April 25, 2024

John Yoo: Trump won a 'two front war' today

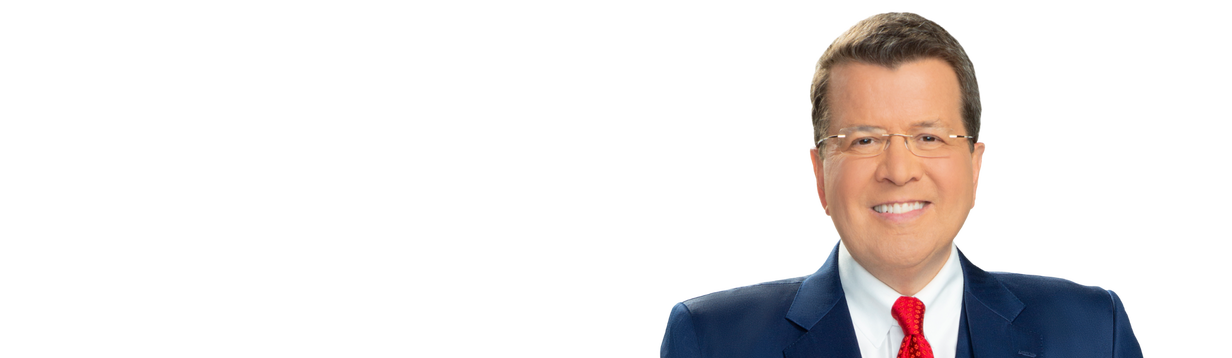

Former deputy assistant attorney general John Yoo and former federal prosecutor Katie Cherkasky discuss the latest in New York v. Trump trial and the Supreme Court hearing the presidential immunity case on 'Your World.'