April 22, 2024

House vote is a 'slap in the face' to the American public: Art Del Cueto

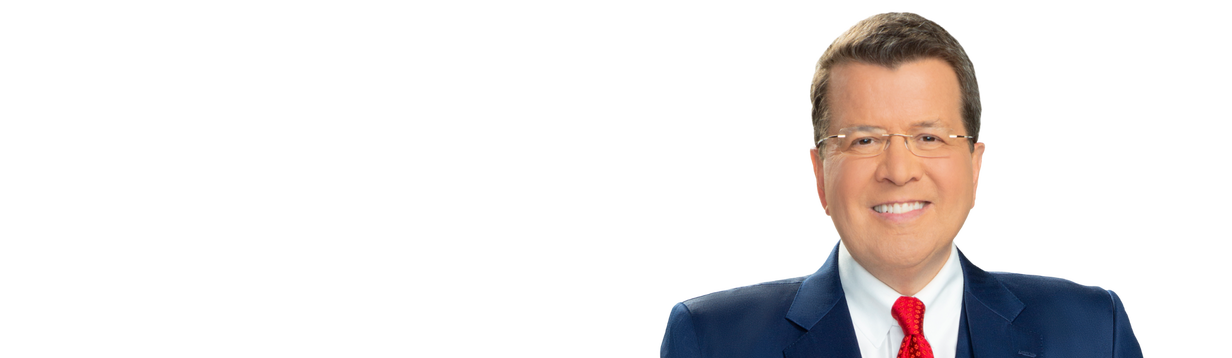

National Border Patrol Vice President Art Del Cueto joins 'Your World with Neil Cavuto' to react to the GOP's latest bid to pass border security measures failing over the weekend.