6M Americans facing tax penalty under health care law

Numbers jump dramatically in new CBO estimate

Nearly 6 million Americans -- most of them in the middle class -- will face a tax penalty for not carrying medical coverage once President Barack Obama's health care overhaul law is fully in place, congressional budget analysts said Wednesday.

The new estimate amounts to an inconvenient fact for the administration, a reminder of what critics see as broken promises.

The numbers from the nonpartisan Congressional Budget Office are significantly higher than a previous projection by the same office in 2010, shortly after the law passed.

The earlier estimate found 4 million people would be affected. The difference -- 2 million people-- represents a 50 percent increase.

That's still only a sliver of the population, given that more than 150 million people currently are covered by employer plans. Nonetheless, in his first campaign for the White House, Obama pledged not to raise taxes on individuals making less than $200,000 a year and couples making less than $250,000.

And the budget office analysis found that nearly 80 percent of those who'll face the penalty would be making up to or less than five times the federal poverty level. Currently that would work out to $55,850 or less for an individual and $115,250 or less for a family of four.

Average penalty: about $1,200 in 2016.

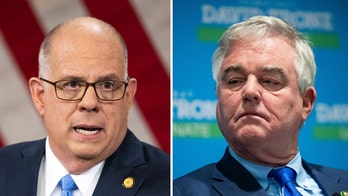

"The bad news and broken promises from Obamacare just keep piling up," said Rep. Dave Camp, R-Mich., chairman of the House Ways and Means Committee, who wants to repeal the law.

There was no immediate response from the administration.

The budget office said most of the increase in its estimate is due to changes in underlying projections about the economy, incorporating the effects of new federal legislation, as well as higher unemployment and lower wages.

Starting in 2014, the new health care law requires virtually every legal resident of the U.S. to carry health insurance or face a tax penalty. The Supreme Court upheld Obama's law as constitutional in a 5-4 decision this summer, finding that the insurance mandate and the tax penalty enforcing it fall within the power of Congress to impose taxes. The penalty will be collected by the IRS, just like taxes.

The budget office said the penalty will raise $6.9 billion when fully in effect in 2016.

The new law will also provide government aid to help middle-class and low-income households afford coverage, the financial carrot that balances out the penalty.

Nonetheless, some people might still decide to remain uninsured because they object to government mandates or because they feel they would come out ahead financially even if they have to pay the penalty. Health insurance is expensive, with employer-provided family coverage averaging nearly $15,800 a year for a family and $4,300 for a single plan.

The Supreme Court allowed individual states to opt out of a major Medicaid expansion under the law. The Obama administration says it will exempt low-income people affected by state decisions from having to comply with the insurance mandate.

Most Americans will not have to worry about the insurance requirement since they already have coverage through employers, government programs like Medicare or by buying their own policies.

Many Republicans still regard the insurance mandate as unconstitutional and rue the day the Supreme Court upheld it.

However, the idea for an individual insurance requirement comes from Republican health care plans in the 1990s.

It's also a central element of the 2006 Massachusetts health care law signed by then-GOP Gov. Mitt Romney, now running against Obama and promising to repeal the federal law. The approach seems to have worked well in Massachusetts, with virtually all residents covered and dwindling numbers opting to pay the penalty instead.