Reuters

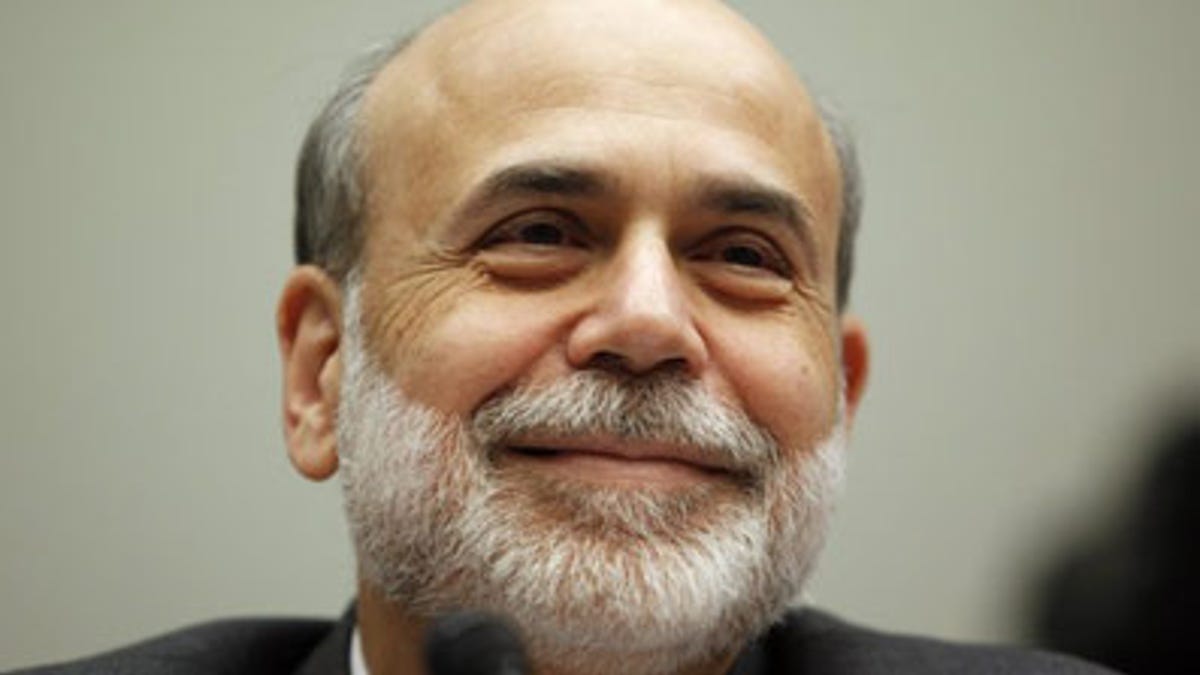

Most participants in the debate over the re-appointment of Fed Chairman Ben Bernanke agree on one thing: in the last year and a half, he has saved us from economic calamity. Senator Harry Reid’s view is typical: “An expert on the Great Depression, Chairman Bernanke helped steer us away from a second one.” The basis of this view seems to be that, a year and a half after the onset of the financial crisis, certain economic indicators point toward recovery.

But this short-range perspective is ominously similar to the type of thinking that took place leading up to the housing boom and bust.

Consider: Between 2001 and 2003, Federal Reserve Chairman Alan Greenspan, in consultation with top deputy Ben Bernanke, engaged in enough money-printing to manipulate interest rates down to the artificially low level of 1% (below the rate of price inflation at the time, thus creating for 2.5 years a negative real rate of interest in the U.S.). The idea was that this "stimulus" would get us out of a recession--sound familiar?--the recession that followed the dot-com bubble. It seemed to, for a while, and Mr. Greenspan won both re-appointment as Fed Chairman and worldwide renown as “the maestro.”

But in reality, “the maestro,” along with Bernanke (who would become the maestro’s hand-picked successor) had spawned and fueled an economy-warping orgy of lending, borrowing, and unsustainable housing bubble profits that would not have existed without ultra-cheap money.

These policies created a dangerous illusion of wealth, as lenders and borrowers alike seemed to be getting rich--everyone from the modest borrower cashing in on the skyrocketing paper value of his house, to the most sophisticated dealer in collateralized debt obligations that depended on rising home values. All of this would inevitably collapse, creating a necessary and painful recession as Americans discovered they were not as rich as they thought.

Unfortunately, Greenspan and Bernanke, like most economists, were steeped in the dogma that government manipulation of interest rates is economically necessary, and saw no housing bubble--only prosperity. Fast forward to 2007, when the logic of Greenspan and Bernanke’s policies played out, with increasing foreclosures signaling an end to the housing bubble, as well as the excessive levels of spending it had brought about. Did Bernanke admit his mistakes, acknowledge he had helped bring about a necessary recession, and pledge to stop manipulating the market in the future?

Hardly. He denied the existence of any significant economic problems. For example, in March 2007 he said “the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.”

When the inferno became undeniable in September 2008, Bernanke was the last person qualified to address it. Because his economic philosophy hasn’t changed, his celebrated policies are simply a rehash of the folly that created the housing bubble. The Fed is printing more money, lending it more cheaply than Greenspan did, and encouraging Americans (and their government) to borrow and spend far more than they can afford. That such a policy has laid the foundation for an enduring “recovery” has all the plausibility of President Bush’s 2003 “Mission Accomplished” banner.

Alex Epstein is a Fellow with the Ayn Rand Center for Individual Rights in Washington, D.C.