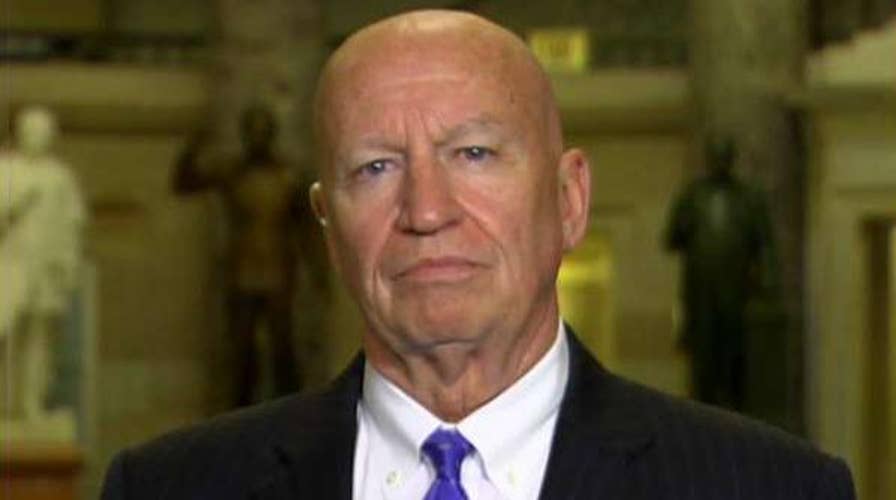

Rep. Brady addresses the 13 GOP no votes on tax reform

House Ways and Means chairman reacts on 'Your World' after the tax reform plan passes in the House.

This is a rush transcript from "Your World," November 16, 2017. This copy may not be in its final form and may be updated.

NEIL CAVUTO, "YOUR WORLD" HOST: Let's go right now to the man who is at the center of all of this, the guy who orchestrated all this, long before it was cool to do so, long before we even had a candidate Donald Trump.

Of course, I'm talking about the House Ways and Means Committee chairman, Kevin Brady. This is his first chat since that vote.

And we're honored to have you, sir. Thank you very, very much.

REP. KEVIN BRADY, R-TEXAS: Thanks, Neil. Love to start off with you.

CAVUTO: I appreciate that.

I was noticing the 13 Republican no votes, and, not surprisingly, most came from these high-tax states. So even with the $10,000 allowance for mortgage interest that those in those states could write off, they were still no.

What would it take to make them yes? Because, in the Senate, they won't even have that provision.

BRADY: Yes, so, we want them to be yes. We want tax relief even in high- tax states.

So, we're continuing to work with them. They continue to bring us ideas. So, look, we just want tax relief, regardless of where you live. But I think the important thing was 227 votes on a hugely complex and politically tough issue.

But, look, this is why Republicans came to Congress. And I also tell you what. Speaker Paul Ryan and his leadership, Kevin McCarthy, Steve Scalise in the Ways and Means Committee, they really did an amazing job.

CAVUTO: You know, Chairman, were you surprised it was only 13 no votes? Obviously, if you added up all the congressmen from all the high-tax states, you would really get it up to 73. We were told that there could have been up to 30 would-be no votes. How did it get down to the 13 who voted no?

BRADY: Yes, here's why.

Some people are looking at one provision in the tax code and deciding it's not good for them. But if you look at everything we're doing, from standard deductions, to lowering the rates, to this big new family tax credit, to eliminating AMT, and lowering where those bracket points are, a lot of the high-tax states look at it and say, wait a minute, this is awfully good for the vastly majority of our taxpayers, and they know that they are continuing to work with me to see how we can do even better.

And I'm pretty confident we can.

CAVUTO: Were you getting any sort of direction when the president came up to Capitol Hill today to meet with all of you guys, the House Republicans? Did he tip his hand as to whether he favored your measure, whether he liked a lot of the components within the Senate measure still being marked up? What?

BRADY: Yes, the answer is no.

He's really encouraging us. He's really proud of the work that has been done. And, look, I credit him from the standpoint of, we decided. The White House, President Trump, the House and Senate tax writers have come together. We spent, I guess, three months working towards one tax reform plan.

If you look closely, both the House and the Senate are shooting right at that target. There may be some differences in how we do, but I think the president's engagement, he calling me on the phone at 3:00 in the morning from Asia during that trip engaged on tax reform. He just wanted to be here for a pretty historic day.

CAVUTO: Were you surprised in the Senate when Ron Johnson, out of nowhere, seemed out of nowhere, to me at least, sir, came out as a no vote on this, and not for any of the reasons you would typically expect, but on the treatment of smaller, medium-sized businesses vs. larger businesses? They're the ones that benefit, he said. The smaller guys do not.

Does that telegraph trouble to you?

BRADY: No, because, one, I believe he is misinformed. In fact, no tax reform has ever put as much toward our small, medium-size businesses who aren't corporations as we do.

That's why the National Federation of Independent Business has embraced this. I have met several times with Senator Johnson on his bill and by phone, I don't know, two weeks ago as well. Look, he's -- it's got good merits. Everyone should make their case, in this case in the Senate.

And then, whether it's adopted or not, to move forward, because I don't know how anyone defends the current tax code, because we're just falling behind the rest of the world.

CAVUTO: Do you like the idea that that panel is kicking around, Chairman, to get rid of the individual mandate, the requirement that individuals purchase health insurance?

It would free up a lot of money, so we know the impetus behind that. But it's already got the likes of Susan Collins, we're told, indirectly Bob Corker, concerned, and others saying you're revisiting that third rail that at least in the Senate they have gotten electrocuted on?

BRADY: Yes, so this is one of those issues Senate Finance as a committee has decided to put it in. They have still got to work that bill through the floor here in about a week-and-a-half. And so we're going to let them do their work.

Obviously...

CAVUTO: Well, do you like the idea, Chairman? Do you...

BRADY: Well, I will tell you this. In the House, there's an awful lot of support.

We have repeatedly repealed the individual mandate, and mainly because -- well, for two reasons. One, it's a tax hike on a lot of modest and middle- income families who don't want that health care. They can't afford it.

And, secondly, you know, our tax code is about the freedom to use your money how you choose. That's about the freedom to buy health care if you want it or not.

CAVUTO: Yes.

BRADY: And so, look, we're going to let the Senate do their work. We're going to prepare. We're pivoting right now towards the work that we are going to need to do with the Senate.

CAVUTO: All right.

Now, you're far apart on a couple of other issues, too, the number of rates, brackets. They have seven. They also lower that top rate another percent. They also delay the corporate tax cut until the year after next, assuming it's passed this year. How do you feel about both?

BRADY: Yes, so a lot of common ground. And I think we're going to find more common ground in the conference committee.

But, look, we want to see growth happen immediately. We want to see those paychecks and those companies competing. So, we will push hard for immediate tax cuts, whether you're a family, a Main Street business or a corporation competing around the world.

As for the brackets, look, there's several different ways to hit this target. We want strong relief at every income level. We do that in the House. But, look, we're going to sit down, sort of pick the best of both plans as we work this out.

CAVUTO: Do you have any concerns, though, in the meantime, Chairman, that this is going to be a problem, because the way it's being sold and the numbers crunched, we hear in excess of 32 million Americans who could pay more taxes?

Now, to be fair, a lot of that seems to be based on credits and special allowances that expire in the next few years. How do you fight that, this counter that, wait a minute, this is not a tax cut for everybody, millions are going to pay more?

What do you say?

BRADY: Well, what I say is, one, make sure you understand this tax reform bill, because you see -- you will see there's tax relief at every income level, and for the vast, vast, vast majority of Americans.

And we can make it even better. And that's one of the things I'm excited about doing. It's a challenge in some of the high-tax states. But, boy, we have already driven tax relief really high into those families.

CAVUTO: But is that how they're figuring, those who pay higher, sir, real quickly, that it's the expiration of those credits, some of them five years out, that if you were to look at it 10 years, that's how they are coming up with that number, that these people pay that?

BRADY: That is part of it.

The other part of it is, there's a real debate about what happens when the economy grows, what happens when corporations can compete and win.

CAVUTO: Right.

BRADY: We believe that accrues to the paychecks and to tax relief. Some don't.

And so, look, I think, at the end of the day, measure us on the final product. Look, we stripped the tax code down to kind of the bare bones. We're building it up based on what America and our economy needs. And so, look, judge it at the end, because I think you're going to like what you see.

CAVUTO: All right.

Roy Moore, that election, he's still running in the Senate. But do you think everyone gets this done before the December 12 election to make that a moot point, at least for Republicans on this tax cut?

BRADY: Yes, so my -- again, my focus has always been get it to the president's desk by the end of the year.

We will let those other issues sort of...

CAVUTO: All right.

BRADY: We have never gotten distracted, and we're not going to now.

CAVUTO: All right, Chairman, thank you very much. Very good seeing you.

BRADY: Thanks, Neil.

CAVUTO: The man who runs the House Ways and Means Committee, of course, a very big victory for him and Republicans in the House.

They did approve their measure. Now, it's up to the Senate, in the middle of marking up its own, not as easy a fight, how they do with theirs.

END

Content and Programming Copyright 2017 Fox News Network, LLC. ALL RIGHTS RESERVED. Copyright 2017 CQ-Roll Call, Inc. All materials herein are protected by United States copyright law and may not be reproduced, distributed, transmitted, displayed, published or broadcast without the prior written permission of CQ-Roll Call. You may not alter or remove any trademark, copyright or other notice from copies of the content.