May 07, 2024

Trump’s lawyers are going to have to come out ‘more aggressive’: John Yoo

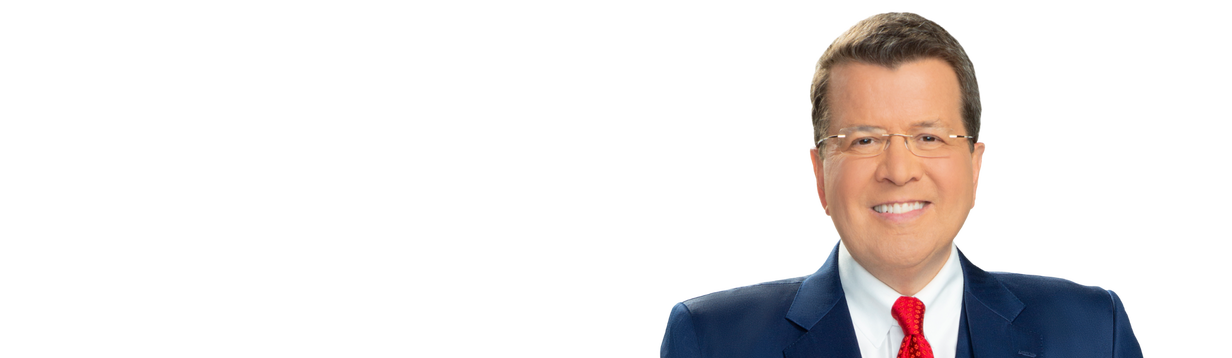

Panelists John Yoo and Andrew Cherkasky discuss the aftermath of the Stormy Daniels testimony on ‘Your World.’

Panelists John Yoo and Andrew Cherkasky discuss the aftermath of the Stormy Daniels testimony on ‘Your World.’