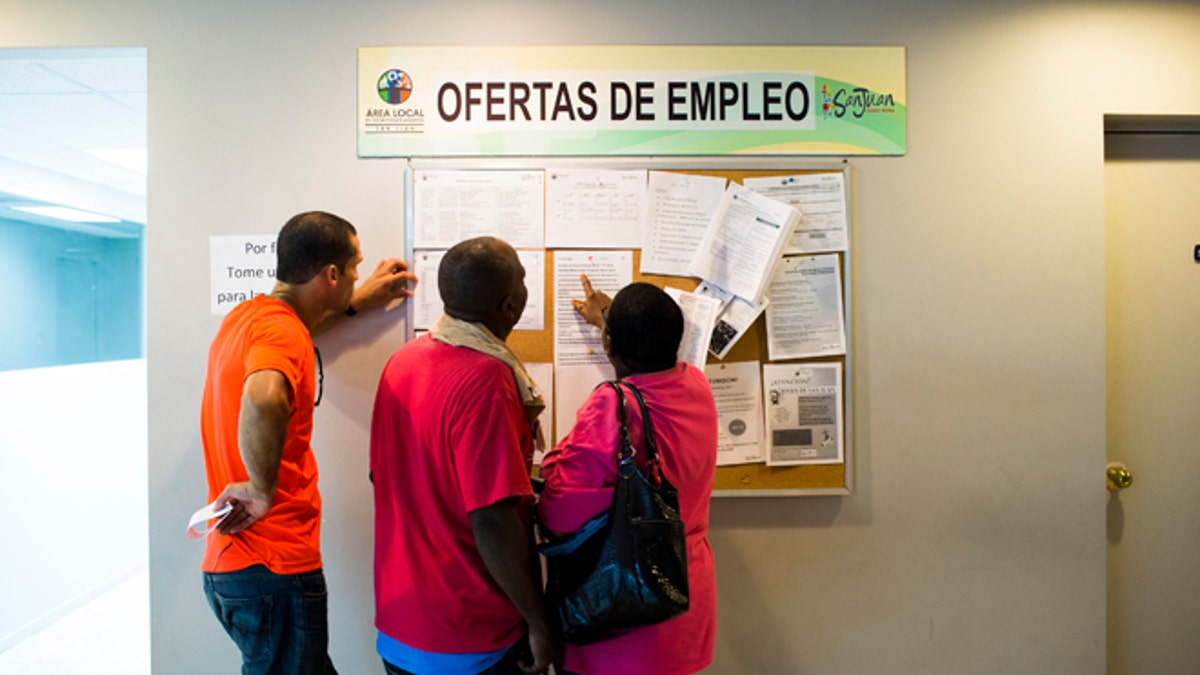

SAN JUAN, PUERTO RICO - NOVEMBER 14: People scan the bulletin board for job postings at the unemployment office on November 14, 2013 in San Juan, Puerto Rico. The unemployment rate hovers around 14 percent, almost twice the national average. The island-territory of the United States is on the brink of a debt crisis as lending has skyrocketed in the last decade with the government issuing municipal bonds. Market analysts have rated those bonds as junk and suspect it's 70 billion dollar debt might be unserviceable in the near future. With a deteriorating manufacturing industry and tourism only contributing to 10 percent of the GDP, the way out is unclear. (Photo by Christopher Gregory/Getty Images) (2013 Getty Images)

SAN JUAN, Puerto Rico (AP) – Puerto Rico's Senate approved several measures late Thursday aimed at helping the U.S. territory take on new loans and better manage its ability to repay an existing $70 billion public debt, an issue that has worried investors.

One measure would create a corporation responsible for issuing bonds to help pay and refinance some of the $590 million in debt held by the island's municipalities. The corporation would use a portion of revenues generated through an existing sales and use tax to guarantee payment. As a result, municipalities would see a slight drop in revenues they receive through the tax.

Another measure would create a special fund for those revenues that would be overseen by the Government Development Bank.

Sen. José Nadal Power said the measures are essential to help raise the funds necessary to protect the credit of Puerto Rico's general obligation bonds, which currently hover just above junk status. He said the measures also would improve the liquidity of the development bank, which expects to re-enter the bond market by next month after cutting sales late last year because of the high interest rates it faced.

Puerto Rico's government is a major issuer of bonds in the U.S., where the bonds are popular because they are exempt from federal and state taxes.

Gustavo Velez, a local economist, said the measures show the government is willing to work on improving public finances.

"Right now, the bank's liquidity and its ability to access the markets are key," he said. "This measure will help achieve that."

Senators of the opposition New Progressive Party voted against the measures, saying they would hurt the finances and autonomy of Puerto Rico's municipalities.

Senate President Eduardo Bhatia said mayors across the island approved the measures after consultations with legislators.

He said the measures would be a boost for the Government Development Bank. "The previous administration decided that the bank was the goose with the golden eggs," he said. "The bank is at its most fragile point ever in its history."

Gov. Alejandro García Padilla has been taken a variety of steps seeking to appease credit rating agencies, including reforming public pension systems that he has warned will run out of funds soon. He is expected to sign the measures soon.

Follow us on twitter.com/foxnewslatino

Like us at facebook.com/foxnewslatino