future,” Arizona State Rep. Jeff Weninger said.

Weninger said the bill he co-sponsored, which passed the Senate Finance Committee with a vote of 4 – 3, will make it easier for people in the state to pay their taxes.

“The ease of use, being able to do it in the middle of the night, being able to do it at home while you’re watching TV,” Rep. Weninger said. “I think in a few years this isn’t even going to be a question.”

According to a University of Cambridge study, the current number of unique active users of cryptocurrency wallets is estimated to be between 2.9 million and 5.8 million. Jack Biltis, a Phoenix business owner is one of them – and he believes this is the way of the future.

“I think in a few years this isn’t even going to be a question.”

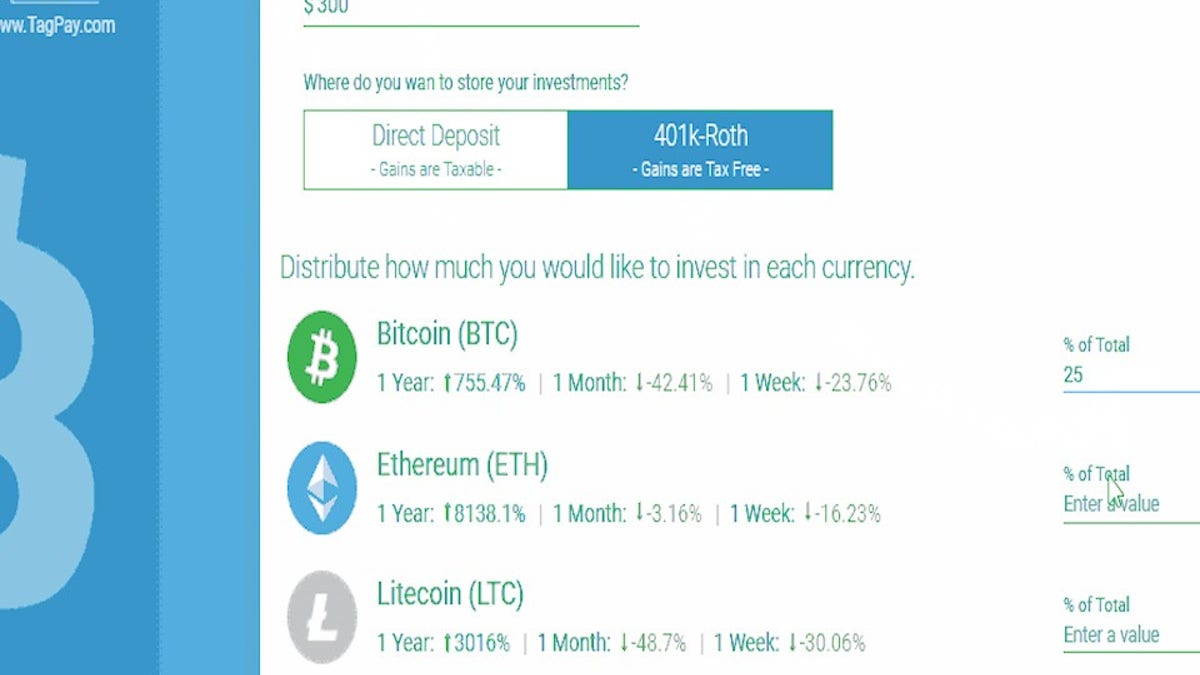

Biltis’ payroll company, Tag Employer Services, allows employees to receive their paychecks through bitcoin and to invest part of their 401(k) into bitcoin.

“We’re living in just a hugely interesting time and, really, we just want to be a part of it,” Biltis said. “We just know that we could be, as Arizona’s chosen to be, at the forefront of this time and encourage these new technologies. That’s just an exciting place to be.”

"We’re living in just a hugely interesting time and, really, we just want to be a part of it,” Biltis said. “We just know that we could be, as Arizona’s chosen to be, at the forefront of this time and encourage these new technologies. That’s just an exciting place to be.” (Fox News)

In July 2010, the bitcoin price per unit was 6 cents. As of Feb. 3, of this year, it’s at $9,300. Since its start in 2009, the number of Bitcoins in circulation has risen to 16.8 million.

"We just know that we could be... at the forefront of this time and encourage these new technologies. That’s just an exciting place to be.”

“By accepting cryptocurrencies, you can do it for pennies and at the same time you can transfer money, really, in almost an instant amount of time,” Biltis said. “So, this new technology is absolutely going to replace what we have now with our inefficient credit cards and banking systems.”

Biltis’ payroll company allows employees to receive their paychecks through bitcoin and to invest part of their 401(k) into bitcoin. (Fox News)

But, others believe those systems already established are enough. Arizona State Senate Minority Leader Steve Farley said he thinks that if the proposal passes, it would put all taxpayers at risk if bitcoin crashes.

“If we had a bill that allowed people to pay their taxes in bitcoin directly, that puts the volatility burden on all other taxpayers because it would mean that that money goes to the state and then the state has to take the responsibility of how to exchange it,” Farley said.

He added that the U.S. dollar should suffice.

"These are American dollars. They're good enough for me,” Farley said. “They should be good enough for anybody else who pays taxes in this country."

"These are American dollars. They're good enough for me. They should be good enough for anybody else who pays taxes in this country."

Farley said three days after the bill was voted on in committee, bitcoin lost 15 percent of its value.

“I think too often in our tax code, certain special interests get advantage, while everyone else pays the price,” Farley said. “This is the perfect example because the lobbyists who came up who spoke on behalf of this bill only wanted advantage for his particular client. That’s part of why our entire tax code becomes such a mess because you have special interest lobbyists going in there and trying to get a break for their own clients. The rest of us who aren’t present frankly we get screwed.”

Weninger said that the entry point to get into bitcoin is low, monetarily. Most of the money, he said, would be spent on educating people on a system that could be confusing.

“It’s always a little scary and thrilling at the beginning, it was with anything (including) the Internet...The world is going to look so different in 20 years and the people that are going to be truly successful are the people that embrace it now and are on the leading edge of that curve.”

“It’s always a little scary and thrilling at the beginning, it was with anything (including) the Internet,” Biltis said. “The world is going to look so different in 20 years and the people that are going to be truly successful are the people that embrace it now and are on the leading edge of that curve.”

Bitcoin is entirely on the Internet, using blockchain technology—where a shared ledger database records and shares every transaction that occurs in the network of users. Five states have enacted or adopted blockchain legislation.

The World Economic Forum estimates that taxes will be collected for the first time by a government via blockchain by 2023. If this Arizona bill goes through, taxpayers could pay via blockchain in just two years.